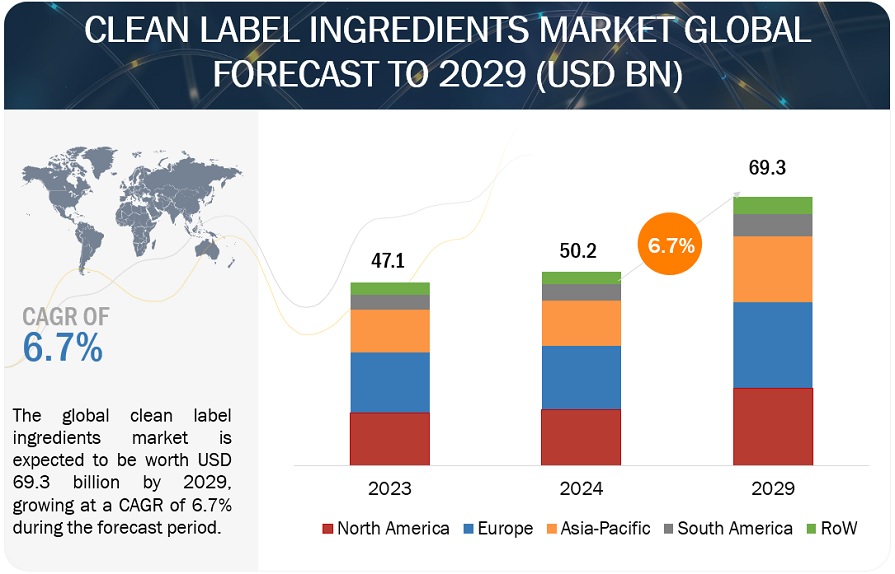

The global clean label ingredients market is projected to reach USD 69.3 billion by 2029 from the 2024 valuation of USD 50.2 billion, displaying a promising Compound Annual Growth Rate (CAGR) of 6.7%. The demand for clean label ingredient demand is rising sharply due to a confluence of factors that span consumer preferences, regulatory pressures, and advancements in food technology. This trend is significantly transforming the landscape of food production and marketing, driven by an increasingly health-conscious and informed consumer base.

Consumers are becoming more educated about the potential health risks associated with artificial additives, preservatives, and genetically modified organisms (GMOs). This increased awareness is propelling them to seek out products that contain natural, minimally processed ingredients. For instance, according to a 2021 survey by the International Food Information Council (IFIC), 63% of consumers are paying more attention to ingredient lists. The desire for transparency in food labelling has led companies to adopt clean label practices, ensuring their products meet consumer expectations for simplicity and wholesomeness.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=99427189

Dry Form Accounted for A Higher Market Share Among Form Segment In 2023.

The convenience factor plays a crucial role. Powdered or dry products offer ease of storage, transportation, and handling compared to other forms like liquid or solid. For instance, dry supplements and food additives are lightweight and compact, making them convenient for both manufacturers and consumers. This convenience translates into cost savings throughout the supply chain, from production to distribution.

Moreover, the versatility of dry form allows for a wide range of applications across industries. Brands can cater to diverse consumer preferences by offering a variety of formulations in dry form, enhancing their market appeal.

The prepared food/ready meals & processed foods segment, among food applications, is estimated to hold the largest share throughout the forecast period.

The prepared food/ready meals and processed foods segment is projected to dominate the clean label ingredients market throughout the forecast period, driven by evolving consumer preferences and significant industry shifts. As consumers increasingly seek convenience without compromising on health, the demand for ready meals and processed foods made with clean label ingredients is surging. The hectic lifestyles of contemporary consumers are a major factor contributing to this expansion, as they increase the need for quick and simple meal alternatives. Moreover, the discriminating and health-conscious customers of today demand that processed foods and ready meals be free of artificial additives, preservatives, and artificial substances. In order to allay these worries, the clean label offers products that appeal to a wide range of consumers by combining convenience and health benefits.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=99427189

Asia Pacific is The Fastest-Growing Market for Clean Label Ingredients Among the Regions.

Asia Pacific is emerging as the fastest-growing market for clean label ingredients, driven by one of the primary drivers, which is the region's rapidly expanding middle class, which is increasingly health-conscious and willing to spend on premium food products. This demographic shift is accompanied by a rising awareness of food safety and nutrition, prompting consumers to seek products with natural and easily recognizable ingredients.

Local food manufacturers in the Asia Pacific are responding to this demand by innovating and reformulating products to include fewer artificial additives and more natural ingredients. This shift is supported by advancements in food technology, which facilitate the development of clean label alternatives that do not compromise on taste or quality. Moreover, the agricultural abundance in many Asia Pacific countries provides a rich source of natural ingredients, enabling the production of a diverse range of clean label products.

The key players in this market include Cargill, Incorporated (US), ADM (US), DSM (Netherlands), International Flavors & Fragrances Inc. (US), Kerry Group plc (Ireland), BASF SE (Germany), Ingredion (US), Sensient Technologies Corporation (US), Corbion (Netherlands), Symrise (Germany), Chr. Hansen A/S (Denmark), Puratos (Belgium), Ajinomoto Co., Inc. (Japan), Tate & Lyle (UK), and Givaudan (Switzerland)