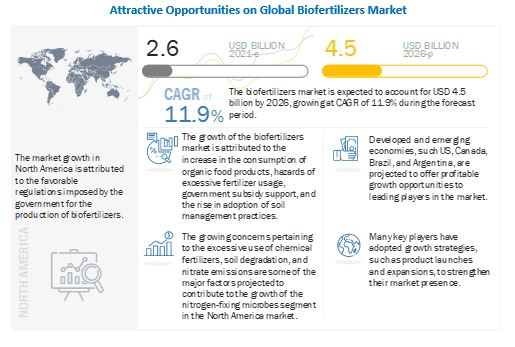

The report "Biofertilizers Market by Form (Liquid, Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type (Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing & Mobilizing), Crop Type, and Region - Global Forecast to 2026", The Biofertilizers Market was valued at USD 2.6 billion in 2021; it is projected to grow at a CAGR of 11.9% to reach USD 4.5 billion by 2026

The increase in consumer preference for organic food products, adoption of soil fertility management practices, serious concerns regarding the control of nitrate emissions and eutrophication in the aquatic environment, and government promotions for the use of organic fertilizers are a few key drivers encouraging the market growth for biofertilizers, globally.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

The Nitrogen fixing Biofertilizers by type is projected to achieve the fastest growth in the Biofertilizers Market.

The value of nitrogen-fixing biofertilizers in improving and enabling a higher yield of legumes and other crops can be realized through the application of biofertilizers. They are mainly used in legumes, pulses, black grams, groundnuts, and soybeans. Moreover, biological nitrogen fixation is considered an important process that determines nitrogen balance in the soil ecosystem. The increase in concerns to reduce pollution caused due to excessive application of nitrogen fertilizers and nitrate emissions in countries, such as the US, Spain, Canada, Brazil, Australia, Argentina, and China, are projected to drive the growth of the nitrogen-fixing biofertilizers market.

By crop type, the Fruits and Vegetable segment is estimated to account for the largest market share in the Biofertilizers Market.

Due to the increase in health concerns, there is an increase in the production and consumption of fruits & vegetables, particularly organic products. In order to improve the quality, shelf life, and yield of fruits & vegetables, various inputs such as biofertilizers are being incorporated. The increase in trend in the cultivation of organic fruits & vegetables and those under IPM practices have created a positive impact on the growth of the biofertilizers market.

The Soil treatment by mode of application is estimated to account for the largest market share of the Biofertilizers Market over the forecast period.

The use of biofertilizers in soil depends on the nutrient content and the type of crops that need to be grown. When these helpful microorganisms are introduced in the soil, they help the plant to receive adequate nutrients that are available in insoluble and absorbable forms. In addition, these biofertilizers do not impact soil fertility adversely but help to enhance its microbial content.

The Liquid Form segment is estimated to observe the fastest market growth in the Biofertilizers Market during the forecast period.

Liquid biofertilizer technology is considered an alternative solution to the conventional form of carrier-based biofertilizers. Liquid fertilizers have significantly higher survival rates after storing for a longer time as compared to other formulations and treatments. They do not get contaminated and have greater immunity against the native soil microbial population. Moreover, it is also convenient for biofertilizer manufacturers due to the limited risks associated with inventory keeping for a longer period and reduces the need for a year-long production process.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=856

North America is estimated to be the largest market.

The imposition of bans on the usage of harmful chemicals and fertilizers in the agricultural industry by governments in North American countries has created a high growth potential for biofertilizers. In addition, the increase in acceptance of organic foods among consumers is projected to widen the scope of growth for leading players. With the increase in inclination toward organic cultivation in the region, the growth of the biofertilizers market is projected to remain high. As per the USDA and Department of Energy (DOE), the increase in the availability of biomass feedstock is also one of the key factors driving the market growth.

Key Market Players:

The key players in this market include Novozymes (Denmark), T. Stanes & Company Limited (India), Kan Biosys (India), Kiwa Biotech (China), and Symborg (Spain).These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.