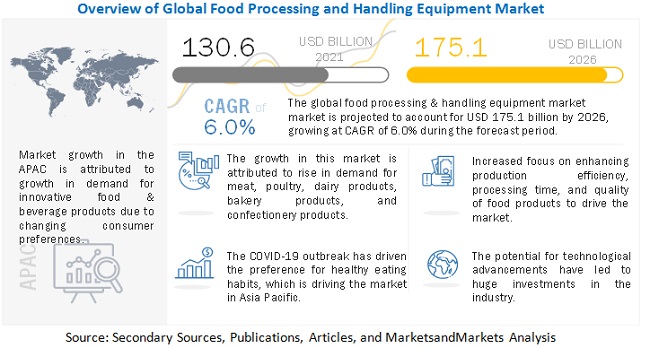

According to a research report "Food Processing & Handling Equipment Market by Type (Food Processing, Food Service, Food Packaging), Application (Meat & Poultry, Bakery & Confectionery, Alcoholic, Non-alcoholic Beverages, Dairy), End-product Form, and Region - Global Forecast to 2026" published by MarketsandMarkets, the food processing and handling equipment market is projected to grow from USD 130.6 billion in 2021 to USD 175.1 billion by 2026, recording a compound annual growth rate (CAGR) of 6.0% during the forecast period. The food processing & handling equipment market is exhibiting strong growth, with the rising demand for prepared food products globally, changes in consumer lifestyles, along with a transformative leap forward in technological capabilities and increasing investment opportunities in the food processing industry. The markets in North America and Europe have been growing consistently due to the established food & beverage processing industry and the presence of international food processing equipment manufacturers. The rise in demand for processed food and convenience food has been supported by the rise in disposable income and rapid urbanization in developing countries, such as India, Brazil, and China.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=145960225

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=145960225

The food packaging equipment segment is projected to grow at the highest CAGR during the forecast period.

This segment comprises food packaging equipment types, which are highly used in the food packaging industry. The increasing demand of consumers for attractive packaging, especially in premium products, is increasing the demand for this equipment type. COVID-19 is expected to have a favorable overall impact on the packaging sector. People in developing countries, who had formerly favored loose unpackaged food from local sellers, are increasingly converting to bagged food, owing to safety and hygiene concerns. As a result, many small and medium-sized businesses are paying more attention to packaging.

The bakery & confectionery segment is projected to account for the largest share in the food processing and handling equipment market during the forecast period.

The bakery & confectionery application segment dominated the food processing & handling equipment market in terms of application. This is due to the low shelf life of bread and bakery items and rising consumer demand for product freshness, which is increasing the demand for bread and bakery products produced locally. This factor, in turn, is propelling the market for bread-producing equipment. Core equipment, such as coating systems, for confectionery processing has a considerable scope in the confectionery market as the demand for coated candies and confectionery products forms an integral part of the confectionery industry.

Request for Customization @

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=145960225

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=145960225

The Asia Pacific region to account for the largest market share during the forecast period.

The Asia Pacific region accounted for major share in the food processing and handling equipment market during the forecast period. The food packaging industry in the Asia Pacific region is inclined toward automation, digitalization, and sustainable innovations inspired by the exponential growth of online retail and consumer interest in environmental issues. Asia Pacific’s millennial population outnumbers the Baby Boomers, who are earning more than ever, with strong wage growth, and are demanding a more responsive e-commerce business model to transform this industry. Smart packaging embedded with new technology is increasingly implemented for tackling supply chain issues.

The prominent players in this market include GEA Group (Germany), ALFA LAVAL (Sweden), Bühler Holding AG (Switzerland), JBT Corporation (US), SPX Flow (US), Robert Bosch (Germany), IMA Group (Italy), Multivac (Germany), Krones Group (Germany), Tetra Laval International S.A. (Switzerland), Middleby Corporation (US), Dover Corporation (US), Ali Group S.r.l (Italy), Electrolux (Sweden), and Hoshizaki (Japan).