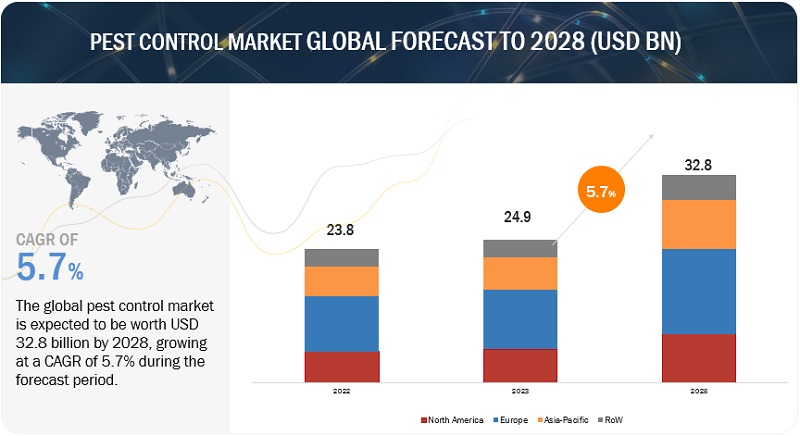

According to a research report "Pest Control Market by Control Method (Chemical, Mechanical, Biological, Software & Services), Pest Type (Insects, Rodents, Termites, Wildlife), Mode of Application (Sprays, Traps, Baits, Pellets, Powder), Application and Region - Global Forecast to 2028" published by MarketsandMarkets, the pest control market is projected to reach USD 32.8 billion by 2028 from an estimated USD 24.9 billion in 2023, at a CAGR of 5.7% during the forecast period in terms of value. The utilization of pest control products and services is being driven by a number of factors that reflect the evolving needs and priorities of individuals, businesses, and industries. Heightened awareness of the health risks associated with pests and the diseases has spurred a greater demand for proactive pest management. Moreover, the increasing urbanization and population density in various regions have created an environment conducive to pest infestations, necessitating effective control measures.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144665518

By application, the residential segment accounted for the largest share of the pest control market.

Pest control products for residential use are essential in maintaining a safe and comfortable living environment for homeowners. These products are designed to address common household pests, including insects like ants, cockroaches, spiders, and termites, as well as rodents like mice and rats. Thus, due to the increasing infestation by pests in residential areas, the utilization of pest control products in residential in expanding at a significant rate.

The insects segment accounted for the largest share of the pest control market by value.

The increasing urbanization and changing climate has increased the global insect population, which is driving the need for pest management, particularly for insects such as bedbugs, cockroaches, mosquitoes, flies, and others. Since insects’ cause irritation to livestock or humans and can be vectors of plant or livestock diseases, thus management of insect pests are essential, due to which the pest control market is anticipated to benefit.

Request for Sample Pages of the Report:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=144665518

By mode of application, the sprays segment accounted to have the largest share in the pest control market.

Sprays are a preferred mode of application in the pest control market, owing to the high demand for liquid chemical formulations. Sprays give consumers a quick and easy way to apply pest control solutions, enhancing pest control and preventing property losses. The spray mode of application also allows for a uniform distribution of the pest control chemicals over the target area, which ensures that pests are exposed to the active ingredients consistently, increasing the effectiveness of the treatment. Moreover, with various nozzle designs and spray patterns, the spray formulations can be applied to specific areas that reduces the risk of non-target species exposure.

By control method, the chemical segment accounted for the largest share in the pest control market.

Chemicals are preferred due to their quick action and effectiveness in controlling pests. The use of chemical pesticides is widespread due to their relatively low cost, the simplicity of application, and their effectiveness, availability, and stability. Chemical pest control products also provide rapid control of pest populations, especially when dealing with immediate threats, outbreaks, or infestations. Moreover, Chemicals can provide a consistent and reliable means of pest control, since chemicals works regardless of weather conditions and can be applied at various growth stages of pests. Thus, these factors are driving the utilization of chemicals in pest control management.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=144665518

The North America region accounted for the largest market, in terms of value, of the global pest control market in 2022.

Due to several factors, the market for pest control is expanding in North America. As consumers look for pest control management, there is first a growing awareness of and adoption of sustainable pest control approaches practices in the area. The stringent regulations in various industries, such as food production, hospitality, and healthcare, have also played a significant role in the market's growth. Additionally, advancements in pest control technologies and methods have made treatments more efficient, targeted, and environmentally friendly, further boosting the market in North America.

The key players in this market includes Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Rentokil Initial plc (UK), Anticimex (Sweden), Rollins, Inc. (US), ATGC Biotech Pvt Ltd. (India), Ecolab Inc. (US), FMC Corporation (US), De Sangosse (France), Bell Laboratories (US), PelGar International (UK), and Fort Products Limited (UK).