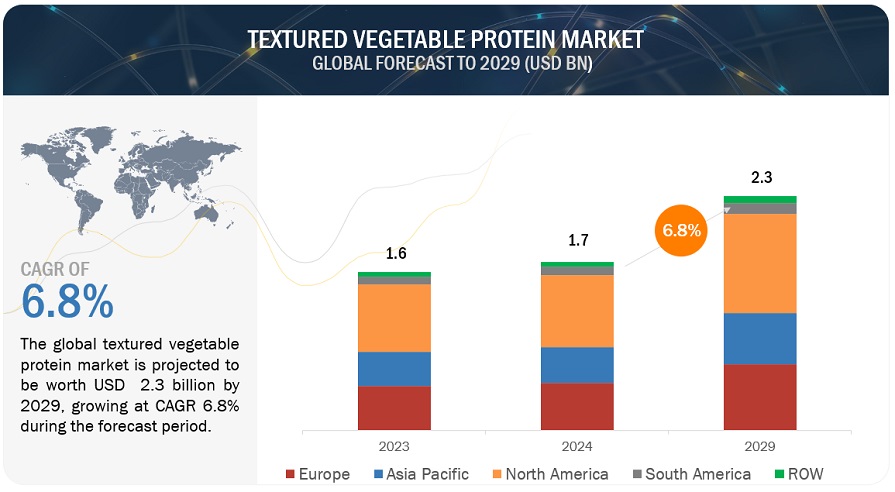

According to a research report "Textured Vegetable Protein Market by Type (Slices, Chunks, Flakes, and Granules), Source (Soy, Wheat, and Pea), Application (Meat Alternatives, Cereals & Snacks), Form (Dry and Wet), Nature and Region - Global Forecast to 2027" published by MarketsandMarkets, the global textured vegetable protein market is estimated to be valued at USD 1.4 billion in 2022. It is projected to reach USD 1.9 billion by 2027, recording a CAGR of 6.9% during the forecast period. Shifting demand patterns are guiding the change in the dynamics of the food & beverage industry across the globe. Developing regions are witnessing a transformation within the industry. Also, the growing urbanization and rising incomes, alongside the availability of innovative products and technology, have the potential to transform the bell curve of the market from price-sensitive to a quality-conscious consumer base. The younger demographic has shifted its attention towards nutrition content and brand value, increasing its willingness to experiment with products. Additionally, international travel and exposure to global products and brands have enhanced their awareness, very evident in their purchase choices and behavior.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=264440297

Food manufacturers in Europe have been focusing on new product developments concerning meat alternatives with better texture, appearance, flavor, and composition to attract more potential consumers.

The European market has been a strong region for textured vegetable protein. The changes in consumption patterns among consumers and manufacturers’ inclination toward developments in meat alternatives have been propelling the growth in the region. According to an article shared by Green Queen Media, in 2021, the number of vegans in Europe doubled from 1.3 million to the current estimated figure of 2.6 million, representing 3.2% of the population. The growing vegan population in western European countries, such as the UK, France, and Germany, showcase robust growth prospects for manufacturers seeking to focus on product developments to grow their product portfolios.

The market for textured vegetable proteins in Europe has been driven by its use in food applications, such as meat alternatives and bakery products majorly sourced from soy and pea. The emergence of newer manufacturers of various food applications has been adopting textured vegetable proteins as a viable substitute, resulting in a growing number of product launches in the region.

The extrusion technique used to provide texture and form to the textured vegetable protein have became popular.

Commercially, extrusion cooking is the only feasible continuous processing platform to obtain textured vegetable proteins. Emerging technologies such as the PowerHeater by the Source Technology (Denmark) involve thermal cooking rather than mechanical energy inputs to obtain moistened, soft plant-based textures. Certain technologies as shear-cell processing and cultured products exist, however the commercial viability of these technologies is still under the scanner. High-moisture extrusion technology is applied in the processing of textured plant protein meat analogs. Players across the supply chain are introducing technologically advance features to promote the textured vegetable protein market.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=264440297

Customizable flavor options and sizes adding to popularity of textured chunks among vegan consumers

Textured vegetable protein chunks are high in protein and are made from multiple sources, such as soy, pea, and wheat. They are used as a meat substitute, which is an ideal solution for vegans, vegetarians, and flexitarians. Textured vegetable protein chunks are offered in various forms, such as regular and mini chunks. They can be used in various food applications, such as plant-based meat and other consumer applications. They are made from de-fatted flour that is compressed and processed into chunks, which comprise 50% of the protein content. Chunks offered by textured vegetable protein manufacturers range from 2.7 mm to 23 mm in size. Textured protein chunks are also often consumed as a part of soups and stews due to their texture and can be substituted for meat with the availability of different flavor types.

The key players in this market include ADM (US), Roquette Frères (France), Ingredion (US), DuPont (US), The Scoular Company (US), Beneo (Germany), Cargill, Incorporated (US), MGP (US), Shandong Yuxin Biotechnology Co. Ltd. (China), Axiom Foods, Inc., (US), Foodchem International Corporation (China), PURIS (US), Kansas Protein Foods (US), and DSM (Netherlands).