https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240885146

Friday, March 11, 2022

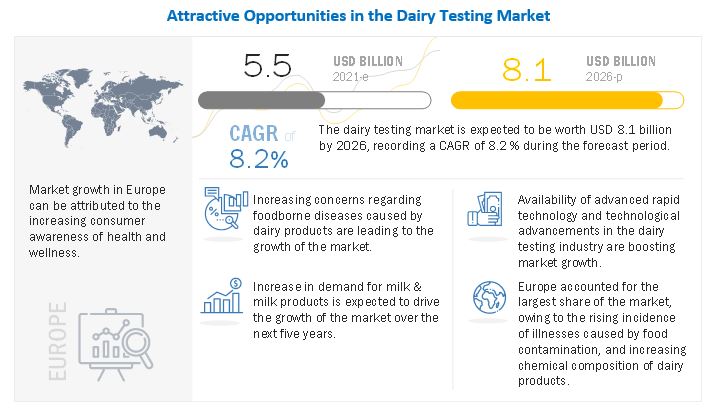

Dairy Testing Market Growth by Emerging Trends, Analysis, & Forecast

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240885146

Thursday, March 10, 2022

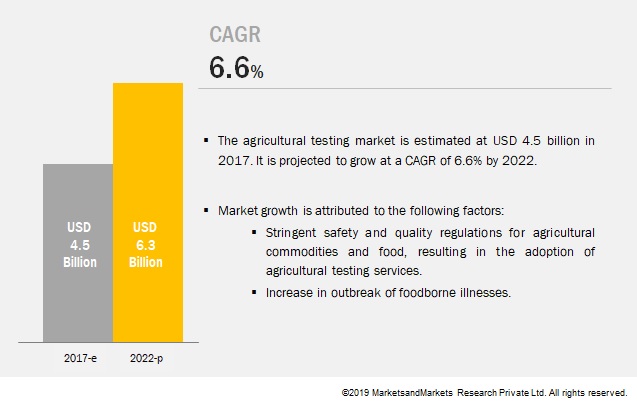

Growth Strategies Adopted by Major Players in the Agricultural Testing Market

Wednesday, March 9, 2022

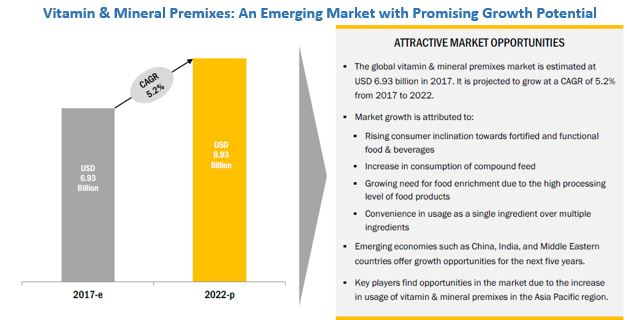

Upcoming Growth Trends in the Vitamin & Mineral Premixes Market

The report "Vitamin & Mineral Premixes Market by Type (Vitamins, Minerals, Vitamin & Mineral Combinations), Application (Food & Beverages, Feed, Healthcare, and Personal Care), Form (Powder and Liquid), and Region - Global Forecast to 2022", The market for vitamin & mineral premixes, in terms of value, is estimated at USD 6.93 Billion in 2017 and is projected to reach USD 8.93 Billion by 2022, at a CAGR of 5.2%.

Download PDF Brochure:

The increasing demand for fortified & functional food products, growing need for food enrichment due to high processing levels of food products, and growth in compound feed consumption have led to an increased demand for vitamin & mineral premixes. Also, with the growing level of consumer understanding of nutrition intake and health issues due to deficiencies, consumers are now focusing on comparing different brands by reading through product labels for information on the nutritional content. Such consumers’ inclination provides an opportunity for the growth of the vitamin & mineral premixes market.

The vitamin & mineral combinations segment accounted for the largest share during the forecast period.

