https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

Thursday, March 31, 2022

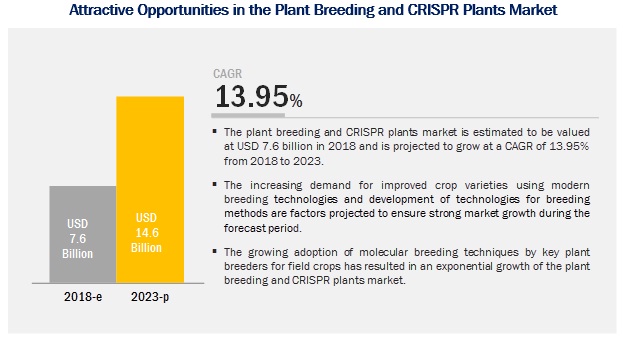

Sustainable Growth Opportunities in the Plant Breeding and CRISPR Plants Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

Wednesday, March 30, 2022

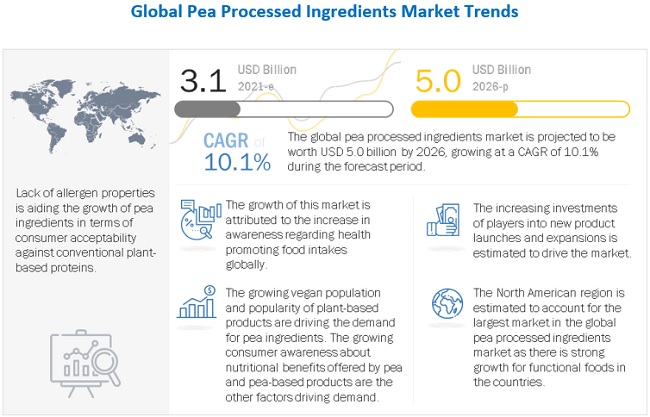

Upcoming Growth Trends in the Pea Processed Ingredients Market

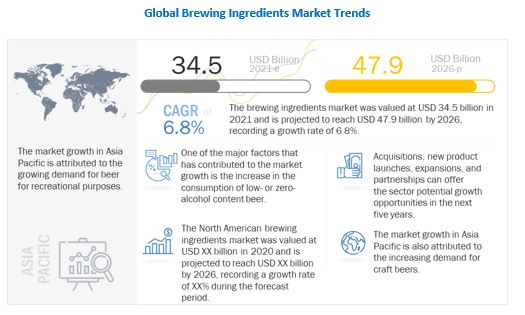

Sustainable Growth Opportunities in the Brewing Ingredients Market

Tuesday, March 29, 2022

Rodenticides Market: Growth Opportunities and Recent Developments

The report "Rodenticides Market by Type (Non-anticoagulants, Anticoagulants (FGAR, SGAR)), End use (Agricultural fields, Warehouses, Residential, Commercial), Mode of application (Pellet, Spray, and Powder), Rodent type, and Region - Global Forecast to 2026", The global rodenticides market size is estimated to be valued at USD 4.9 billion in 2020 and is expected to reach a value of USD 6.6 billion by 2026, growing at a CAGR of 5.0% during the forecast period. Factors such as the displacement of rodents due to urbanization and increase in rodent population due to climatic change such as global warming drive the growth of the market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=189089498

The rodenticides market includes major product manufacturers and service providers like Syngenta AG, Bayer AG, BASF SE, UPL Ltd, Rentokil Initial plc, Ecolab Inc and Rollins Inc. These companies have their manufacturing and service facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses up to some extent. Though this pandemic situation has impacted their businesses, there is no significant impact on the global operations and supply chain of rodenticides. Multiple manufacturing facilities of players are still in operation. The service providers are providing rodent control services by following safety and sanitation measures.

Anticoagulant, by type, is estimated to grow at the highest rate during the forecast period

Anticoagulant rodenticides are widely used for controlling commensal rodents, which are primarily Norway rats, ship rats, and house mice. Despite the consistent decrease in ecological risk assessments, the anticoagulant segment is projected to dominate the rodenticides market due to the high demand for effective rodent-control alternatives and the lack of safe alternatives.

Pellet, by mode of application, is estimated to hold the largest share in the rodenticides market, in terms of value, in 2020

Pellets offer effective control against commensal rodents and are resistant to various environmental conditions, which makes them suitable for outdoor use. With the increase in urbanization and displacement of rats in city areas, the pellets mode of application is widely used in residential buildings, as they can easily be used with baits.

