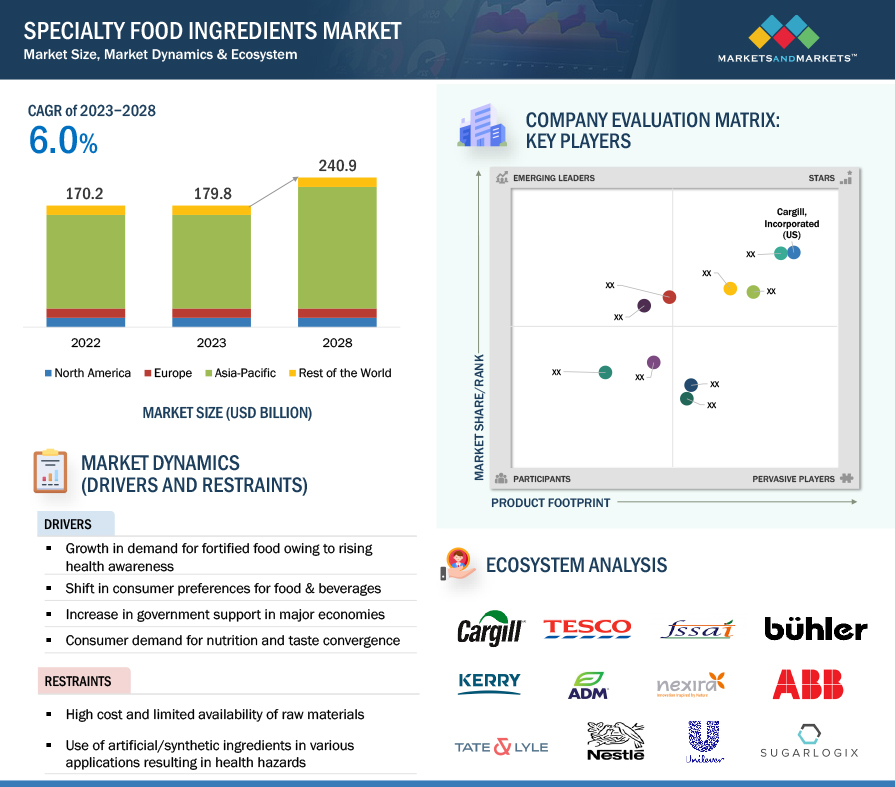

The global specialty food ingredients market is expected to grow from USD 179.8 billion in 2023 to USD 240.9 billion by 2028, with a compound annual growth rate (CAGR) of 6.0% in terms of value. Specialty food ingredients, such as additives, Flavors, sweeteners, colors, and functional ingredients, play a crucial role in enhancing the quality, taste, and nutritional value of food and beverages. The rising health consciousness among consumers has driven a shift in eating habits from merely satisfying hunger to prioritizing healthy food choices, which, in turn, has fuelled the demand for specialty food ingredients.

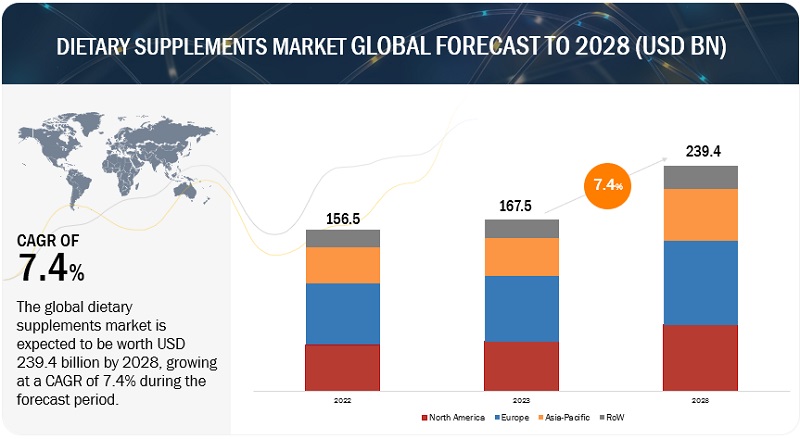

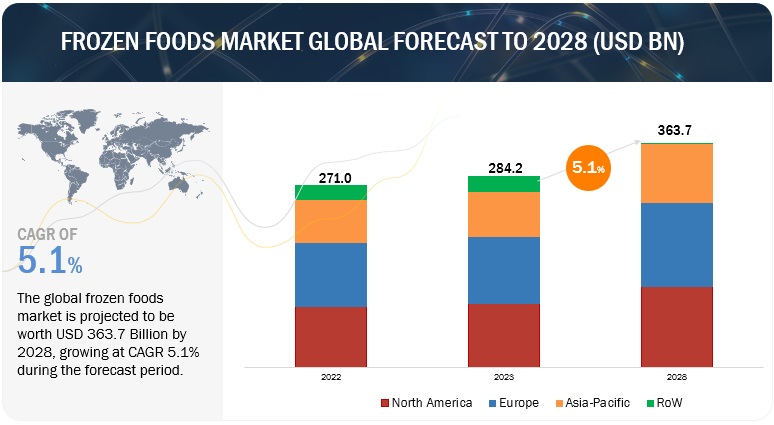

Dietary trends such as gluten-free, vegan, and keto diets are becoming increasingly popular among consumers. Additionally, in their quest for unique and superior culinary experiences, customers are seeking out new Flavors, healthier alternatives, and products with clean labels and specific health benefits. To meet this demand, producers are expanding their offerings to include a diverse range of specialty ingredients that are allergen-free, ensuring inclusivity. Moreover, consumers' preference for supporting local businesses and artisanal products is expected to further drive the demand for specialty food ingredients.