In 2016, on the basis of type, the vitamin & mineral combinations segment accounted for the largest share, in terms of both value and volume. The large market share of vitamin & mineral combinations in various food & feed applications can be attributed to these products being a cost-effective solution to customers and supplying multiple nutrients to humans and animals. Also, one of the factors fueling the growth of this market is the occurrence/prevalence of vitamin & mineral deficiencies and anemia in developing countries. Leading manufacturers are tapping this opportunity and addressing the malnutrition concerns by introducing blends of vitamin and mineral premixes for a wide range of applications.

Healthcare: The fastest-growing application in the vitamin & mineral premixes market.

In 2016, the healthcare segment accounted for the largest share of the vitamin & mineral premixes market, in terms of value, and is projected to grow at the highest CAGR from 2017 to 2022. With the increased occurrence of health problems such as obesity, malnutrition, and weak immune systems and rise in geriatric population, the demand for dietary supplements and products which are high in nutrition has increased. Significant growth in the demand for infant formula products is one of the major factors driving the growth of the vitamin & mineral premixes in the healthcare segment.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=78349714

Asia Pacific is projected to be the fastest-growing market for vitamin & mineral premixes.

The demand for food and feed products with specific health benefits is experiencing growth in the Asia Pacific region owing to the changing lifestyles of customers. The major drivers for vitamin & mineral premixes in this region are the growing regional population; rise in disposable incomes; rapid urbanization, especially in China, India, and Japan; and continuous modernization in the food & feed industry. Rising population and changing consumer tastes & preferences for healthy and sustainable lifestyles drive the growth of the vitamin & mineral premixes market.

This report studies marketing and development strategies, along with the product portfolios of leading companies such as DSM (Netherlands), Corbion (Netherlands), Glanbia (Ireland), Vitablend Nederland (Netherlands), Watson (US), SternVitamin (Germany), The Wright Group (US), Zagro Asia (Singapore), Nutreco (Netherlands), Farbest-Tallman Foods Corporation (US), Burkmann Industries (US), and Bar-Magen (Israel).

