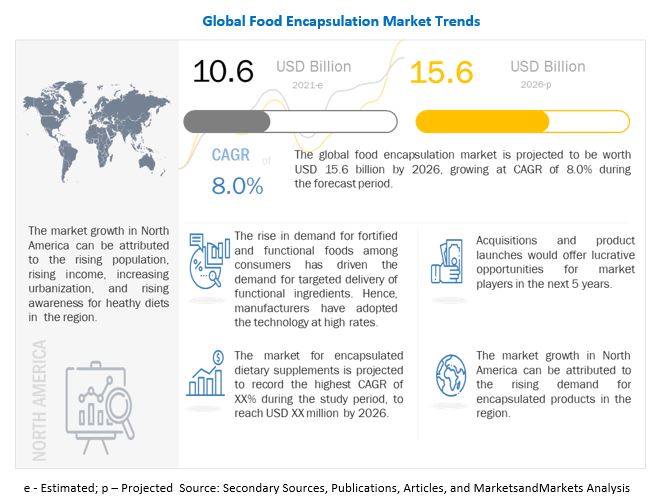

The report "Food Encapsulation Market by Shell Material (Polysaccharides, Emulsifiers, Lipids, Proteins), Technology (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation), Application, Method, Core Phase, and Region - Global Forecast to 2026", The market for food encapsulation is estimated at USD 10.6 Billion in 2021; it is projected to grow at a CAGR of 8.0% to reach USD 15.6 Billion by 2026.

The development of retail channels in the form of supermarkets, hypermarkets, and convenience stores has encouraged the growth of the food encapsulation market. These large food chains are the major outlets for functional food products due to the increase in the trend of on-the-go consumption. This trend is projected to drive the growth of the food encapsulation market to make these products more stable. Different bioactive compounds, such as omega-3 and omega-6 fatty acids, vitamins, phenolic compounds, and carotenoids, are now widely used to develop products with numerous functional properties to meet the increasing consumer demands. However, such compounds are highly unstable under certain conditions of light, temperature, pH, and oxygen. Therefore, microencapsulating such compounds is a mode of protecting them from harsh conditions during food processing. Several food constituents that are widely encapsulated include different flavoring agents, lipids, antioxidants, essential oils, pigments, probiotic bacteria, and vitamins. The need for complex properties for fortification in food products is expected to increase over the next few years. Some of these complex properties are delayed-release, stability, thermal protection, extended shelf-life, and suitable sensory profile, which would be challenging to achieve without encapsulation technology.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=68

Polysacharides sub-segment in by shell material segment is estimated to account for the largest share in the food encapsulation market.

The polysaccharides segment accounted for the largest market for shell material segement and is projected to follow the same trend through 2026. Owing to their enormous molecular structure and ability to entrap bioactives, polysaccharides are considered the most-suitable building blocks for delivery systems. They are preferred to synthetic polymers because they are safe, inert, biocompatible, non-toxic, biodegradable, eco-friendly, low in cost, and abundantly available in nature.

In by method segment, the physico-chemical sub-segment is projected to account for the fastest market growth in the food encapsulation market.

Since co-acervation does not subject the core phase to high temperatures, it is the most preferred physico-chemical method for food encapsulation. The physico-chemical process is an inclusion of the physical and chemical means of encapsulation of the core phase with the shell material. The process is advanced than the physical process because it has the capability of producing smaller encapsulated products than the physical process.

The microencapsultion sub-segment by technology is projected to account for the largest market share of the food encapsulation market over the forecast period.

Microencapsulation is used to provide an improved quality of ingredients in food products. This technology is used for protecting the core ingredients from interacting with other ingredients while processing the food products and for protecting them from the external environment. Microencapsulation covers up the unwanted taste of nutrients, such as minerals, to enable the production of nutrient-fortified foods with necessary sensory properties.

The dietary supplements sub-segment by application segment is projected to account for the fastest growth in the food encapsulation market over the forecast period.

Dietary supplements contain active ingredients such as amino acids, vitamins, essential fatty acids, minerals, and probiotics, which help improve the functioning of the human body by providing all the essential compounds that are not sufficiently received from a regular diet. They are available in various formats, including capsules, pills, liquids, and tablets. Due to these advantages the use of encapsulation technology is increasing in the sector.

Request for Customization @ https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=68

North America is estimated to dominate the global food encapsulation market over the forecast period.

North America dominated the food encapsulation market due to the presence of a large number of players in the region and the growing consumer awareness and demand for functional food products, North America is projected to dominate the food encapsulation market through 2026. Demand for encapsulation is also driven in the region due to its growing use in the development of several products such as functional and fortified food products, packaged products, and nutraceutical products. Most of the key market players have a presence in the region.

Key Market Players:

The key players in this market include Cargill, Incorporated, BASF SE, DuPont, FrieslandCampina, DSM, Kerry, and Ingredion. These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Polysacharides sub-segment in by shell material segment is estimated to account for the largest share in the food encapsulation market.

The polysaccharides segment accounted for the largest market for shell material segement and is projected to follow the same trend through 2026. Owing to their enormous molecular structure and ability to entrap bioactives, polysaccharides are considered the most-suitable building blocks for delivery systems. They are preferred to synthetic polymers because they are safe, inert, biocompatible, non-toxic, biodegradable, eco-friendly, low in cost, and abundantly available in nature.

In by method segment, the physico-chemical sub-segment is projected to account for the fastest market growth in the food encapsulation market.

Since co-acervation does not subject the core phase to high temperatures, it is the most preferred physico-chemical method for food encapsulation. The physico-chemical process is an inclusion of the physical and chemical means of encapsulation of the core phase with the shell material. The process is advanced than the physical process because it has the capability of producing smaller encapsulated products than the physical process.

The microencapsultion sub-segment by technology is projected to account for the largest market share of the food encapsulation market over the forecast period.

Microencapsulation is used to provide an improved quality of ingredients in food products. This technology is used for protecting the core ingredients from interacting with other ingredients while processing the food products and for protecting them from the external environment. Microencapsulation covers up the unwanted taste of nutrients, such as minerals, to enable the production of nutrient-fortified foods with necessary sensory properties.

The dietary supplements sub-segment by application segment is projected to account for the fastest growth in the food encapsulation market over the forecast period.

Dietary supplements contain active ingredients such as amino acids, vitamins, essential fatty acids, minerals, and probiotics, which help improve the functioning of the human body by providing all the essential compounds that are not sufficiently received from a regular diet. They are available in various formats, including capsules, pills, liquids, and tablets. Due to these advantages the use of encapsulation technology is increasing in the sector.

Request for Customization @ https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=68

North America is estimated to dominate the global food encapsulation market over the forecast period.

North America dominated the food encapsulation market due to the presence of a large number of players in the region and the growing consumer awareness and demand for functional food products, North America is projected to dominate the food encapsulation market through 2026. Demand for encapsulation is also driven in the region due to its growing use in the development of several products such as functional and fortified food products, packaged products, and nutraceutical products. Most of the key market players have a presence in the region.

Key Market Players:

The key players in this market include Cargill, Incorporated, BASF SE, DuPont, FrieslandCampina, DSM, Kerry, and Ingredion. These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.