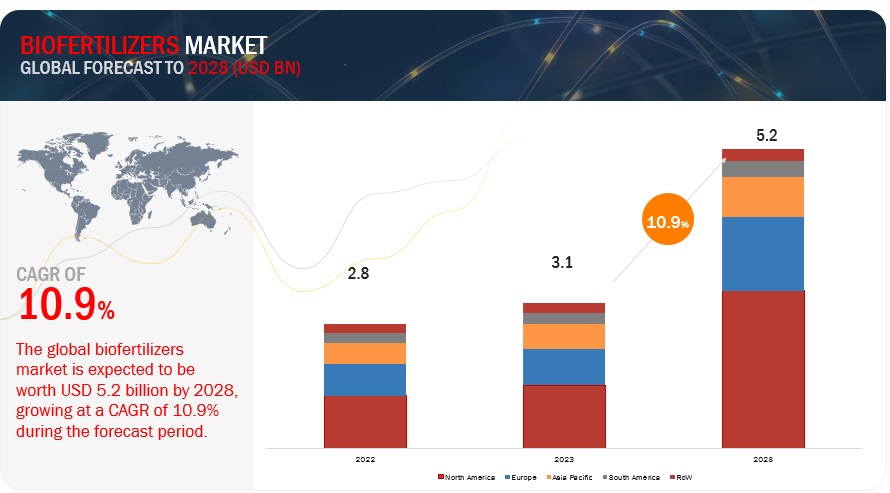

The global biofertilizers market is valued at USD 2.8 billion in 2022. It is projected to reach USD 5.2 billion by 2028, recording a CAGR of 10.9% during the forecast period. The increasing farmland area across the globe is a major driver for the biofertilizer market. According to FiBL, the organic farmland area is recorded at 76 million ha. in 2021. The increase in concerns about environmental health and the usage of synthetic fertilizers in crops has also fueled the growth of the biofertilizer market in various regions. The rise in initiatives taken by governments across the globe to encourage sustainable practices is also propelling the growth of biofertilizers market.

Biofertilizers Market Opportunities: New target markets: Asia Pacific and Africa

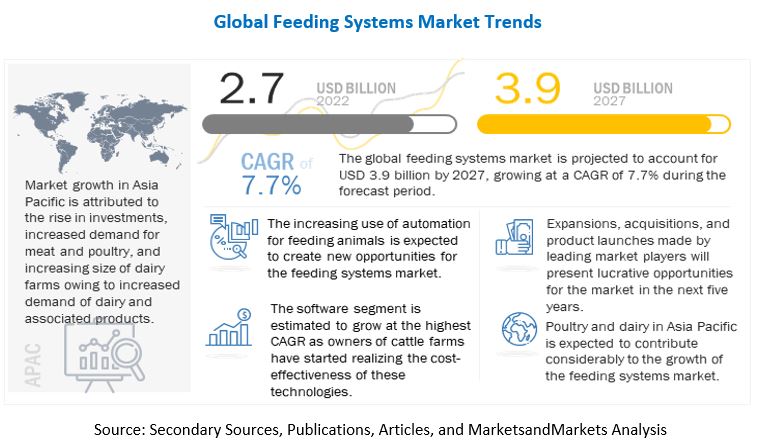

The Asia Pacific and Africa regions are two of the largest consumers of fertilizers. Population development, particularly in Asia, has led to an increase in food demand, which will ultimately result in an increase in fertilizer usage. Governments in these regions are placing a strong emphasis on the use of environmentally benign fertilizers, like biofertilizers and organic manure, to mitigate the negative impacts of chemical fertilisers. Government agencies have aided in raising farmer understanding of the benefits of using biofertilizers. Africa has experienced active conventional farming over the past few decades, which has utilized synthetic fertilizers to supply the soil with vital plant nutrients. However, the quality of the soil and the vital nutrients have been compromised by the over application of these fertilizers. The region now needs biofertilizers as a result of this aspect.

Challenges: Intense competition and product rivalry due to similar products

A significant problem in the sector is the availability of counterfeit biofertilizers, which harms farmers’ perceptions of the finished product and restrains market expansion. Due to their exact chemical qualities and comparable physical traits, counterfeit products have a very low production cost and have shown to be impossible for farmers to distinguish from genuine biofertilizers. Poor microbial load, contaminated items, or inappropriate strains are used to simulate a product. Due to a highly fragmented market with unorganised participants, counterfeit products are sold in Asian nations.

Download PDF Brochure: Biofertilizers Market

By mode of application, soil treatment segment is anticipated to occupy major share in the biofertilizers market during the study period.

When planting legume seeds in hot, dry, highly acidic soils, adverse weather, or when seeds have been treated with chemicals that are toxic to rhizobia bacteria, it is necessary that a liquid biofertilizer formulation be applied directly to the soil to achieve optimal nodulation. When applied to the soil, fertilizers diffuse their way into the crops. Fertilizers promote increased yield and productivity since the roots of the crop are in close touch with them. Hence, the growth of segment occurred during the review period.

A few leading players operating in the market are Novozymes (Denmark), UPL (India), Chr. Hansen Holding A/S (Denmark), Syngenta (Switzerland), T.Stanes and Company Limited (India), Lallemand Inc (Canada), and Rizobacter Argentina S.A. (Argentina). The companies are launching different kinds of products into the market. The expansion of product portfolios offered by the companies is strengthening their presence around the globe. Companies are manufacturing different kinds of biofertilizers for different types of crops. This is resulting in their increased market penetration. Similarly, partnerships are also fostering the expansion of the companies, and helps to create synergy and; obtain a competitive advantage in the industry.

Novozymes is a multinational biotechnology company that primarily manufactures and sells enzymes, biofertilizers, and biopharmaceutical components. The company operates in two key segments: enzymes and biobusiness. They provide biofertilizers within the agriculture biologicals category. The company’s goods are sold/exported in over 130 countries. Biofertilizers occupies a significant portion of agriculture biologicals category and has generated considerable income for the corporation, particularly due to tremendous development in the regions like Asia Pacific and South America. In October 2020, Novozymes launched three new biofertilizer products; TagTeam; BioniQ; and Optimize LV, into the market which aims to enhance the crop yeild. Apart from this in October 2021, Novozymes announced a partnership with Anuvia Plant Nutrients (US) for the development of new biofertilizers by sharing resources.

UPL is a global leader in providing a comprehensive range of patented and post-patented agricultural solutions for arable and specialty crops. It offers seed solutions, crop protection, soil improvement, post-harvest solutions, and farmer involvement activities. This guarantees that UPL is present at all stages of the value chain. The company has a strong presence in more than 138 countries and has 42 manufacturing units and 30 R&D centers across the globe. In October 2021, UPL entered into a collaboration with CHR Hansen Holding A/S to innovate agricultural biological solutions, including biofertilizers to improve farm productivity.

Request Sample Pages: Biofertilizers Market

Key Questions Addressed by the Biofertilizers Market Report:

- What is the projected market value of the global biofertilizers market?

- What is the estimated growth rate (CAGR) of the global biofertilizers market for the next five years?

- What are the major revenue pockets in the biofertilizers market currently?

- What kind of information is provided in the competitive landscape section?