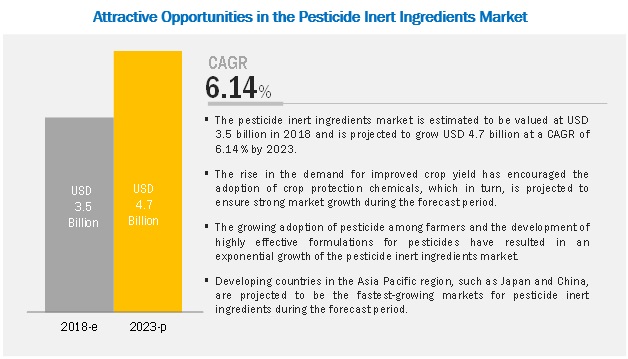

The pesticide inert ingredients market is projected to grow at CAGR of 6.14% from USD 3.5 billion in 2018 to 4.7 billion during the forecasted year of 2023. The pesticide inert ingredient is added to the active ingredients to formulate the pesticide final product. When the inert ingredient is added to the formulation, it modifies the surface tension between pesticide spray drops and plant leaf surface to achieve better wetting, distribution, and penetration quality, resulting in an enhanced pesticide effect. The effectiveness of a pesticide increases manifolds with the addition of inert ingredients. The global market for pesticide inert ingredients is projected to grow at a steady rate, and the growth of the market is highly dependent on the requirement of crop protection products for improving the quality of crops.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176580687

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176580687

The inert ingredients of a pesticide product potentially constitute up to 99% of the pesticide formulation and have been a confidential composition and therefore withheld by most of the pesticide manufacturers on their labels. According to the National Center for Biotechnology Information (NCBI), inert ingredients have been legally kept hidden from public view despite their toxic nature; the primary factor was to protect industry trade secrets. However, the US regulatory authority, Environmental Protection Agency (EPA) has been working toward policy changes, which requires 100% disclosure of a pesticide product’s ingredients. The major issue with pesticides and the inert ingredients is associated with its handling and environmental degradation, which in turn, gives rise to the development of major technologies such as microencapsulation. The advent of microcapsules as a type of inert ingredient results in better handling of toxic active ingredients and also controls the optimum release of pesticides. Technological advancements in inert ingredients for pesticide formulations are inevitable to succeed in the biological agrochemicals industry. This is projected to encourage the adoption of the microencapsulation technology in the crop protection industry, which has proven effects on the target. These factors are projected to impact the overall pesticide inert ingredients market with its rapid growth rate.

On the basis of type, the carriers segment is projected to witness the highest growth from 2018 to 2023, due to high demand for pesticide inert ingredients, which can help in the efficient application of pesticide products on the crops. Although emulsifiers account for the largest share in the market due to their efficacy to form emulsions that help in the formulation of water-oil-based pesticides, the carriers segment is estimated to be the fastest-growing market. The use of pesticides may kill non-target pests due to the inefficacy of pesticide application; this can be overcome through the use of carrier inert ingredients. Due to this factor, the carrier segment is estimated to record the highest CAGR during the forecast period.

The steady increase in market demand for organic fruits and vegetable has led to a gradual shift from synthetic products to bio-based products across the supply chain of the pesticide industry, which includes every constituent that is organically sourced. The pesticide products are made of active as well as inert ingredients. Thus, to make the products organic, it is required to formulate these with materials, which are non-toxic or mildly toxic in nature. There are many companies including AstroBio and Chem21, which are producing bio-based solvents such as bio-ethanol, limonene, and 2-methyl tetrahydrofuran (2-MeTHF) for their usage in various industries. This creates an opportunity for major players of agrochemical industries to develop bio-based inert ingredients and term the formulated pesticide appropriate for organic use and meet with the growing demand in the market.

Request Sample Pages of the Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=176580687

On the basis of region, Asia Pacific is estimated to be the fastest growing market during the forecast period. Agriculture is one of the largest industries in the Asia Pacific region, with a large share of farmland and good soil fertility. Moreover, the region is rich in plant diversity due to the wide variations in climate across the countries. The major players in the global market are focusing on expanding into the market to explore the untapped potential, due to which the investments in the agriculture industry from the public sector are declining. The Asia Pacific region is one of the leading consumers of pesticides across the globe, though the region heavily depends on imports for pesticide supply. Since inert ingredients are majorly consumed by pesticide manufacturers at the production facility during the formulation stage, and since countries such as India, Thailand, and Vietnam depend on imports for formulations, the market for inert ingredients is smaller compared to the Americas and Europe. However, with the increasing establishment of production plants in the Asian countries, the use of inert ingredients along with pesticide application would increase in the future.