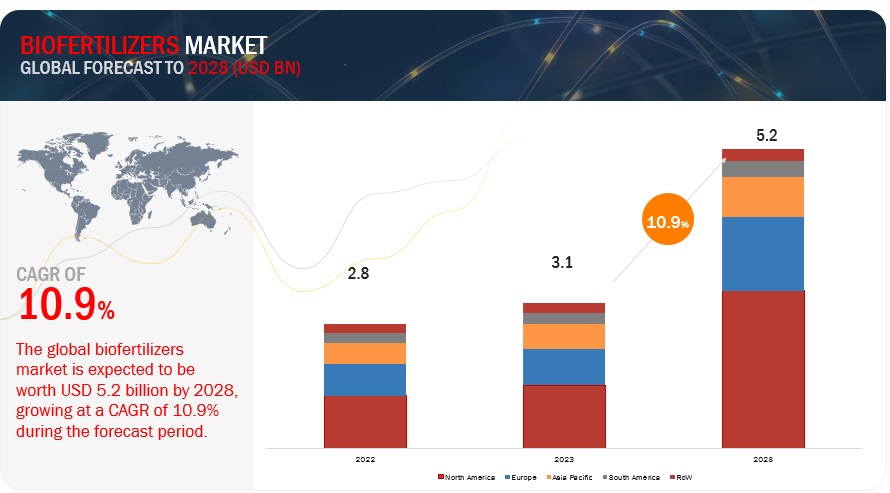

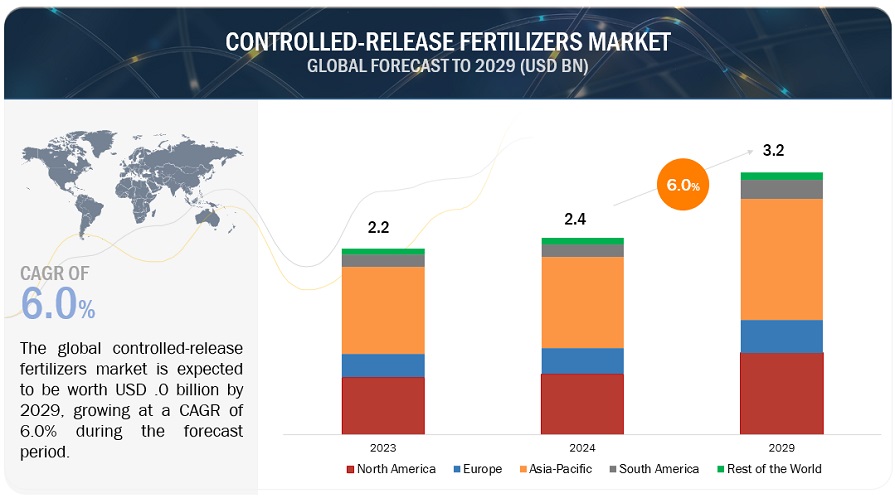

The global controlled-release fertilizers market is projected to reach USD 2.9 billion by 2028 from USD 2.2 billion by 2023, at a CAGR of 5.9% during the forecast period in terms of value. The controlled-release fertilizers market has witnessed significant growth and established its dominance in the global agriculture industry. According to the World Bank Report 2023, approximately 9.2% of the world’s population faced hunger in 2022, compared with 7.9% in 2019. The rising levels of hunger and food insecurity highlight the urgent need to increase agricultural productivity to ensure food availability. Thus, the increasing demand for enhanced agricultural output while reducing environmental effects is one of the main driving factors. These fertilizers deliver nutrients gradually, enhancing plant absorption while lowering leaching and runoff, which helps reduce water pollution. Furthermore, the use of controlled-release fertilizers is accelerated by the push for sustainable agricultural practices, which are complementary to their advantages.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

