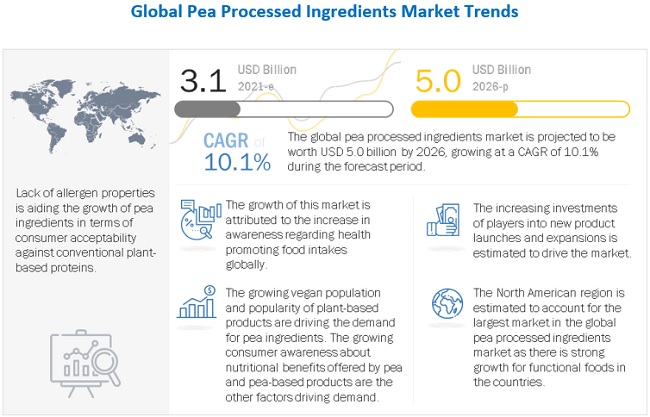

The report "Pea Processed Ingredients Market by Type (Pea protein (Isolates, Concentrates and Textured), Pea starch, Pea fiber, Pea Flour), Application (Food & Beverages), Source (Yellow split peas, chickpeas and lentils), and Region - Global Forecast to 2026", pea processed ingredients includes pea protein, pea starch, pea flour and pea fiber. The global pea processed ingredients market is expected to value at USD 3.1 billion in 2021 and is projected to reach nearly USD 5.0 billion by 2026, growing at a CAGR of 10.1% during the forecast period (2021-2026). Pea processed ingredients are used in different industries that includes food and beverage industry, pet food industry, feed industry among others. Owing to the health benefits received from the pea ingredients has resulted in more popularity among the customers across the globe.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=22233721

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=22233721

By type, the pea protein segment is expected to hold the largest share in the market, during the forecast period

By different types the market has been segmented into pea protein, pea starch, pea fiber and pea flour. Pea protein segment dominated the market in 2020 and is expected to display similar trend in the coming years. Pea protein has high protein content and is a popular option among the vegan population as well as the people preferring plant based ingredients infused in the food and beverage products. Pea protein consists of all the essential amino acids that is required in the food and is low in methionine.

The food segment is expected to hold one of the largest shares in the pea processed ingredients market, in terms of value, in 2021

In terms of application, the market has been segmented into food, beverage, and others that include pet food, feed, and industrial. Food segment dominated market in 2020 and is expected to display similar trend in the coming years. Rising demand for meat and meat substitute products among the customers is resulting to the dominance of food segment. Wheat, soy, peas, and beans are common sources of replacement plant based ingredients, which is attracting the vegan population as well as the people preferring plant based ingredients infused in the food products. A consumer survey in the UK and the Netherlands shows that, while consumers are typically aware of the ethical and political implications of their food choices, purchase intention is ultimately driven by the product’s sensory attributes. Pea protein has emerged as a key ingredient in the manufacturing of meat substitute products, such as burgers, sausages, and other product types.

By source, yellow split peas segment dominated the market in 2020 and is expected to display similar trend in the coming years

By different source, yellow split peas dominated the market in 2020. Yellow split peas is rich in protein content and is considered as a popular choice among the ingredient manufacturers. Yellow split peas are adopted for use in multiple food applications, including plant-based burgers and pea milk, which utilize pea processed ingredients such as pea protein starch derived from yellow split peas. They are also regarded as a high source of fiber and are taste-neutral in comparison. They are well-regarded for their non-allergen properties that aid their integration into different product types.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=22233721

North America region is projected to dominate the majority market share, in the pea processed ingredients market, in terms of value, in 2021

On the basis of region, the global pea processed ingredients market is segmented into North America, Europe, Asia Pacific, South America, and Rest of the World (including Africa and the Middle East). The North America region dominated the market in 2020 and is also expected to witness fastest growth during the forecast period. There is a rising demand for plant based ingredients among the population owing to the increasing demand for healthy meat and dairy substitute products. There is a growing trend towards vegan diets and consuming nutritious foods. This paradigm shift in food culture is being supported by medical communities, health & fitness clubs, celebrities and athletes influencing wellness and fitness. In addition to this, rising incidences of obesity, diabetes among the people in North America have also prompted consumers to adopt plant based ingredients in the food and beverage products.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the pea processed ingredients market. It includes the profiles of leading companies such as Emsland Group (Germany), DuPont (US), Kerry (Ireland), COSUCRA Groupe Warcoing SA (Belgium), Roquette Frères (France), Vestkorn Milling AS (Norway), Ingredion Incorporated (US), Axiom Foods, Inc (US), Felleskjøpet Rogaland Agder (Norway), AGT Food and Ingredients (Canada), Parrheim Foods (Canada), Puris Foods (US), Meelunie B.V (Netherlands) among others.