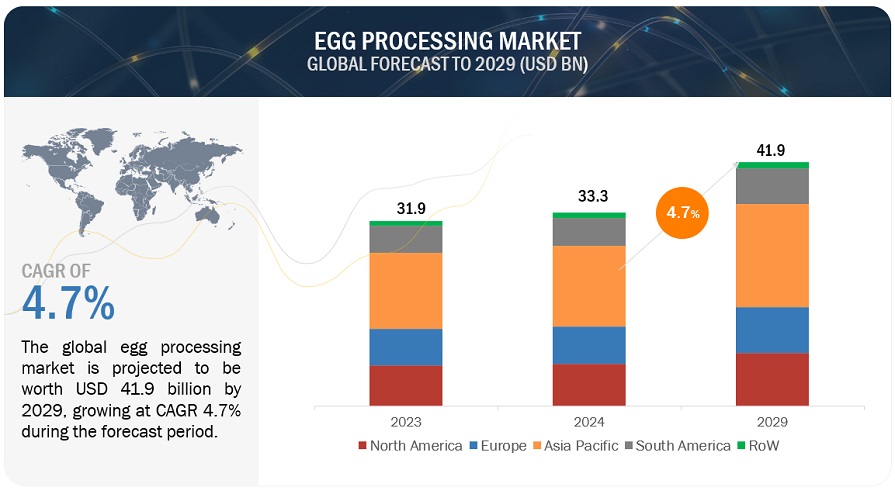

The global egg processing market is expected to reach USD 47.2 billion by 2029, with an estimated value of USD 37.5 billion in 2024, representing a compound annual growth rate (CAGR) of 4.7% from 2024 to 2029. This growth surge is primarily attributed to several key factors, such as consumers are increasing awareness of the nutritional value of eggs, which are rich in protein, vitamins, and essential minerals. This drives the demand for both fresh and processed egg products. The food industry heavily relies on egg products for various applications, such as baking, pasta production, sauces, and dressings. The growth of the food industry, particularly in bakery and confectionery segments, directly translates to increased demand for processed eggs. In October 2018, The American Egg Board (AEB) is celebrating World Egg Day by highlighting the egg industry's commitment to "sustainable nutrition." This means providing high-quality protein while minimizing environmental impact. Egg farmers are working to reduce their use of land and water, while also making eggs affordable and accessible to people around the world. Studies have shown that eggs can significantly improve health outcomes in children, especially in areas with limited access to nutritious food.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=124810046

Opportunities: Cutting-edge technology enhances efficiency and market appeal in egg processing.

The integration of advanced automation technologies in egg production presents a significant opportunity for the industry's growth and efficiency. In Canada, where labor shortages and the transition to cage-free systems are driving forces, investments in automated packing, stacking, and palletization technologies are enhancing operational efficiency and egg quality. For instance, the adoption of automated packing and stacking equipment, such as Damtech's systems, streamlines egg collection and processing, reducing labor-intensive tasks and improving productivity. Additionally, innovations like the Ovoconcept palletizing robot at Rose Valley Colony exemplify how automation can significantly increase efficiency, with the ability to palletize 10,000 eggs in just 30 minutes. These technological advancements not only optimize operations but also improve egg quality and cleanliness, leading to fewer cracked and broken eggs. With potential return on investments as short as four to five years for equipment like the Ovoconcept robot, the adoption of automation offers a promising opportunity for egg processing companies to enhance efficiency, reduce costs, and meet evolving consumer demands.

Challenges: Plant-based egg substitutes challenge traditional egg products in diverse applications.

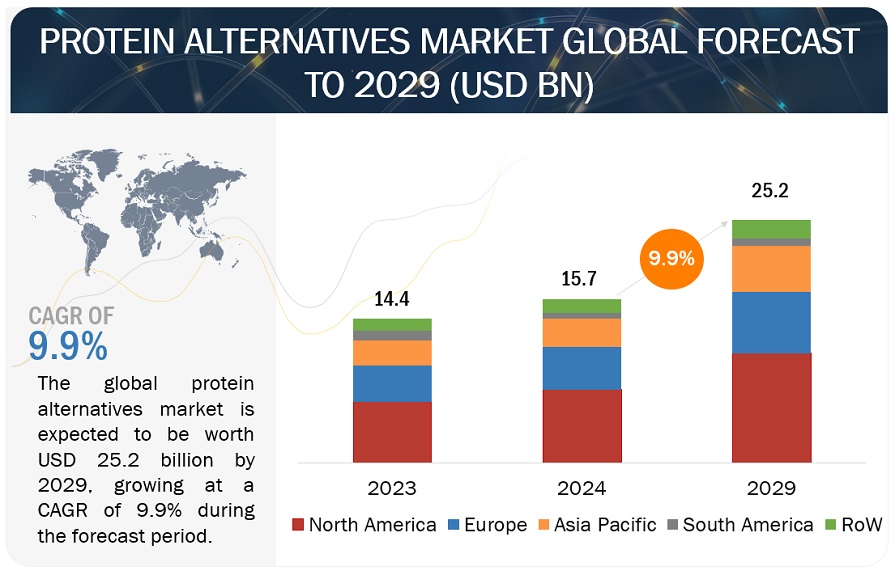

According to Good Food Institute reports, the rise of plant-based egg alternatives presents a formidable challenge to the egg processing market. In the US alone, retail sales of plant-based egg alternatives soared to USD 255 million in 2022, marking substantial growth. Despite limited per capita consumption data, household penetration of these alternatives hovered around 2% in 2022, with a notable uptick in repeat purchases, indicating increasing adoption. Unit sales of plant-based eggs in the US have surged by a factor of 7 since 2019, signaling a significant uptick in consumption trends. This growing popularity of plant-based alternatives, driven by factors such as health consciousness and dietary preferences, directly competes with processed egg products in various food applications, posing a significant challenge to the traditional egg processing industry.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=124810046

The organic egg products segment is the fastest-growing market in the upcoming forecast period.

The demand for organic egg products is on the rise, driven by consumer trends favoring perceived health benefits, food safety concerns, animal welfare considerations, and environmental sustainability. According to the United Egg Producers, organic and cage-free shell egg production has increased from 29.3% (96.1 million hens) in 2021 to 34% (106.2 million hens) in 2022 to meet the consumers are concerned about the welfare of animals raised for food production, and organic certification ensures that hens have access to outdoor space and are not given antibiotics or growth hormones.

Europe accounts for the second-most dominant position within the egg processing market throughout the forecast period.

According to the European Commission in 2023, the European Union (EU) has over 350 million laying hens, producing nearly 6.7 million tons of eggs annually. France, Germany, Spain, and Italy are the top producers, accounting for more than half the EU's production. Processed egg products are becoming increasingly popular in Europe, driven by growing consumer concerns about animal welfare and environmental impact are pushing egg processors to adopt more sustainable practices, such as sourcing eggs from cage-free hens and using recyclable packaging. However, adapting to evolving consumer preferences and addressing welfare concerns are the major factors contributing to the growth of the market.

Request Sample Pages: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=124810046

The key players in this market include Cal-Maine Foods, Inc. (US), Rose Acre Farms (US), Ovobel Foods Limited (India), SKMEgg.com (India), Rembrandt Foods (US), IGRECA (France), Eurovo Srl (Italy), Hillandale Farms (US), Avril SCA (France), and Interovo Egg Group BV (Netherlands).