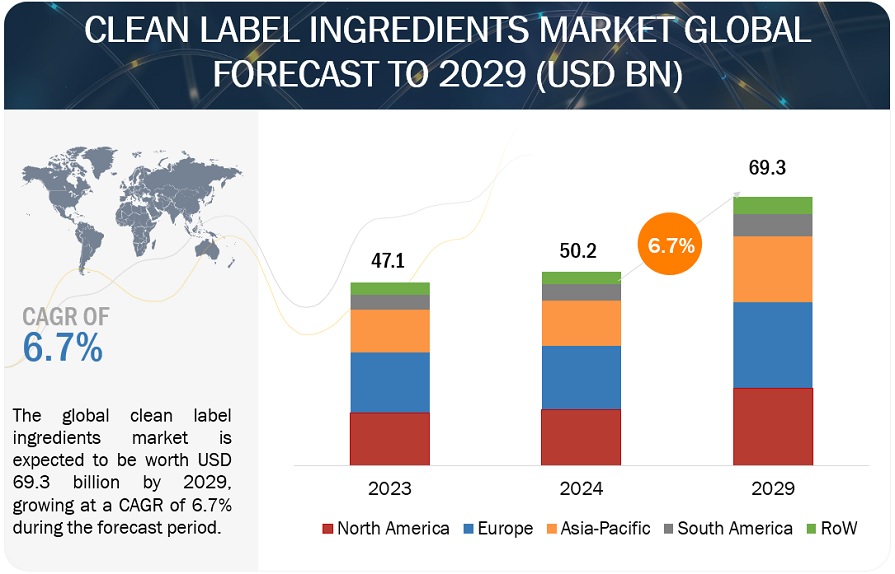

The global clean label ingredients market, estimated to be worth USD 50.2 billion in 2024, showcases a remarkable growth projection, anticipated to escalate to USD 69.3 billion by 2029, indicating a robust compound annual growth rate (CAGR) of 6.7% during the forecast period. Consumers today are more informed and conscientious about their food choices, seeking products with simple, understandable ingredients. This shift in consumer preference is compelling food and beverage manufacturers to reformulate products using clean label ingredients, which typically exclude artificial additives, preservatives, and colorants. The primary driver of this market is the growing health consciousness among consumers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=99427189

Furthermore, the rise in health issues such as allergies and intolerances has made consumers increasingly vigilant about the contents of their food. They are scrutinizing food labels more closely, preferring products that do not contain synthetic additives or artificial ingredients. This trend is further accelerating the clean label movement as manufacturers respond to consumer demands by reformulating their products to exclude potentially harmful substances and highlight their commitment to health and safety. As a result, the market for clean label ingredients continues to grow, reflecting a broader societal shift towards prioritizing natural and transparent food options.

The prepared food/ready meals & processed foods segment, among food applications, is estimated to hold the largest share throughout the forecast period.

The prepared food/ready meals and processed foods segment is projected to dominate the clean label ingredients market throughout the forecast period, driven by evolving consumer preferences and significant industry shifts. As consumers increasingly seek convenience without compromising on health, the demand for ready meals and processed foods made with clean label ingredients is surging. The hectic lifestyles of contemporary consumers are a major factor contributing to this expansion, as they increase the need for quick and simple meal alternatives. Moreover, the discriminating and health-conscious customers of today demand that processed foods and ready meals be free of artificial additives, preservatives, and artificial substances. In order to allay these worries, the clean label offers products that appeal to a wide range of consumers by combining convenience and health benefits.

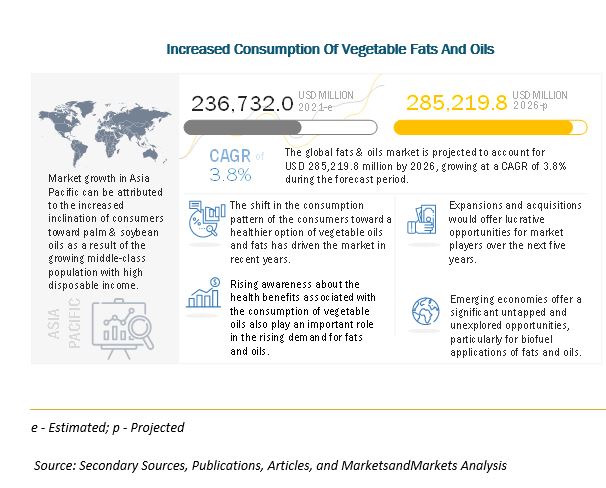

Additionally, the rise in health awareness and the growing prevalence of dietary-related health issues, such as obesity, diabetes, and food allergies, are compelling consumers to opt for cleaner, more natural food options. This shift is prompting manufacturers in the prepared food and processed foods segment to reformulate their products using clean label ingredients, such as natural preservatives, plant-based colorants, and minimally processed components.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=99427189

In Europe, Germany is poised to maintain its dominant position within the clean label ingredients market throughout the forecast period.

Throughout the projection period, Germany is expected to maintain its dominant position in the European clean label ingredients market due to high consumer demand and a strong emphasis on food quality and safety. When it comes to food, German consumers are especially picky, exhibiting a significant preference for natural, organic, and additive-free products. Food producers are being forced by consumer behavior to restructure their goods using clean label ingredients in order to satisfy the increasing demand for food labels that are clear and easy to read.

Moreover, Germany's regulatory landscape is highly supportive of the clean label. The country has some of the most stringent food safety and labeling regulations in Europe, which encourage manufacturers to adopt cleaner and more transparent ingredient lists. Regulatory bodies, such as the Federal Office of Consumer Protection and Food Safety (BVL), play a critical role in enforcing these standards, thereby fostering a market environment that prioritizes clean and natural ingredients.

The key players in the market are Cargill, Incorporated (US), ADM (US), DSM (Netherlands), International Flavors & Fragrances Inc. (US), Kerry Group plc (Ireland), BASF SE (Germany), Ingredion (US), Sensient Technologies Corporation (US), Corbion (Netherlands), Symrise (Germany), Chr. Hansen A/S (Denmark), Puratos (Belgium), Ajinomoto Co., Inc. (Japan), Tate & Lyle (UK), and Givaudan (Switzerland).