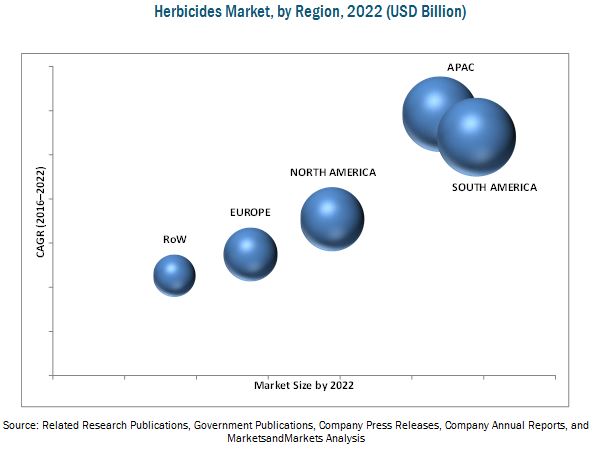

Herbicides Market to Showcase Continued Growth in the Coming Years

Upcoming Growth Trends in the Plant-based Beverages Market

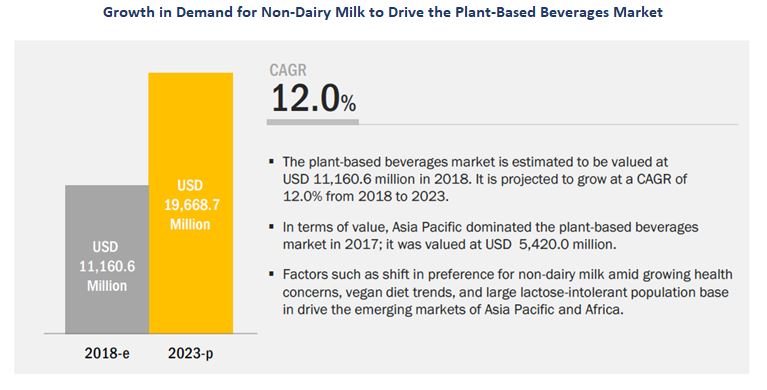

The plant-based beverages market was valued at USD 11.16 billion 2017 and is projected to reach USD 19.67 billion by 2023, growing at a CAGR of 12.0% during the forecast period. The market for plant-based beverages is driven by factors such as the increased demand for vegan food options, amidst the growing health concerns about the consumption of animal-based diets. Apart from this, consumers in emerging countries are adopting hectic lifestyles, which urge them to look out for low-calorie food options with high nutritional value. This has boosted sale of plant-based beverage products.

- To define, segment, and measure the plant-based beverages market with respect to its source, type, function (qualitative), and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for the stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments—new product developments, mergers & acquisitions, expansions, joint ventures, and partnerships—in the plant based beverages market

- To profile the key plant-based beverage companies, based on business overview, recent financials, segmental revenue mix, geographic presence, and information about the products & services

- The market has been covered by mapping plant-based beverage products only. Yogurt has been excluded from the plant-based beverages market scope, as it falls under the food category.

Tuesday, March 8, 2022

Upcoming Growth Trends in the Crop Protection Chemicals Market

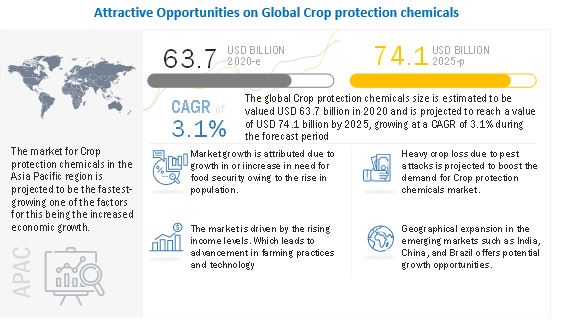

The report "Crop Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides & Bactericides), Origin (Synthetic, Biopesticides), Form (Liquid, Solid), Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and Region - Global Forecast to 2025" The global Crop protection chemicals size is estimated to be valued USD 63.7 billion in 2020 and is projected to reach a value of USD 74.1 billion by 2025, growing at a CAGR of 3.1% during the forecast period. The growth of this market is attributed to an increasing need for food security of the growing population.

Upcoming Growth Trends in the Dietary Supplements Market

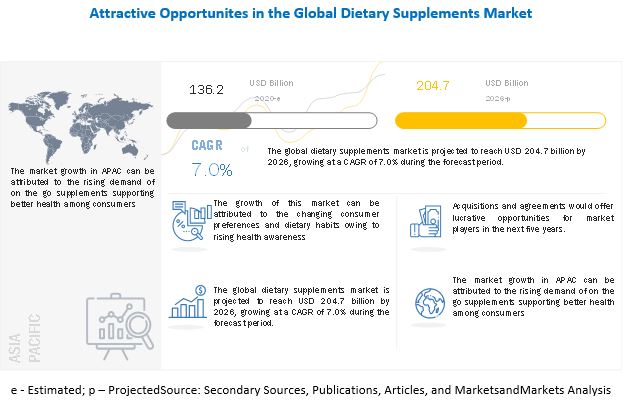

According to MarketsandMarkets, the global dietary supplements market size was valued at USD 136.2 billion in 2020 and projected to reach USD 204.7 billion by 2026, recording a CAGR of 7.0% during the forecast period. The market for dietary supplements is increasingly driven by shifting consumer preferences, rising health awareness, growing geriatric population, and adoption of a healthy diet. The convergence of major industry trends is giving rise to new opportunities for key players in the industry. Changing lifestyles and dietary habits is one of the major factors driving the demand for dietary supplements. The growing positive outlook towards sports nutrition would also positively impact the dietary supplements market.