YARA

Yara is primarily engaged in manufacturing and marketing fertilizers and industrial products. The company operates through major business segments, namely, fertilizer and chemical products, freight, and insurance services. Yara is a leading player in global crop nutrition and operates a global leading ammonia and nitrates capacity. Deep agronomic knowledge, crop nutrition solution, and digital capabilities enable Yara to work toward climate positive future. The company offers a wide range of controlled-release fertilizers including YaraBela, YaraVita, YaraVera, and YaraMila. These fertilizers typically consist of granules that contain a blend of essential nutrients such as nitrogen, phosphorus, and potassium, along with other secondary and micronutrients. The nutrients are encapsulated within a polymer coating or other controlled-release matrix, which determines the rate at which the nutrients are released into the soil. In September 2021, Yara acquired Ecolan (US), a producer of fertilizers for agriculture and forestry, to expand its organic fertilizer business. This was Yara’s first acquisition in the organic fertilizer segment. This would help improve nutrient use efficiency in this segment by capitalizing on deep crop nutrition knowledge. Yara's goal of enhancing nutrient use efficiency across different farming systems resonates with the benefits of controlled-release fertilizers.

Nutrien Ltd.

Nutrien Ltd. is one of the leading producers of crop inputs, services, and solutions. The company operates its business in Nitrogen, Potash, Phosphate, and Retail segments. The company focuses to produce and distribute more than 27 million tonnes of potash, nitrogen, and phosphate products for agricultural, industrial, and feed customers throughout the world. The company has the most extensive crop nutrient product portfolio, combined with its global retail distribution network, which includes more than 1,500 farm retail centers. In the premium technologies segment, the company offers “ESN Smart Nitrogen” which is a controlled-release fertilizer that minimizes nitrogen loss and maximizes crop yield. ESN technology uses a flexible polymer coating to encapsulate a urea granule comprised of 44% nitrogen. The unique coating protects and releases nitrogen based on soil temperature. ESN provides nitrogen based on the demand for the growing crop.

In July 2022, Nutrien Ltd. entered into an agreement to acquire Brazilian company Casa do Adubo S.A. (Casa do Adubo). The acquisition includes 39 retail locations, under the brand Casa do Adubo, and 10 distribution centers, under the brand Agrodistribuidor Casal, in the states of Acre, Bahia, Espirito Santo, Maranhao, Mato Grosso, Minas Gerais, Para, Rio de Janeiro, Rondonia, Sao Paulo, and Tocantins. The acquisition expands the company’s footprint in Brazil from five states to 13 and supports growers in a key region of the world that increasingly rely on to sustainably increase crop production and feed a growing population. With a larger footprint and increased market presence, Nutrien could potentially expand its product offerings to include a wider range of agricultural inputs, including specialized fertilizers like controlled-release fertilizers.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=136099624

Mosaic

The Mosaic Company is one of the leading producers, marketers, and distributors of concentrated phosphate and potash crop nutrients. The company is organized into Phosphates, Potash, and Mosaic Fertilizantes business segments. The company mines its phosphate products from its own land in Central Florida, US, and also through its joint venture in Peru. The company offers high-quality controlled-release fertilizers and distributes its products to countries in North America and worldwide. The company has three business segments—phosphates, potash, and Mosaic Fertilizantes.

By leveraging their expertise, Mosaic Controlled-release fertilizers are committed to providing innovative solutions that improve crop quality, enhance nutrient intake, and contribute to overall plant growth over the globe. In March 2021, Mosaic entered into a strategic partnership with AgBiome to pioneer new biological alternatives that enhance soil health and fertility. This collaboration illustrates a larger industry trend toward sustainable agriculture solutions, particularly in the field of controlled-release fertilizers.

Argentina is expected to be the fastest-growing market in the South American region during the forecast period.

Argentina is poised to emerge as the fastest-growing player in the controlled-release fertilizers market within South America. Argentina places considerable emphasis on sustainable farming practices, aligning with global trends and consumer preferences. Controlled-release fertilizers offer a solution to minimize nutrient runoff, reduce environmental impact, and promote soil health, making them a natural fit for the country's sustainable agriculture initiatives.