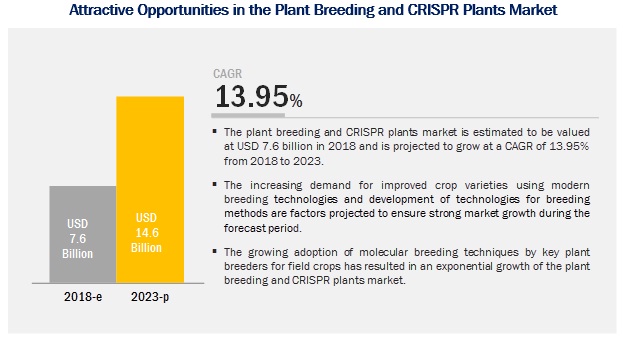

The plant breeding and CRISPR plants market is estimated to account for USD 7.6 billion in 2018 and is projected to reach USD 14.6 billion by 2023, growing at a CAGR of 13.95% during the forecast period. Increasing investments from the private sector and increasing consolidation of the in-house plant breeding facilities is driving the growth of the plant breeding and CRISPR plants market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

The scope of this report includes a detailed study of leading seed manufacturers with in-house plant breeding facilities, such as Bayer (Germany), Syngenta (Switzerland), DowDuPont (US), KWS SAAT (Germany), Limagrain (France), and DLF Trifolium (Denmark), and also major service providers, such as Eurofins (Luxembourg), SGS SA (Switzerland), Pacific Biosciences (US), Benson Hill Systems (US), Hudson River Biotechnology (US), Evogene (Israel), Bioconsortia (US), and Equinom (Israel). In addition, these companies are focusing on developing, introducing, and manufacturing various seed lines utilizing advanced techniques, which enable farmers to encourage sustainable farming practices.

Bayer, a life sciences company, offers crop protection products, seeds, and non-agricultural pest control products. These products are offered through its business segments, namely, crop protection/seeds and environmental science. The company offers a broad product portfolio of high-value seeds and effective pest management solutions. The company operates in various regions including North & South America, Europe, Asia Oceania, the Middle East, and Africa through its production facilities. The company innovates plant traits and develops new seed varieties of cotton, canola, soybeans, rice, wheat, and vegetables, through investments in R&D activities. Bayer’s manufacturing facilities operate in 130 sites, which are spread across 34 countries. It has its distribution network and sales operations in over 120 countries. For instance, in September 2018, Bayer set up its breeding and trait development station in North Carolina (US). This expansion helps the company to increase its customer base, and thereby increase its market share in the North American plant breeding market. The company’s recent acquisition of Monsanto, which is one of the leading plant breeders, has enabled the company to utilize cutting-edge technology solutions for plant breeding processes.

Syngenta is a leading company that provides crop protection products. It offers over 145 crop protection products across the globe, which can be used for nearly 200 crops. It is engaged in the development, production, and marketing of various products to improve crop yield and its quality. The company operates through three business segments-crop protection, seeds, and lawn & garden. The investment in Syngenta’s seeds division has enabled it to expand its product offerings, services, and R&D facilities. The company invests more than USD 1.3 billion each year on R&D, and in 2017, it invested USD 1.2 billion on crop protection and seeds business. With the increasing investment in innovations, the company could offer new technologies that would help growers to gain higher crop yield in return of investment. New technologies offered by the company are mainly in the form of genetics and traits, which offer disease resistance, insect control, herbicide tolerance, drought resistance, and increase yields in seed varieties, complemented by innovations in digital agriculture and crop protection.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=256910775

The increasing industrial value for corn and soybean in the US has been encouraging breeders to adopt advanced technologies for better yield, owing to which the adoption rate for crop genetics in this country has been high. Also, the limited regulatory control and high promotional support for intellectual property affairs in genetic technology have been extremely favorable toward the adoption of plant biotechnological tools in agriculture. Hence, North America dominated the global plant breeding market in 2017. On the other hand, there has been an ever-increasing demand for commercial seeds in the Asian market, in line with the improving economic conditions. Also, seed manufacturers such as Bayer, Monsanto, and Syngenta have been showing increasing interest in tapping this potential market, wherein the companies have been expanding their R&D centers across the Asia Pacific.