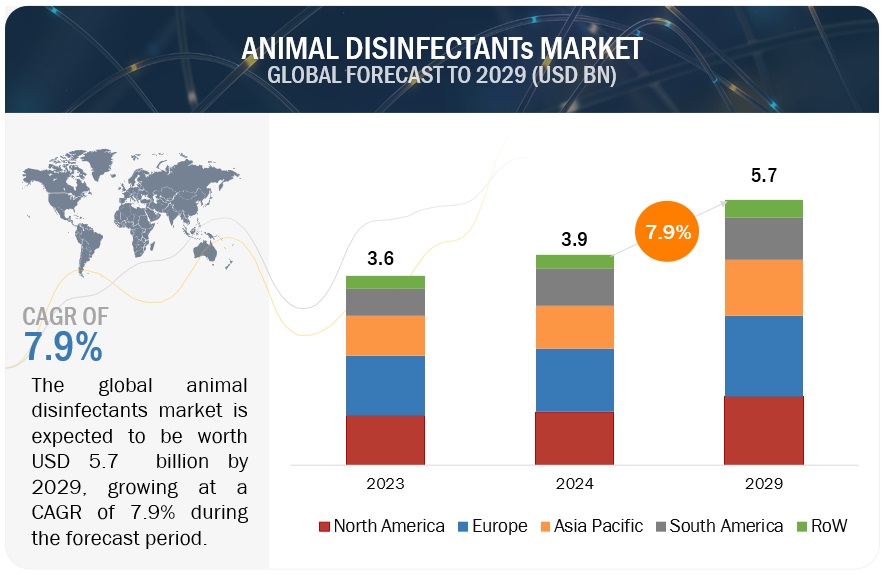

The animal disinfectants market size is projected to reach USD 4.9 billion by 2028 from USD 3.4 billion by 2023, at a CAGR of 7.7% during the forecast period in terms of value. The demand for animal disinfectants is rising globally due to factors such as animal health and hygiene awareness, government regulations, and the need to prevent the spread of zoonotic diseases. With the increasing awareness of animal diseases and the need to maintain good health and hygiene, the use of disinfectants has become crucial in the livestock industry. Additionally, governments worldwide are imposing regulations on the use of disinfectants to prevent the spread of diseases. Furthermore, the rise in industrial livestock farming practices has increased the need for animal disinfectants.

Animal Disinfectants Market Opportunities: Rise in consumer preference for biological disinfectants

The demand for biological disinfectants is expected to increase during the forecast period on account of the rising consumer inclination toward non-toxic disinfectants coupled with the rising livestock production globally. The general consumer perception is toward the toxic nature of synthetic formulations that farmers are seeking to avoid and adopt biological solutions. The recent change in the regulatory requirements in the developed markets, including the classification of formaldehyde as a possible carcinogen, is a key factor expected to propel the demand for biological disinfectants.

For instance, in Sep 2022, Canada based company Thymox SF, a subsidiary of Laboratoire M2 Inc., made a partnership with Construction Distribution and Supply Co. Inc. (CDS) (US). Through this partnership, CDS gains access to Thymox SF's advanced technology and product line, allowing them to diversify their offering and meet the needs of customers seeking eco-friendly disinfection options for animal facilities. By incorporating Thymox SF's biodegradable disinfectants into their distribution network, CDS can position themselves as a reliable supplier of sustainable solutions, attracting environmentally conscious customers and gaining a competitive advantage in the market.

By application, the dairy cleaning segment is projected to dominate the market during the forecast period.

The cleaning of dairy cattle involves removing equipment and bedding before cleaning. The nature of the surfaces will influence the disinfection process. Rough and porous surfaces are difficult to disinfect in comparison to smooth surfaces. Both the milking parlor and milk toxin-producing machines must be cleaned daily. The milking machines, including the teat dips and milk tongs, are among the major sources of infection and can have an adverse impact on the health of the livestock. Therefore, these disinfectants can be applied to various areas, including milking parlors, holding pens, feeding areas, equipment like milking machines and others to thoroughly sanitize and eliminate the potential sources of contamination. Also, the regular utilization of animal disinfectants in dairy cleansing helps to create a healthier and more productive environment for both animals and dairy workers, thereby promoting the overall well-being and efficiency of the dairy operation.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38718363

Europe is expected to lead the animal disinfectants market with the highest market value during the forecast period.

Europe is one of the leading per capita consumers of chemicals and is a key market for animal disinfectants. There has been a significant utilization of animal disinfectants for farm animals in the region to reduce animal diseases. Regulatory requirements and standards regarding animal health and welfare are becoming more stringent in Europe. Compliance with these regulations necessitates the use of effective disinfection protocols. As a result, farmers and animal care facilities are seeking reliable and approved animal disinfectants to ensure they meet the required hygiene standards. This has contributed to the rising demand for such products in the European market. The region also has a significant livestock population that includes poultry, cattle, swine, and others. The concentration of livestock in the region, both in terms of commercial farming and smaller-scale operations, creates a substantial market for animal disinfectants to preserve the health and hygiene of the animals.

Animal Disinfectants Market Share

The key players of the market include Neogen Corporation (US), GEA Group (Germany), Lanxess (Germany), Zoetis (US), Solvay Group (Belgium), Kersia Group (France), Stockmeier Group (Germany), Ecolab (US), Albert Kerbel GMBH (Germany), PCC Group (Germany), G Sheperdanimal Health (UK), Sanosil Ag (Switzerland), Delaval Inc (Sweden), Diversey Holdings Ltd (US), Fink Tech Gmbh (Germany). These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped them achieve major sales and revenues in the global animal disinfectants market.