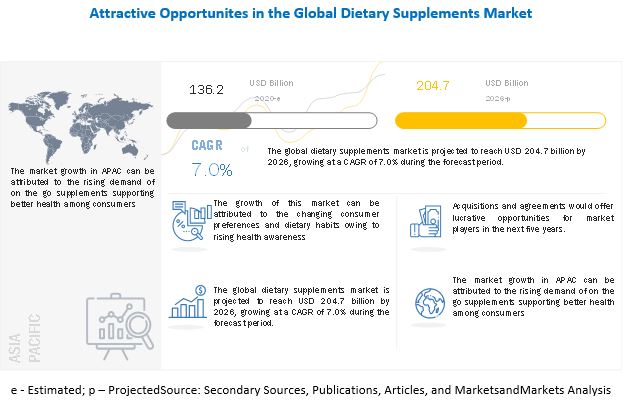

The report "Dietary Supplements Market by Type (Vitamins, Minerals, Botanicals, Amino acids, Enzymes, Probiotics), Function (Additional, Medicinal, Sports Nutrition), Mode of Application (Capsules, Tablets, Liquid), Target Customer and Region - Global Forecast to 2026", According to MarketsandMarkets, the global dietary supplements market size is estimated to be valued at USD 136.2 billion in 2020 and projected to reach USD 204.7 billion by 2026, recording a CAGR of 7.0% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=973

The demand for dietary supplements is increasing significantly owing to rising prevalence of chronic diseases and changing dietary habits of the consumers. Increasing consumer health awareness and rising disposable income across regions are factors that have encouraged people to shift to dietary supplements. The elderly population is focusing on adapting to nutritional supplements specifically tailored to their needs to maintain their good health and quality of life.

The adult segment, by target customer, is projected to witness significant growth during the forecast period.

The deficiency of certain vitamins in adults is one of the key factors that have led to the rise in the consumption of dietary supplements among adults. According to National Health and Nutrition Examination Survey, in 2016, nearly 150 million Americans consume dietary supplements, out of which, among adults, 44% of men and 55% of women are consumers. This is projected to drive the demand for dietary supplements among adults.

The North American region dominates the dietary supplements market with the largest share in 2020.

North America is projected to hold the largest share in the dietary supplements market. This dominance is driven by the prevalence of chronic diseases due to the hectic lifestyles and increasing awareness among consumers regarding the health benefits of the product. Also, the region has the highest prevalence of obesity. According to the CDC, in the US, the obesity prevalence was 39.8% and affected about 93.3 million adults between 2015 and 2016. Such factors are projected to contribute to the growth of dietary supplements market.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=973

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=973

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, Amway (US), Herbalife Nutrition (US), ADM (US), Pfizer (US), Abbott Laboratories (US), Arkopharma Laboratories (France), Bayer (Germany), Glanbia (Ireland), Nature’s Sunshine Products (US), FANCL (Japan), Danisco (Denmark), Bionova Lifesciences (India), XanGo (US), Ekomir (Russia), American Health (US), Pure Encapsulations (US), UST Manufacturing (US), Capstone Nutrition (US), Anona GmBH (Germany), Plantafood Medical GmBH (Germany).