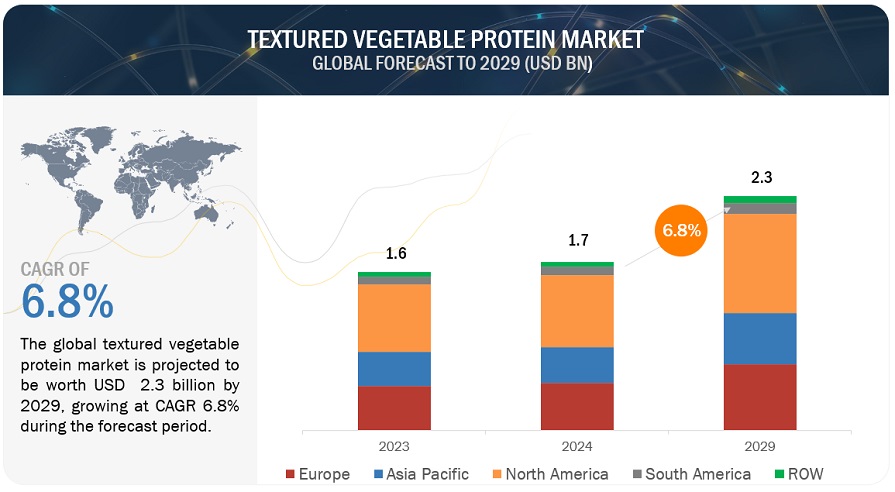

According to MarketsandMarkets, the "Textured Vegetable Protein Market by Application (Meat alternatives, Cereals & snacks, Others), Form, Source (Soy, Wheat, and Peas), Type (Slices, Flakes, Chunks, and Granules), and Region - Global Forecast to 2025", the market size is estimated to be valued at USD 1.1 billion in 2020 and is projected to reach USD 1.5 billion by 2025, recording a CAGR of 6.2%, in terms of value. The changing consumer preference and interest in vegetable protein sources, due to its nutritional profile, inclination toward clean eating, rise in health concerns, and environmental concerns, as well as animal welfare, have resulted in the growth of the alternatives, such as plant-based meat, and ingredients such as textured vegetable protein.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=264440297

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=264440297

The meat alternatives application segment is projected to witness significant growth during the forecast period.

Based on application, the textured vegetable protein market is dominated by meat alternatives applications. Textured proteins are among the key components of meat alternatives, where they have been used as extenders, analogues, and replacers. Texturized vegetable proteins can substitute meat products while providing an economical, functional, and high-protein food ingredient or can be consumed directly as a meat alternatives. They have been successful because of their healthy image (cholesterol-free), meat-like texture, and low cost. Europe and North America are the two regions expected to drive the market for textured vegetable protein.

The slices type segment is projected to account for a major share in the textured vegetable protein market during the forecast period

By type, the textured vegetable protein market is dominated by slices. Textured vegetable protein slices are obtained by processing various beans with higher protein content. They are the unique source of protein that contains essential amino acids, protective ingredients, minerals, and vitamins, which are necessary for total metabolism. During adequate heat treatment, the anti-nutritive factors are removed, thereby improving the protein content. They are generally characterized by structural integrity, which remains the same during hydration and heat treatments.

The North American region is the largest in the textured vegetable protein market during the forecast period.

The textured vegetable protein market is driven by the rise in the detrimental effects of conventional meat production and health concerns among consumers. This has increased the demand for meat alternatives and advancements in the research & development activities to substitute traditional meat products. The North American textured vegetable protein market is led by its various applications with respect to sustainability. Advancements in ingredient development have helped improve the adaptability of textured proteins for a wide range of food applications and are estimated to drive growth in the region. The North American region is the largest market for textured vegetable protein, owing to the development of novel and superior quality meat alternatives, developed technologies, and higher consumer adaption to meat alternatives. The increase in processed and convenience food production and innovations in segments such as meat alternatives and cereals & snacks drives the demand for textured vegetable protein in the North American region.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as ADM (US), Cargill (US), CHS (US), Roquette Freres (France), DuPont (US), Wilmar International (Singapore), The Scoular Company (US), Puris Foods (US), VestKorn (Norway), MGP Ingredients (US), Beneo GmbH (Germany), Shandong Yuxin Bio-Tech (China), FoodChem International (China), Shandong Wonderful Industrial Group (China), Axiom Foods (US), AGT Food & Ingredients (Canada), Sun NutraFoods (India), Crown Soya Protein Group (China), La Troja (Spain), and Hung Yang Foods (Taiwan).