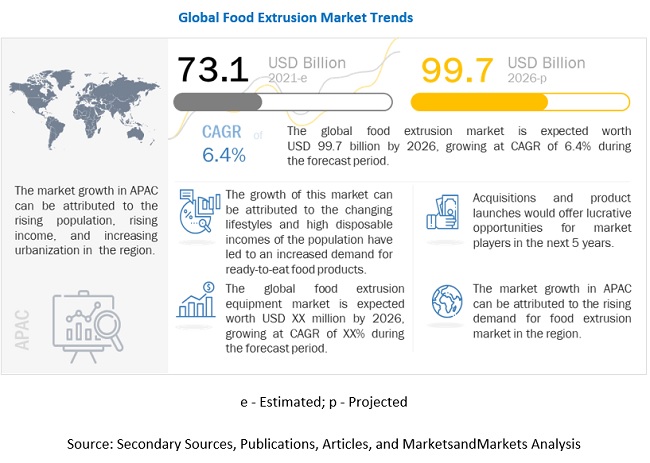

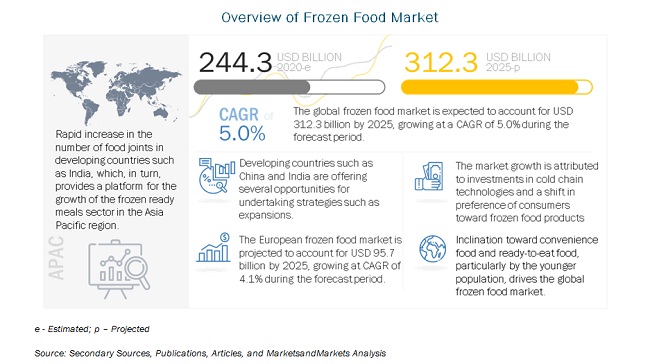

The report "Food Extrusion Market by Extruder (Single Screw, Twin Screw, and Contra Twin Screw), Process (Cold and Hot), Product Type (Savory Snacks, Breakfast Cereals, Bread, Flours & Starches, and Textured Protein), and Region - Global Forecast to 2026", is estimated to be valued at USD 73.1 billion in 2021. It is projected to reach USD 99.7 billion by 2026, recording a CAGR of 6.4% during the forecast period. The food extrusion market in the food industry has been growing in accordance with the processed food industry. The effect of busy lifestyles in developing economies has driven the market for processed food; hence, there is a rise in demand for extruded product types. In developing countries, the food extrusion market is also evolving in response to the rapidly increasing demand for convenience product type options.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=221423108

Savory snacks are projected to witness the highest growth during the forecast period.

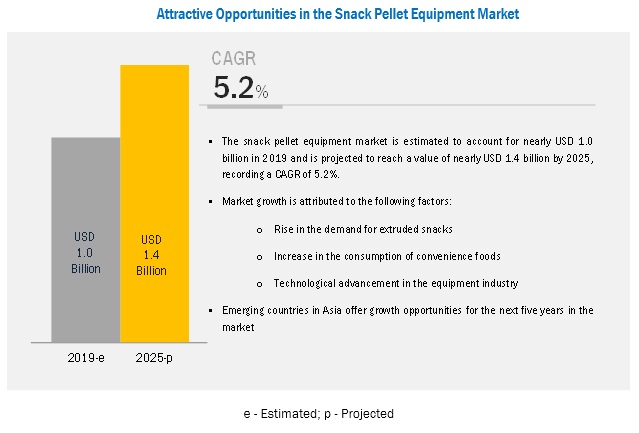

Extrusion technology is mainly used to produce snack products. These snacks may be either ready to eat, ready to fry, or ready to bake and consume. Raw materials such as rice, corn, potato, and taro, high in starch content, have been popular feed materials for food extrusion because of their ease of availability and good functional properties. Potato-based extruded snacks are the most popular among the snack foods in most regions. Corn and tortilla-based extruded snacks are increasingly becoming a significant portion of snack foods consumed.

By extruder type, the twin screw extruder segment dominated the food extrusion market in 2020.

Twin screw extruders consist of two intermeshing, co-rotating screws mounted on splined shafts in a closed barrel. The extruder can ensure transporting, compressing, mixing, cooking, shearing, heating, cooling, pumping, shaping, and various other functions with a high level of flexibility. Twin screw extrusion equipment offers numerous advantages over single screw extrusion and is responsible for the increased demand for these extruders from various manufacturers in the food processing industry.

Request for Sample Pages of the Report:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=221423108

https://www.marketsandmarkets.com/requestsampleNew.asp?id=221423108

US dominated the North America market for food extrusion market in 2020.

It is estimated that around two-thirds of the women in the US are estimated to work, leading to an increase of the working population. The US is estimated to lead the food extrusion market in North America. The market is highly fragmented, emphasizing the presence of companies of large, medium, and small scales, and comprises a complex supply chain that involves many intermediaries. It is the largest consumer of extruded food; it also exports extruded snacks to South America and Asia.

The key service providers in this market include Bühler (Switzerland), Akron Tool & Die (US), Baker Perkins (UK), Coperion (Germany), GEA (Germany), KAHL Group (Germany), Triott Group (Netherlands), Flexicon (US), Groupe Legris Industries (Belgium), The Bonnot Company (US), American Extrusion International (US), Shandong Light M&E Co., Ltd (China), Snactek (India), Doering systems, inc. (US), PacMoore (US), Egan Food Technologies (US), Schaaf Technologie GmbH (Germany), Wenger Manufacturing, Inc. (US), Brabender GmbH & Co. KG (Germany), and Jinan Darin Machinery Co., Ltd., (China)