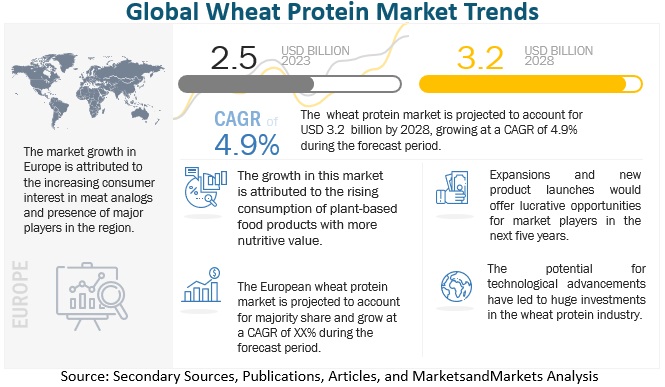

The global wheat protein market size is anticipated to reach a value of $2.5 billion by 2023 and $3.2 billion by 2028, representing a compound annual growth rate (CAGR) of 4.9% from 2023 to 2028. Owing to the increase in demand for meat-free diets, rising obesity cases resulting in demand for low-calorie foods, and consumers seeking healthy foods. Wheat gluten, being rich in proteins, is a suitable option and has boosted the demand for it in the global wheat protein market.

Wheat Protein Market Drivers: Increase in consumer preference for meat analogues

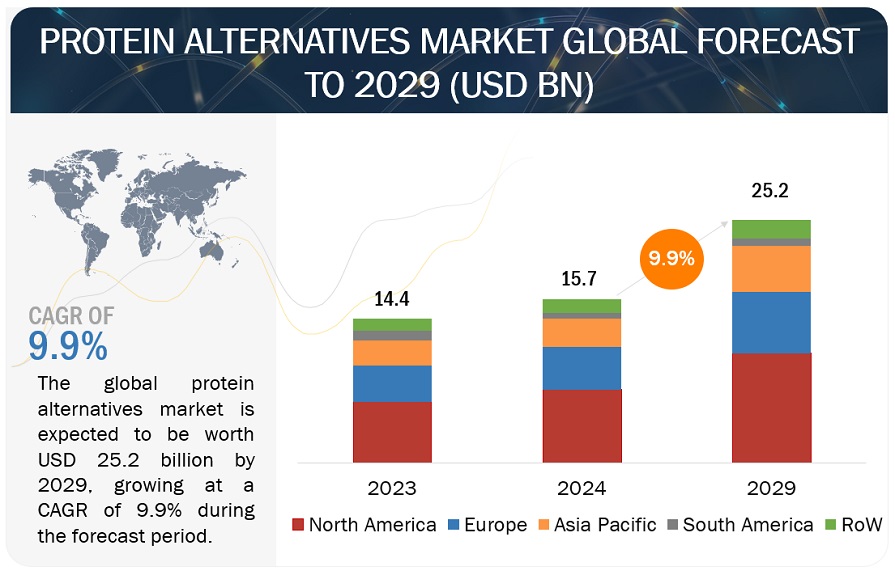

The global market for plant-based meat alternatives has been expanding rapidly as consumers increasingly seek products that mimic the texture, structure, and mouthfeel of traditional meat. This growing demand has spurred the development of plant protein-based meat substitutes worldwide. As more consumers become aware of the benefits of healthy and nutritious foods, a new group known as "flexitarians" has emerged individuals who are actively reducing their meat intake. This shift in eating habits has driven the creation of innovative products that not only replicate the taste of meat but also offer comparable high-protein nutritional value. For example, under the European research initiative LikeMeat, academic researchers and various small and medium-sized enterprises have successfully developed fibrous, meat-like structures from plant proteins using a modified cooking extrusion process, which has been further processed into a range of food products.

Wheat Protein Market Opportunities: Growing role of wheat protein in the pet industry

The pet food market is driven by two primary trends globally. These trends are premiumization and humanization. There is a growing trend of pet humanization as a “family member” among owners. Due to this, there is a rise in the demand for premium pet food with nutritional benefits, better digestibility, and improved ingredient quality for pets. Considering this changing human tendency, the major players, such as Crespel & Deiters Group (Germany), are offering wheat protein as an ingredient that can be incorporated in pet food products.

