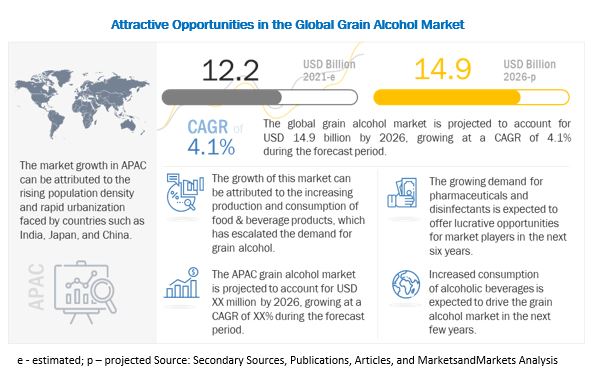

The report "Grain Alcohol Market by Type (Ethanol, Polyols), Application (Food, Beverages, Pharmaceutical & Healthcare), Source (Sugarcane, Grains, Fruits), Functionality (Preservative, Coloring/flavoring agent, Coatings), and by Region - Global Forecast to 2026", published by MarketsandMarkets™. According to MarketsandMarkets, the global grain alcohol market size is estimated to be valued at USD 12.2 billion in 2021 and is projected to reach USD 14.9 billion by 2026, recording a CAGR of 4.1% during the forecast period. The increase in demand for grain alcohol in various industries such as food & beverages and health & personal care is driving the grain alcohol market globally. The grain alcohol market is gaining momentum due to increase in the production of beer and increasing demand for craft beer. The use of ethanol in the beverage industry has resulted in the growth in the market of grain alcohol for beverage applications. Grain alcohol is also used as preservatives, food color, or coatings in the end products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=8581594

The beverages segment, by application, is projected to witness significant growth during the forecast period.

The beverages segment includes beer, wine, spirits, and other beverages such as ready-to-drink (RTDs), premixes, cider, and perry. Beer is the world's most widely consumed alcoholic beverage, and the third-most popular drink overall, after water and tea. Global beer consumption is mainly driven by growing disposable income, improvements in the quality of beer, marketing & advertising activities, and a steadily growing beer-consuming population base. Wine is an alcoholic beverage made by fermenting grapes or other fruits. Spirits are alcoholic beverages produced by distillation of ethanol obtained by the fermentation of grains, fruits, or vegetables. The ethanol concentration in spirits is increased above that of the original fermented mixture by a method called distillation. With the rapidly rising demand for alcoholic beverages and the increased production of the same, the beverages segment is likely to grow at the highest rate during the forecasted period.

The polyols segment, by type, is projected to witness higher growth during the forecast period.

The various polyols considered for the study include sorbitol, maltitol, xylitol, mannitol, and erythritol, among others. Sorbitol is a low-calorie sugar known as a polyol or sugar alcohol. Naturally, it is found in foods including apricots and prunes. Its uses include retention of moisture in products, bulk sweetener, and an ingredient in sugar-free sweets, chewing gums, and pharmaceuticals. Maltitol is a type of sugar alcohol, which is used as a replacing agent to table sugar as it does not cause tooth decay, has fewer calories, and has a lesser effect on blood glucose. The manifold applications of polyols in the food & beverage industry is projected to drive the growth of this segment.

The Asia Pacific region is projected to witness the highest growth during the forecast period.

The Asia Pacific region is characterized by dense population and urbanization, which has resulted in a rise in the consumption of food & beverage products. This has in turn, given an opportunity to the grain alcohol market to secure its position in the food & beverage industry by introducing new innovative alcohol products to cater to the changing demands of the manufacturers and end consumers.

Request for Customization:

Key Players:

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, ADM (US), Cargill (US), Merck Group (Germany), Roquette Frères (France), MGP Ingredients (US), Cristalco (France), Grain Processing Corporation (US), Wilmar Group (Singapore), Manildra Group (Australia), Glacial Grain Spirits (US).