Commercial, by end-use sector, estimated to account for the largest market share, by value, in 2020

A majority of the commercial places across the European and North American countries have a mandate annual rodent control service program. Hence, the market is estimated to be dominated by the commercial segment in 2020.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=189089498

Asia Pacific is projected to grow at the highest CAGR during the forecast period

The market for rodenticides is projected to grow at the highest CAGR in the Asia Pacific region owing to the increase in awareness of the effectivity of chemical rodenticides. As the world’s largest and most populous region, Asia Pacific is one of the key markets for rodenticides. Rodents are common pests present in agricultural fields. Annually, extensive volumes of agricultural produce are destroyed and contaminated by rodents. To meet the increase in demand for food products and to reduce the crop damages caused by rodents, the use of rodenticides has increased significantly in the region. Food retail, food manufacturing, pharmaceutical, hospitality, and residential sectors are projected to be major growth verticals in this market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the rodenticides market. It consists of the profiles of leading companies such as Bayer AG (Germany), Syngenta AG (Switzerland), BASF SE (Germany), Rentokil Initial Plc (UK), Ecolab Inc (US), Rollins Inc (US), UPL Limited (India), Anticimex (Sweden), The Terminix International Company (US), Liphatech Inc (US), Neogen Corporation (US), PelGar International (UK), Bell Laboratories Inc (US), JT Eaton (US), Truly Nolen (US), Abell Pest Control (Canada), Futura Germany (Germany), SenesTech Inc (US), Bioguard Pest Solutions (US) and Impex Europa S.L (Spain).

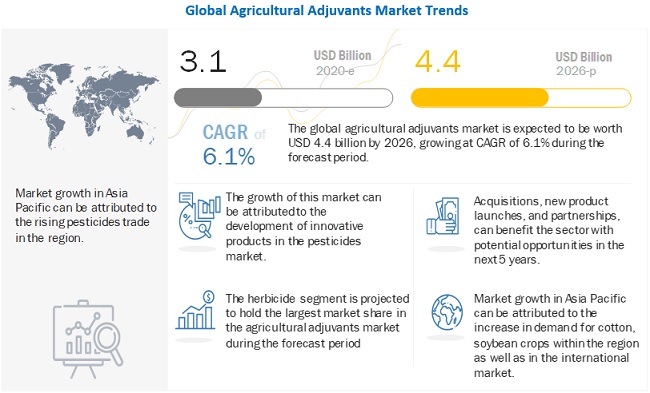

Agricultural Adjuvants Market to Record Steady Growth by 2026

Monday, March 28, 2022

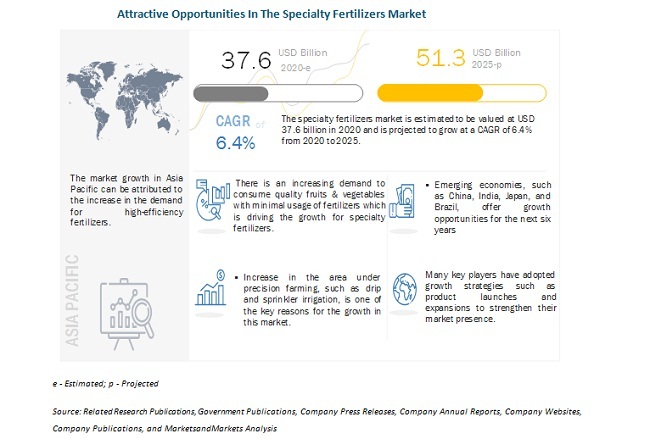

Sustainable Growth Opportunities in the Specialty Fertilizers Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=57479139

Growth Opportunities in the Feed Yeast Market

The global feed yeast market size is estimated at USD 1.8 billion in 2020 and is projected to grow at a CAGR of 5.1% to reach USD 2.3 billion by 2025. The market has a promising growth potential due to several factors, including the increasing awareness of yeast-based animal feed products and strict government regulations regarding animal health.

