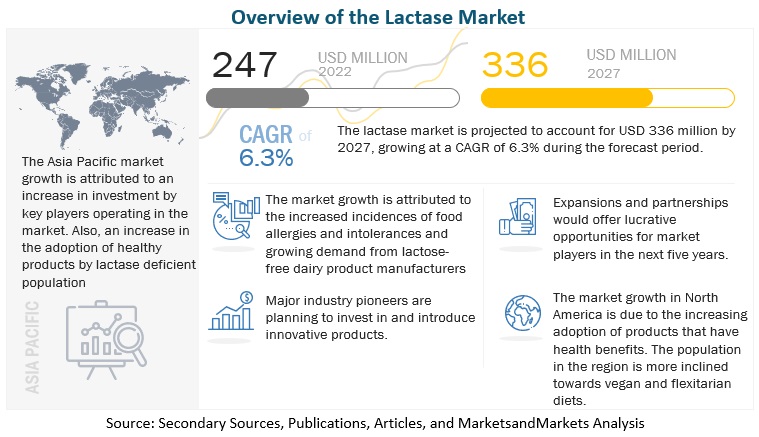

According to a research report "Lactase Market by Source (Yeast, Fungi, and Bacteria), Form (Liquid and Dry), Application (Food & Beverages and Pharmaceutical products & Dietary Supplements), Region (North America, Europe, Asia Pacific, South America and RoW) - Global Forecast to 2027" published by MarketsandMarkets, the global lactase market is estimated to be valued at USD 247 million in 2022. It is projected to reach USD 336 million by 2027, at a CAGR of 6.3%, in terms of value between 2022 and 2027. Lactase enzyme is used food and beverage industry to hydrolyze lactose found in milk and dairy products. The lactase enzyme is obtained from different sources which have high activity and enzyme stability which can sustain the fermentation process during manufacturing. A significant increase in the number of people suffering from lactose intolerance is driving up the demand for lactose-free products. This is one of the most important factors influencing the demand for lactase enzymes for the manufacturing of lactose-free products. Further, an increase in R&D activities by key players to provide affordable and sustainable solutions to the stakeholders in the value chain is expected to drive the market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125332780

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125332780

Yeast accounts for the largest market share in the lactase market

Based on the source, the yeast segment dominates the market. Lactase enzymes are traditionally extracted from yeast, and they are stable for their application in food & beverages and pharmaceutical. Yeast contains â-galactosidase which breaks down lactose to simpler sugars. It involves the mechanism of phosphorylation, where lactose is cleaved intracellularly by a â-galactosidase.

The liquid segment accounts for the largest market share in the lactase market during the forecast period

Based on form, the liquid segment is projected to account for the largest market share in the lactase market. Liquid lactase accelerates chemical and biological reactions thus making it ideal for food & beverage application. Due to the liquid form, the enzyme is diluted and can also be used in lesser dilutions according to the application. The drawback of the liquid form is that the enzyme needs to be stored at the optimal temperature to maintain its enzymatic activity.

The pharmaceutical products & dietary supplements segment is projected to grow at a significant CAGR in the lactase market during the forecast period

By application, the lactase market is segmented into food & beverages and pharmaceutical products & dietary supplements. In the pharmaceutical segment, lactose is used as an excipient that binds the table. It is not suitable for patients with lactose intolerance; hence the dry lactase powder is used to break down the sugar and make it ideal for consumption by people with lactose intolerance. Similarly, lactose-free dietary supplements provide all nutrition from the milk without compromising on the health and taste of the product.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=125332780

Asia Pacific is projected to grow with the highest CAGR in the lactase market during the forecast period

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period and occupies a significant share in the global lactase market. The increasing awareness regarding lactose intolerance in both adults and infants is gaining momentum in the region. Additionally, the demand for lactose-reduced infant formula and lactose-free products for adult nutrition is significantly catering to the growth of the lactase market in the region. Asia Pacific is also witnessing significant expansion in terms of production by key players operating in the market. The regional manufacturers are currently focusing on new product developments and strategic deals such as partnerships, collaborations, and expansions to create more awareness among consumers and cater to the growing demand.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as CHR. Hansen Holdings A/S (Denmark), Kerry Group plc. (Ireland), Koninklijke DSM N.V. (the Netherlands), Novozymes A/S (Denmark), Merck KGaA (Denmark), IFF (US), Amano Enzymes (Japan), Advanced Enzymes (India), Novact Corporation (US), Antozyme Biotech Pvt. Ltd (India), Nature Biosciences Pvt. Ltd (India), Aumgene Biosciences (India), Creative Enzymes (US), Biolaxi Enzymes Pvt. Ltd (India), Enzyme Biosciences Pvt. Ltd (India), Infinita Biotech (India), Mitushi Biopharma (India), Oenon Holdings Inc. (Japan), Ultreze Enzymes (India), and Senson (Finland)