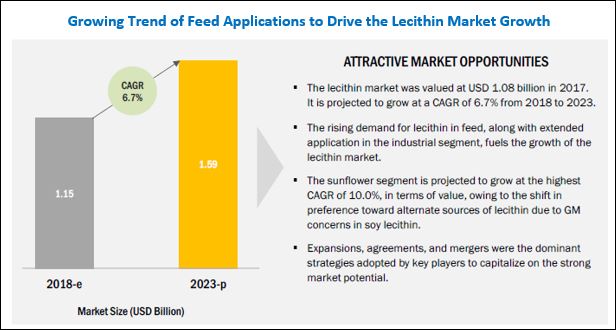

The report "Lecithin & Phospholipids Market by Source (Soy, Sunflower, Rapeseed, Egg), Type (Fluid, De-Oiled, Modified), Application (Feed, Food (Confectionery Products, Convenience Food, Baked Goods) Industrial, Healthcare), and Region - Global Forecast to 2023", The global lecithin market was valued at USD 1.15 billion in 2018 and is projected to reach USD 1.59 billion by 2023, at a CAGR of 6.7% during forecast period. The global phospholipids market was valued at USD 3.23 billion in 2018 and is projected to reach USD 4.36 billion by 2023, at a CAGR of 6.2% during the forecast period. The lecithin market is driven by factors such as increased demand from the feed segment, a shift in preference towards convenience foods in the emerging economies of the Asia Pacific and South American regions. On the other hand, the phospholipids market is driven by the increased demand for natural ingredients in personal care products and cosmetics in countries such as China, India, Japan, and South Korea.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=259514839

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=259514839

Based on type, the de-oiled type segment of the lecithin market is projected to grow at the highest CAGR during the forecast period

Based on type, the lecithin market has been segmented into de-oiled, fluid, and modified. The de-oiled segment is projected to grow at the highest CAGR during the forecast period. It offers benefits to manufacturers such as ease of handling since it is available in the powdered or granular form. It provides nutritional benefits to consumers and is used in dietary foods, bakery products, confectionery products, and convenience food. These are the key factors that drive the de-oiled segment in the lecithin market.

Based on the source, the sunflower segment of the lecithin market is projected to grow at the highest CAGR during the forecast period

Based on source, the lecithin market has been segmented into soy, sunflower, rapeseed, and eggs while the phospholipids market is segmented into soy and egg. The sunflower segment is projected to grow at the highest CAGR during the forecast period. For food applications, the preferred lecithin is non-GMO lecithin, due to concerns about health issues related to the consumption of genetically modified products and strict regulations in regions such as Europe. The lecithin extracted from soy is generally GM; hence, end-user industries are switching to other options such as sunflower and rapeseed. The wide availability of sunflower in European countries such as Ukraine and Russia is also expected to favor the growth of the lecithin market in this region.

In terms of application, nutrition & supplements segment is estimated to account for the largest share of the phospholipids value market in 2018

The nutrition & supplement segment is estimated to account for the largest share of the phospholipids market in 2018. The demand for phospholipids is growing in the developing economies of Asia Pacific, Eastern Europe, along with Africa, and the Middle East. Developing regions are expected to emerge as the fastest-growing consumers of phospholipids for pharmaceuticals and nutrition & supplement applications, due to the continuous increase in the per capita income in these regions and the increase in health awareness among consumers for natural ingredients.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=259514839

The Asia Pacific region accounted for the largest share of the phospholipids market in 2017

The Asia Pacific region accounted for the largest share of the phospholipids market in 2017 market. Changes in consumer preference toward natural ingredients have increased the demand for phospholipid products. In Asia Pacific, a rise in the young population (under 30 years of age) and rising awareness about health have prompted consumers to opt for healthier alternatives such as food supplements. Furthermore, increased demand for bakery items such as cakes, pastries, and cookies will also drive the demand for lecithin in the region.

This report includes a study of the development strategies, along with the product portfolios of leading companies. It includes major players such as Cargill (US), ADM (US), Stern-Wywiol Gruppe (Germany), DowDuPont (US), and Bunge (US), who are focusing on expansions & investments, acquisitions, and agreements to strengthen their base in the lecithin & phospholipids market. Other players include Lipoid GmbH (Germany), Wilmar International (Singapore), Sonic Biochem Extractions (India), Avanti Lipids Polar (US), Lecico (Germany), VAV Life Sciences (India), Sodrugestvo (Luxembourg), Kewpie Corporation (Japan), Sojaprotein (Serbia), American Lecithin Company (US), Sime Darby Unimills, Lecital (Austria), and Lasenor Emul (Spain); these players are also strengthening their market position through expansions and new product launches.