According to the National Pesticide Information Center (US), ‘Rodenticides are pesticides that kill mice and rats.’ Even though rodents play an important role in nature, they are increasingly required to be controlled, as they damage crops, transmit diseases, and in some cases, cause ecological damage. Rodenticides are formulated as baits, which are designed to attract rodents.

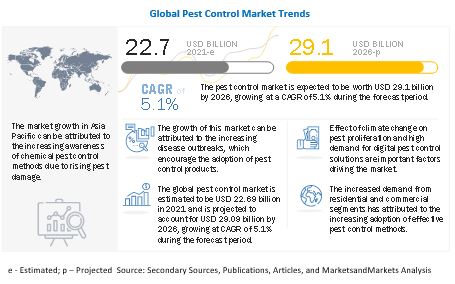

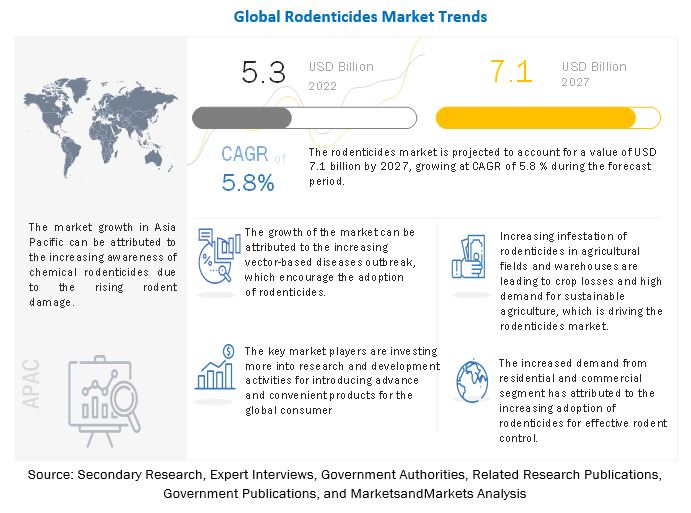

The rodenticides market is estimated to be valued at USD 5.3 billion in 2022. It is projected to reach USD 7.1 billion by 2027, recording a CAGR of 5.8% during the forecast period. The rodenticides market is witnessing significant growth due to the rise in economic activities, an increase in residential and commercial construction activities, and the growth in awareness of public and environmental health.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=189089498

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=189089498

Key players in this market include Basf Se(Germany), Bayer Ag(Germany), Syngenta Ag(Switzerland), UPL Limited(India) & Neogen Corporation(US)

BASF SE is a leading company that produces a wide range of chemical products. It operates via six business segments, namely chemicals, industrial solutions, materials, nutrition & care, surface technologies, and agricultural solutions. BASF’s agricultural solutions segment includes functional crop care, biotechnology, turf, ornamentals and landscape, pest control, and animal nutrition. BASF uses innovative active ingredients and technologies in a wide range of pest control products to eradicate pests, such as bed bugs, termites, ants, flies, and rats. It offers innovative formulations of insecticides and rodenticides that are comparatively effective. The company has a global presence in regions, such as Asia Pacific, North America, Europe, South America, Africa, and the Middle East. In Nov 2020, BASF SE (US) launched Selontra rodent bait in Europe. It is a soft bait formulation based on the active ingredient, cholecalciferol, which makes the product three times more effective than the standard anticoagulant rodenticides.

Bayer AG is a global leader in agriculture research and solutions; it operates through four segments—pharmaceuticals, consumer health, crop science, and animal health. It also supplies high-quality food products, feed, and plant-based raw materials, and helps in promoting the sustainable use of natural resources. It also offers herbicides, corn seed & traits, soybean seed & traits, insecticides, fungicides, vegetable seeds, and digital agriculture solutions. Bayer AG’s subsidiary, Bayer CropScience, is involved in the development of crop protection, non-agricultural pest control, and plant biotechnology. The company produces highly palatable and fast-acting rodenticides, which are designed for professional use. These rodenticides are highly effective against all types of rodents. It has a presence in over 120 countries across the globe. The company primarily operates in Europe and has an active presence in North America, Latin America, Africa, the Middle East, and Asia Pacific. In Aug 2019, Bayer entered into a partnership with UrbanClap (India), which would facilitate the pest control products to UrbanClap for effective and safe pest management solutions for consumers in the residential segment.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=189089498

The Asia Pacific market is completely driven by the country markets of China, India, Japan, Australia, Thailand, Indonesia and few other Asian counties. As the world’s largest and most populous region, Asia Pacific is one of the key markets for rodenticides. Rodents are common pests present in agricultural fields. Annually, extensive volumes of agricultural produce are destroyed and contaminated by rodents. To meet the increase in demand for food products and to reduce the crop damages caused by rodents, the use of rodenticides has increased significantly in the region. The food retail, food manufacturing, pharmaceutical, hospitality, and residential sectors are expected to be major growth verticals in this market.Asia Pacific is expected to be the fastest-growing region during the forecast period due to several reasons. One of the major drivers of the market is the fact that agriculture is one of the most significant revenue-generating sectors in China and India. The growing population within the region is urging the farmers to provide a maximum yield to fulfill the demand of the increasing population. In such cases, the increasing crop damage and decreasing food production due to rodents are expected to leverage this market positively.