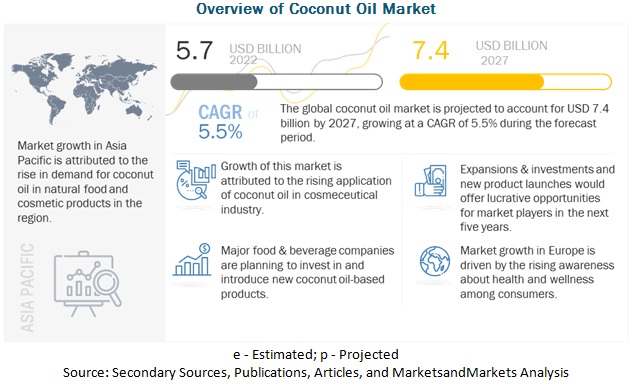

The report "Coconut Oil Market by Product Type (RBD, Virgin, and Crude), Source (Dry Coconut and Wet Coconut), Application (Food & Beverages, Cosmetics & Personal Care Products, and Pharmaceuticals), Nature and Region - Global Forecast to 2027", the global coconut oil market size is estimated to be valued at USD 5.7 billion in 2022. It is projected to reach USD 7.4 billion by 2027, recording a CAGR of 5.5%, in terms of value. The Increasing demand of natural ingredients in food and cosmeceutical industry to drive the coconut oil market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=78320975

The RBD segment accounts for the largest market share in the coconut oil market

Based on product types, RBD segment is the largest segment in the overall coconut oil market. RBD coconut oil is also widely used in the cosmetic industry, particularly to make soaps. It enables the soap to lather more to the point that a soap extremely high in coconut oil can lather in saltwater, which is not the case with normal soaps.

The wet coconut segment is projected to grow with the highest CAGR in the coconut oil market

Based on source, wet coconut segment is projected to grow with the highest CAGR in the coconut oil market. The wet process involves the use of raw coconut instead of dried copra. The coconut’s protein content produces an oil and water emulsion, which leads to a process of separating the emulsion to collect only the oil. This process uses techniques such as centrifuges or pre-treatments that apply cold, heat, acids, salts, enzymes, electrolysis, shock waves, or steam distillation. Sometimes, there is a combination of these processes.

The food & beverage segment accounts for the largest market share in the coconut oil market

By application, the coconut oil market is segmented into food & beverage, Cosmetics & personal care products, pharmaceuticals, and other applications. Food & beverages include bakery & confectionery, snacks & cereals, beverages, soups, salads, and sauces, and other food & beverage applications. Coconut oil adds nutritional & functional value to the final food products. It also has a high smoking point which makes it a preferable choice among food product manufacturers.

The organic segment is projected to grow with the highest CAGR in the coconut oil market

By nature, the coconut oil market is segmented into conventional and organic. The main aim of organic coconut farming is the production of quality products that contain no chemical residues and maintain soil fertility. Organic farming of coconut allows the use of organic fertilizers such as compost manure, farmyard manure, fish meal, blood meal, neem cake, groundnut cake, and bone meal. Different countries have different sets of rules to be followed to get coconuts certified as organic produce.

Request for Customization @

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=78320975

The Europe region is the second-largest region in the coconut oil market in the forecast period

Europe is the second-largest region in the global coconut oil market in the forecast period. According to the National Starch Food Innovation Europe, part of the Ingredion Group of incorporated companies, demand for ‘clean label’ products has gripped the whole of Europe, rather than select countries. It also stated that EU consumers were paying more attention to all forms of labeling.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Cargill Incorporated (US), ADM (US), Bunge Limited (US), Mangga Dua (Indonesia), Greenville Agro Corporation (Philippines), Royce Food Corporation (Philippines), Novel Nutrients Pvt. Ltd. (India), Aromaax International (India), Adams Group (US), and Connoils LLC (US).