Key players in the feed yeast market include Associated British Foods Inc. (UK), Archers Midland Company (US), Alltech Inc. (US), Cargill (US), Angel Yeast Company (China), Chr. Hansen (Denmark), Lesaffre (France), Nutreco N.V. (Netherlands), Lallemand Inc. (Canada), Novus International (US), Zilor (Biorigin) (Brazil), Kerry Group (Ireland), and Kemin (US). Manufacturers are adopting strategies such as new product launches, expansion & investments, mergers & acquisitions, agreements, collaborations, joint ventures, and partnerships to strengthen their position in the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=108142106

Associated British Foods PLC (UK) is one of the market leaders in Europe and is trying to increase its global presence by offering various feed grades to fulfill customer needs and demands. The company has entered the retail sector, which has helped it grab opportunities in the market. The company operates with various subsidiaries at the global level but has a wider distributional reach in the European region. The major growth strategies of the company include organic approaches to collaborate and partner with other players such as Lallemand (Canada) for effective operations of the Hutchinson site. The company operates through numerous subsidiaries, such as AB Agri Ltd (UK), AB Mauri (UK), ABF Ingredients (UK), ABITEC Corporation (US), and Ohly (Germany). Of these, AB Mauri, ABF Ingredients, Ohly, and AB Vista produce yeast and yeast extracts. In January 2019, Ohly (UK) and Lallemand (Canada), entered into a strategic partnership for the divestment of Ohly’s Hutchinson Torula Yeast facility and associated Torula whole-cell business in the US. The long-term supply partnership between these companies aims at benefitting Ohly by ensuring the sustainable security of the Hutchinson site.

Alltech Inc. (US) is engaged in the production and sale of nutritional products and solutions for the feed industry. The company’s core capabilities lie in yeast fermentation, peptide technology, and solid-state fermentation. It has used these technologies to offer a range of natural solutions to the feed industry for improving animal performance and profitability. The company performs research and innovation in various areas such as bioscience centers, nutrigenomics centers, aquaculture centers, community biorefinery, and quality assurance. Alltech is one of the leading animal nutrition companies across the globe. The company has its presence in various countries with 31 manufacturing facilities. It has a great market coverage as the company serves customers in more than 120 countries. Use of inorganic approaches such as the acquisition of WestFeeds Inc. (US) helped the company to strengthen its distribution network and product portfolio in the animal nutrition segment. Owing to its strong financial capabilities and being a global innovator in feed formulations and technologies, the company holds opportunities by investing in R&D for the development of innovative yeast-based ingredients for feed solutions.

Cargill (US) manages its business operations through its business segments, such as agriculture; animal nutrition and protein; food; and financial and industrial. Through its animal nutrition and protein segment, the company offers various animal nutrition products including yeast for beef, dairy, pet, poultry, and pork segments. The company manufactures and supplies feed yeast throughout the world under various brands. Cargill has a very strong product portfolio as compared to its competitors. This would help in positioning the company’s overall position in absorbing investment risks to expand their production capacity as well as their market share. Cargill offers high-quality products to its customers with strong R&D capabilities, which provide it with a strategic advantage over its competitors. The company is focusing immensely on R&D to meet the demands of the feed industry. In terms of animal nutrition, the company has invested in acquiring Diamond V (US), which would help the company in gaining competitive advantage in the animal health and nutrition sector.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=108142106

As per the FAO figures of 2019, the consumption rate of meat products in East Asia had witnessed rapid growth. The consumption rate reached 50 kg per person in 2015 from nearly 9 kg per capita in the 1960s. However, the ban on the use of antibiotics as a growth promoter in the livestock sector across the European and North American countries has indirectly impacted the Asia Pacific countries. This has encouraged key companies of feed additives to develop natural growth promoters and health supplements. Since the ban, the livestock producers had identified innovative ways to promote animal production through products with similar benefits by replacing antibiotic growth promoters with microbial-based feed additives, which possess antibiotic properties. Many key players such as Lallemand Inc. (Canada) and Angel Yeast (China) are focusing on tapping the Asia Pacific market by setting up their feed additive manufacturing units.

Recent Developments:

- In January 2019, Ohly (UK) and Lallemand (Canada), entered into a strategic partnership for the divestment of Ohly’s Hutchinson Torula Yeast facility and associated Torula whole cell business in the US. The long-term supply partnership between these companies aims at benefitting Ohly by ensuring sustainable security of the Hutchinson site.

- In January 2019, ADM acquired Neovia (Chicago) which is a a global leader in value-added products and solutions for both production and companion animals. This acquisition would add new products such as premixes, complete feed, ingredients, pet care solutions, aquaculture, additives, feed yeast, and amino acids to the existing portfolio.