Specialty Food Ingredients Market Drivers: Increasing Global Population Drives Growth in Specialty food ingredients Market

The rapid growth of the global population is significantly boosting the specialty food ingredients market. As the number of people worldwide continues to rise, so does the demand for food products that cater to a wide range of dietary needs, preferences, and health considerations. According to the FAO, the global population, currently at 5.3 billion, is growing by approximately 250,000 people each day, with an estimated 1 billion more births expected over the next decade. This surge in population fuels the need for innovative and value-added food solutions, making specialty food ingredients essential for meeting these evolving demands. These ingredients offer unique flavors, textures, and nutritional benefits, tailored to diverse consumer preferences.

The expansion of the specialty food ingredients market is also driven by increasing globalization and the influence of diverse culinary traditions on eating habits. As consumers are exposed to a broader array of international cuisines, there is a growing trend of incorporating exotic and ethnic ingredients into everyday meals. Specialty food ingredients, such as spices, herbs, and unique flavor enhancers, allow consumers to explore and enjoy a wide variety of culinary experiences. Consequently, the rising global population is a key driver of growth in the specialty food ingredients market.

Specialty Food Ingredients Market Opportunities: Rising disposable incomes in emerging economies, driving specialty food ingredients segment

The specialty food ingredients market offers a significant opportunity for new product development. As the market grows and reaches new regions, companies must find ways to differentiate themselves from competitors. Manufacturers have ample opportunities to create innovative food products with enhanced properties to meet the evolving demands of consumers and various industries. The industry’s geographic expansion also allows companies to tailor their products to the unique preferences and needs of consumers in different regions. Overall, the specialty food ingredients sector provides a promising avenue for companies to develop new and innovative products that align with the shifting needs and preferences of consumers.

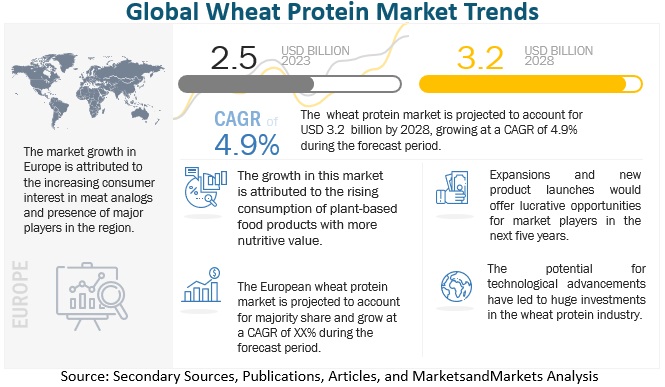

The expanding middle class in emerging economies is placing greater emphasis on health and wellness. Health-conscious consumers increasingly seek food products that align with their dietary choices and offer nutritional benefits. Specialty food ingredients can meet these demands by providing healthier alternatives to traditional ingredients, such as plant-based proteins, natural sweeteners, and functional additives. This trend presents manufacturers with the opportunity to develop customized food ingredients that cater to specific dietary requirements, including gluten-free, vegan, or organic options.

US is dominating the specialty food ingredients market share in 2023.

The US has a significant, wealthy consumer base with significant purchasing power. American consumers are renowned for their openness to trying out novel goods and experimenting with emerging culinary trends. The need for specialty food ingredients is driven by consumers values for convenience, quality, and diversity in their food options. The demand for a wide variety of specialty ingredients, such as flavors, functional ingredients, and natural additives, is further fueled by the different culinary preferences and multicultural populations. The US market is a leader in specialty food ingredients due to the strong customer demand and considerable purchasing power. According to the USDA Food Processing report of April 2023, in the U.S. market, food processing ingredients hold a significant share of 60 percent. Within this sector, specialty food ingredients play a crucial role in shaping the diverse and innovative landscape of the food industry. As consumers increasingly prefer innovative products, the demand for specialty food ingredients continues to grow, further driving the development and expansion of this dynamic sector.

Top Specialty Food Ingredients Companies

Major manufacturers in this market are based in North America and Europe. ADM (US), DSM (Netherlands), International Flavors & Fragrances Inc. IFF (US), Kerry Group plc. (Ireland), Givaudan (Switzerland), Cargill, Incorporated (US), Sensient Technologies Corporation (US), Ingredion. (US), Chr. Hansen Holding A/S (Denmark), and Tate & Lyle (UK) are among a few leading players operating in the specialty food ingredients market. These players have adopted various growth strategies to strengthen acquisitions, and new product development activities to further expand their specialty food ingredients market presence.