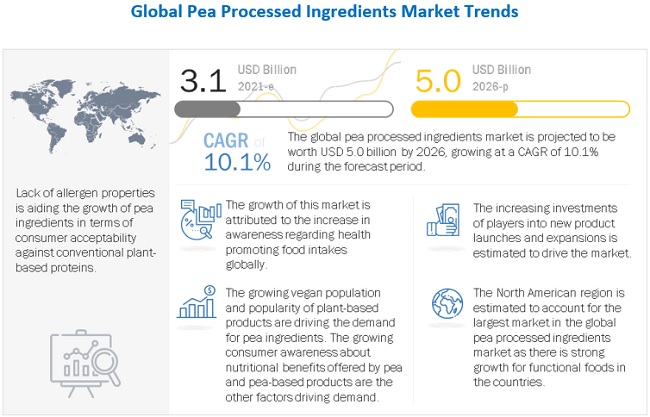

The report "Pea Processed Ingredients Market by Type (Pea protein (Isolates, Concentrates and Textured), Pea starch, Pea fiber, Pea Flour), Application (Food & Beverages), Source (Yellow split peas, chickpeas, and lentils), and Region - Global Forecast to 2026", is estimated at USD 3.1 billion in 2021; it is projected to grow at a CAGR of 10.1% to reach USD 5.0 billion by 2026.

Pea protein is an ingredient produced from a variety of sources, such as yellow split peas, chickpeas, and lentils. It is an ingredient that is neutral in taste and has an array of applications in the food & beverage and health supplement industries. Pea protein is extracted in the form of isolates, concentrates, and textured. There is an increasing opportunity for pea processed ingredient manufacturers from the food & beverage and supplements markets. These markets seem to develop and formulate new products and technologies using pea protein, pea starch, pea fiber, and pea flour as a raw material, causing to innovate and implement groundbreaking products with an array of applications.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=22233721

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=22233721

Pea protein powder is highly beneficial to humans, as it is allergen-friendly, easily digestible, contains eight amino acids necessary for the human body, naturally cholesterol-free and gluten-free, and contains BCAAs. Consumers these days are now becoming aware of the benefits provided by plant-based sources, which are mostly organic by nature and are preferred over the conventional synthetically made source. Pea processed ingredients provides gluten-free solutions to food manufacturers with other nutritional benefits, such as low-fat, low-calorie, lactose-free, and allergen-free solutions. The use of gluten-free solutions in the production of bakery products helps in reducing the fat content, improving cholesterol levels, increasing the metabolic rate, and promoting healthy digestion.

Pea proteins sub-segment in by type segment is estimated to account for the largest share in the pea processed ingredients market.

The pea protein subsegment holds a dominant position in the pea processed ingredients market by type. This is due to the high protein content offered by isolates as well as their use in a wide array of applications, including plant-based meat and performance nutrition. In terms of volume, pea flour segment dominated the market owing to lower price and easy extrusion process compared to the other types.

In by application segment, the beverages sub-segment is projected to account for the fastest market growth in the pea processed ingredients market.

Considering the growing population of lactose-intolerant consumers and a general paradigm shift of consumers seeking dairy alternatives, manufacturers have directed their efforts toward producing non-dairy alternatives that are allergen-free. Pea proteins are allergen-friendly and are devoid of any genetic modification. Drinks such as soups, juices, smoothies, and meal replacer drinks are now available being fortified with dietary fibers. They increase the viscosity and stability of the drink as well as the shelf life of the beverages. These beverages are of low caloric content but with similar taste and improved texture. It is used as an alternate source of sugar for confectionery products, and hence, is popular among health-conscious consumers.

The yellow peas sub-segment by the source is projected to account for the largest market share of the pea processed ingredients market over the forecast period.

Yellow peas are among the most preferred sources of pea by product manufacturers. This is due to the functionality and adaptability of peas into different product types, which is driving the demand for yellow peas across different products, such as plant-based meat, beverages, and even functional foods, and performance nutrition. The high protein content offered by yellow split peas makes it ideal for manufacturing pea protein isolates.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=22233721

North America is estimated to dominate the global pea processed ingredients market over the forecast period.

Consumers in the North American region are gradually shifting their diet preferences and are going vegan due to the health and wellness benefits associated with it. This paradigm shift in food culture is being supported by health & fitness industries, medical communities, celebrities, and athletes, which has bolstered the demand for pea-based food ingredients. The rising incidences of obesity, cardiovascular diseases, and diabetes among the American population have also prompted consumers to adopt vegan diets.

Key Market Players:

The key players in this market include Emsland Group (Germany), COSUCRA Groupe Warcoing SA (Belgium), Roquette Frères (France), Vestkorn Milling AS (Norway), Ingredion Incorporated (US), Axiom Foods, Inc (US), and Felleskjøpet Rogaland Agder (Norway). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.