Thursday, February 24, 2022

Meal Replacement Market Will Hit Big Revenues In Future

Fats & Oils Market: Growth Opportunities and Recent Developments

Sustainable Growth Opportunities in the Modified Starch Market

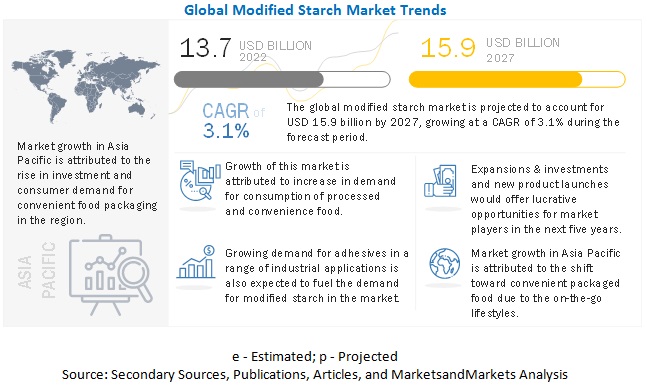

According to MarketsandMarkets "Modified Starch Market by Raw Material (Corn, Cassava, Potato, and Wheat), Application (Food & Beverages (Bakery & Confectionery, Processed Foods, Beverages, and Other Food Applications), Industrial, and Feed), Form, and Region - Global Forecast to 2025", the global modified starch market size is estimated to be valued at USD 13.1 billion in 2020 and projected to reach USD 14.9 billion by 2025, recording a CAGR of 2.7%, in terms of value. The functional properties of modified starch and their ease of incorporation in a wide range of applications are driving the global modified starch market.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=511

The corn segment accounted for the largest share in the modified starch market

Based on raw material, corn dominated the modified starch market. Corn is a staple food, and it is preferred across the globe due to its importance in the diets of several countries. It is used extensively as a thickening agent in soups and liquid-based foods such as sauces, gravies, and custards.

The food & beverages segment is projected to account for a major share in the modified starch market during the forecast period

By application, the modified starch market is segmented into food & beverages, industrial, and feed. The food & beverage segment is further classified into bakery & confectionery products, processed food, beverages, and others, which includes snacks and soups. Modified starches have been developed for a significant period, and their applications in the food & beverage industry are increasingly gaining importance. Modified starches are considered as food additives that are prepared by treating starch or their granules with chemicals or enzymes, causing the starch to be partially degraded.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=511

The Asia Pacific region dominated the modified starch market with the largest share in 2019, and it is also expected to grow with the highest CAGR

The modified starch market in Asia Pacific is dominant due to the increasing demand for processed food because of a shift in lifestyle trends. People are looking for ready-to-eat meal options as they are leading a busy life.

Asia Pacific is also the fastest-growing market as industrial applications and technologies involved in starch processing are changing rapidly in the region. The demand for modified starch is increasing as various industries are incorporating in their manufacturing processes and products. Also, key players are increasingly investing in the Asia Pacific modified starch market.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Archer Daniels Midland Company (ADM) (US), Cargill (US), Ingredion (US), Tate & Lyle (UK), Roquette Frères (France), Avebe U.A (the Netherlands), Grain Processing Corporation (US), Emsland (Germany), AGRANA (Austria), SMS Corporation (Thailand), Global Bio-Chem Technology Group (Hong Kong), SPAC Starch (India), Qindao CBH Company (China), Tereos (France), and KMC (Denmark), Beneo (Germany), Angel Starch Food Pvt. Ltd. (India), Shubham Starch Chem Pvt Ltd. (India), Everest Starch India Pvt Ltd. (India), Sheekharr Starch Pvt Ltd. (India), Sanstar Bio-Polymers Ltd. (India), Universal Biopolymers (India), Sonish Starch Technology Ltd. (Thailand), Venus Starch Suppliers (India), and Gromotech Agrochem Pvt. Ltd. (India).