In dry dog foods and biscuits, wheat is a grain that provides high-quality carbohydrates. In addition to giving us energy for daily tasks, it also gives food the ability to be processed. Wheat is a major source of nutrients and offers a wide range of advantages. Wheat-based products offer holistic, wheat-based solutions for optimizing pet food because they are rich in starches, vitamins, minerals, trace elements, and fiber, which aid in the formation of balanced pet food products.

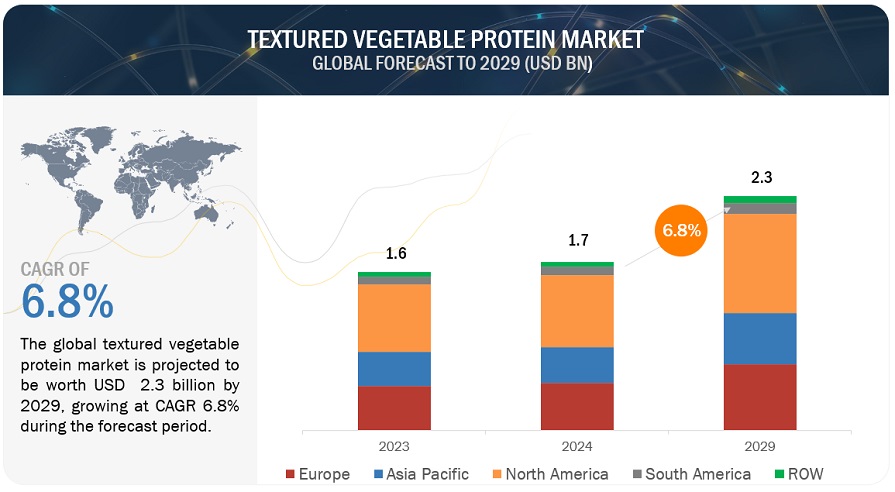

How does the rise in plant-based meat substitutes influence the demand for textured wheat protein?

Textured wheat protein, also known as wheat meat, wheat gluten, or seitan, is a popular plant-based protein source used as a meat substitute for many years. A study published in the journal, Foods, in 2021 found that the demand for meat substitutes, including textured wheat protein, is increasing worldwide due to health, ethical, and environmental concerns associated with meat consumption. In 2019, a survey by the International Food Information Council found that 22% of US consumers reported consuming plant-based meat substitutes, including textured wheat protein, at least once a week.

Therefore, the demand for textured wheat protein is increasing globally, driven by factors such as the growing popularity of plant-based diets and the increasing demand for sustainable and ethical food products.

North America dominates the wheat protein market share.

Countries such as the US, Canada, and Mexico have been considered in this study. The market in the US is driven by growing consumer awareness about the importance of protein in the diet, which, in turn, has encouraged the demand for functional food & beverages. The versatile functionality of wheat protein has sustained demand in the baking industry, leading to constant growth in consumption. Research and technological developments in hydrolyzed wheat protein have also led to a long-term consumption trend of wheat protein in the US. However, the increase in discussion on gluten intolerance acts as a hindrance to the growth of the wheat protein market in this region. The high functional profile, low carbon footprint, and low price of wheat-sourced proteins are the key factors encouraging the consumption of wheat protein, particularly in baked products.

Top Wheat Protein Market Companies

The key players in this market include ADM (US), Cargill, Incorporated (US), Tereos (France), Südzucker AG (US), MGP Ingredients (US), Roquette Frères (France), Glico Nutrition Foods Co., Ltd. (Japan), Kerry Group PLC (Ireland), Manildra Group (Australia), Kröner-Stärke (Germany), among others. The study includes an in-depth competitive analysis of these key players in the wheat protein market with their company profiles, recent developments, and key market strategies.

Key questions addressed by the Wheat Protein Market Report:

- What is the projected market value of the global wheat protein market?

- What is the estimated growth rate (CAGR) of the global wheat protein market for the next five years?

- What are the major revenue pockets in the wheat protein market currently?

- What are the nutritional benefits of wheat protein?

- What are the factors driving the growth of the wheat protein market?

- What are the major players operating in the wheat protein market?