Wednesday, February 23, 2022

Sustainable Growth Opportunities in the Wheat Protein Market

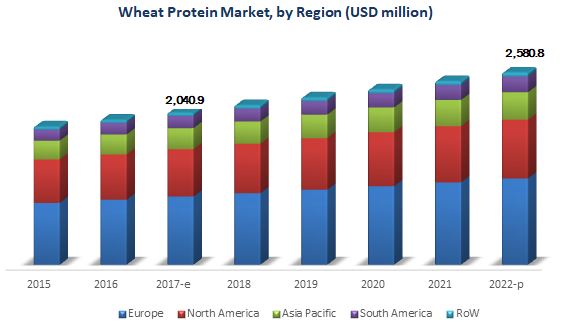

The global wheat protein market is estimated at USD 2.04 Billion in 2017 and is projected to reach USD 2.58 Billion by 2022, at a CAGR of 4.8% from 2017. The wheat protein market has been largely driven by the growing demand for bakery products, the increasing popularity of plant-based foods, wheat protein being a suitable alternative for non-animal protein among vegans coupled with nutritional benefits for lactose-intolerant consumers.

- To define, segment, and project the global wheat protein market size with respect to product, application, form, and key regions

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, and new product developments in the wheat protein market

- Wheat protein producers, suppliers, distributors, importers, and exporters

- Food & beverage manufacturers, manufacturers of animal feed products, food ingredient manufacturers, and researcher organizations

- Related government authorities, commercial research & development (R&D) institutions, and other regulatory bodies

- Trade associations and industry bodies such as International Wheat Gluten Association (IWGA), and Food and Agriculture Organization (FAO)

Agricultural Testing Market By Technology Advancements & Business Outlook

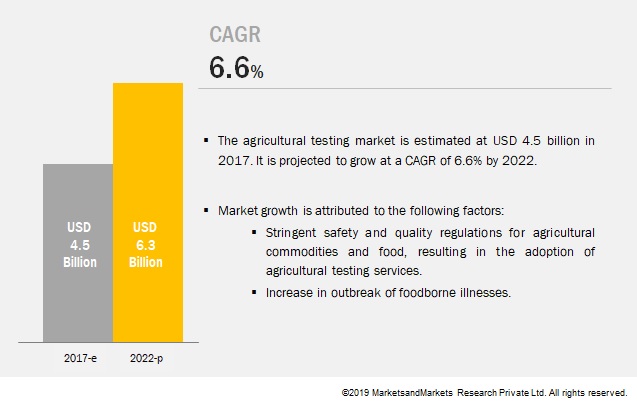

The report "Agricultural Testing Market by Sample (Soil, Water, Seed, Compost, Manure, Biosolids, Plant Tissue), Application (Safety Testing (Toxins, Pathogens, Heavy Metals), Quality Assurance), Technology (Conventional, Rapid), and Region - Global Forecast to 2022", agricultural testing market is estimated to be valued at USD 4.56 Billion in 2017, and is projected to reach USD 6.29 Billion by 2022, at a CAGR of 6.64%. The market is driven by stringent safety and quality regulations for agricultural commodities, increase in outbreaks of foodborne illnesses, and rapid industrialization leading to the disposal of untreated industrial waste into the environment.

Monday, February 21, 2022

Feed Yeast Market: Growth Opportunities and Recent Developments

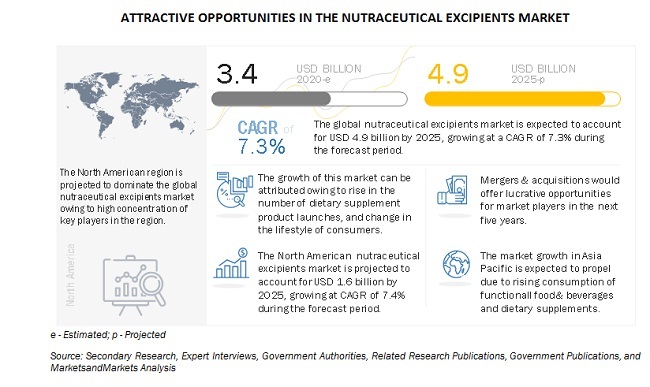

Latest Regulatory Trends Impacting the Nutraceutical Excipients Market

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=247060367