https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=162422288

Monday, April 11, 2022

Biological Seed Treatment Market to Record Steady Growth by 2025

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=162422288

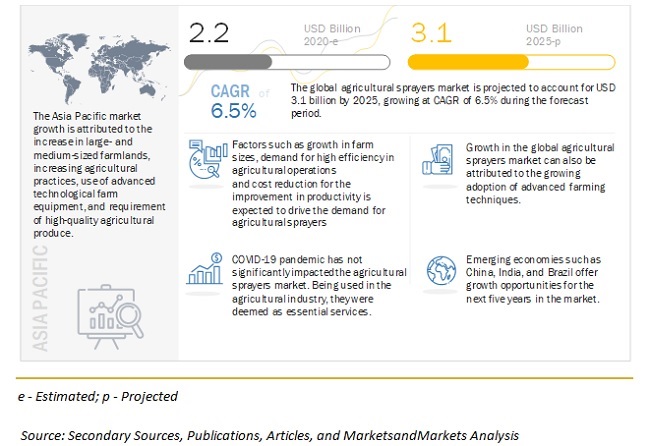

Latest Regulatory Trends Impacting the Agricultural Sprayers Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

Friday, April 8, 2022

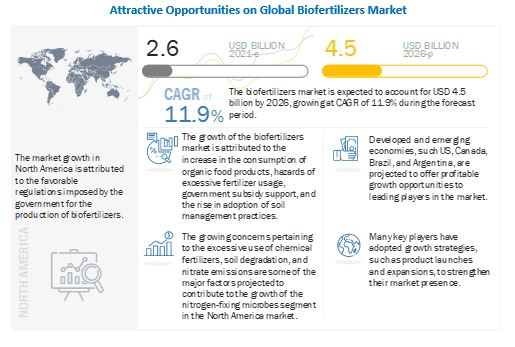

Biofertilizers Market to Record Steady Growth by 2026

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=856

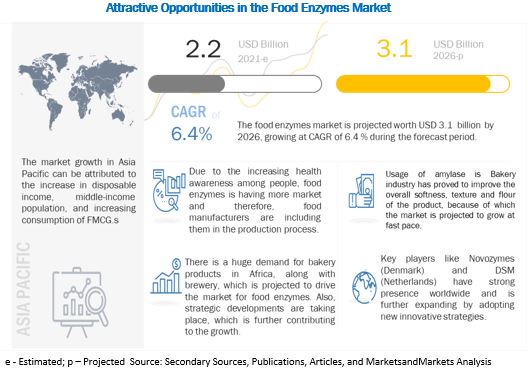

Food Enzymes Market Growth by Emerging Trends, Analysis, & Forecast

Thursday, April 7, 2022

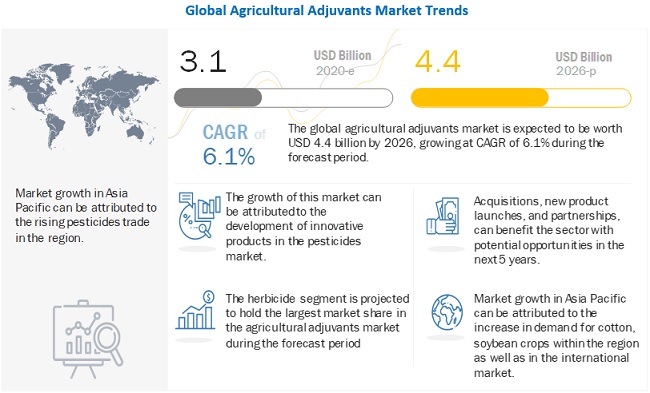

Factors Driving the Agricultural Adjuvants Market

The report "Agricultural Adjuvants Market by Function (Activator and Utility), Application (Herbicides, Insecticides, and Fungicides), Formulation (Suspension Concentrates and Emulsifiable Concentrates), Adoption Stage, Crop Type, and Region - Global Forecast 2026", is estimated to be valued at USD 3.1 billion in 2020 and is projected to reach a value of USD 4.4 billion by 2026, growing at a CAGR of 6.1% during the forecast period. Factors such as the rising demand for improved crop varieties is driving the growth of the agricultural adjuvants market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

Agricultural adjuvants are materials that are added to crop protection products or agrochemicals for enhancing the efficacy of active ingredients and improving the overall performance of the product. The effectiveness of a pesticide increases manifold with the addition of adjuvants, wherein agrochemicals and agricultural adjuvants are formulated to be compatible with each other. Hence, adjuvant consumption is directly affected by the demand for pesticides; higher the consumption of agrochemicals, higher will be the demand for adjuvants.

The utility adjuvants segment is estimated to be the fastest growing function in the agricultural adjuvants market.

The demand for utility adjuvants remains high in the developed countries due to the introduction of strict regulations on pesticide usage and increasing government support for a sustainable foliar spray of pesticides. However, due to their high cost, the adoption of adjuvants in developing countries is low. Hence, utility adjuvants are projected to offer profitable growth opportunities for manufacturers in developed countries during the forecast period.

The fungicide segment is estimated to be the second-largest market in the agricultural adjuvants market, in 2021

Adjuvants play a vital role in increasing the biological efficacy of agrochemicals. Fungi can adversely affect the quality and the yield of agriculture. Majority of the fungicides available in the market are effective against a large variety of pathogenic fungi and can be used over various crops. Thus key players are opting for adjuvant applications specific for fungicide uses.

The cereals & grains segment, by crop type, is estimated to account for the largest market share, by value, in 2020

The production of cereals and grains varies across different regions based on the topography and climatic conditions, and hence, the type of pesticide application also varies. Cereals & grains accounted for the highest consumption of herbicides in North America and Asia Pacific, due to the increased cultivation of corn and wheat in countries, such as the US and China. Adjuvants used in herbicide treatment solutions for cereals and grains help in improving the spray droplet retention and penetration of active ingredients into the plant foliage.

Request for Customization @

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1240

Asia Pacific is projected to grow at the highest CAGR% during the forecast period

The market for agricultural adjuvants in the Asia Pacific region is projected to grow at the highest CAGR from 2020 to 2026, owing to the increasing investments by key players in countries such as China, India, and Thailand, and also the rising adoption of adjuvant technology by the crop growers for insecticide applications. Furthermore, advanced agricultural technologies are widely accepted and practiced in this region. Owing to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2020 to 2026.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the agricultural adjuvants market. It includes the profiles of leading companies such as this market include Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), WinField United (US), Kalo Inc. (US), Nouryon (Netherlands), Corteva (US), Evonik Industries (Germany), Nufarm (Australia), Croda International (UK), Solvay (Belgium), BASF (Germany), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), Innvictis Crop Care (US), Interagro (UK), Lamberti S.P.A (US), Drexel Chemical Company (US), GarrCo Products Inc. (US), and Loveland Products Inc. (US).

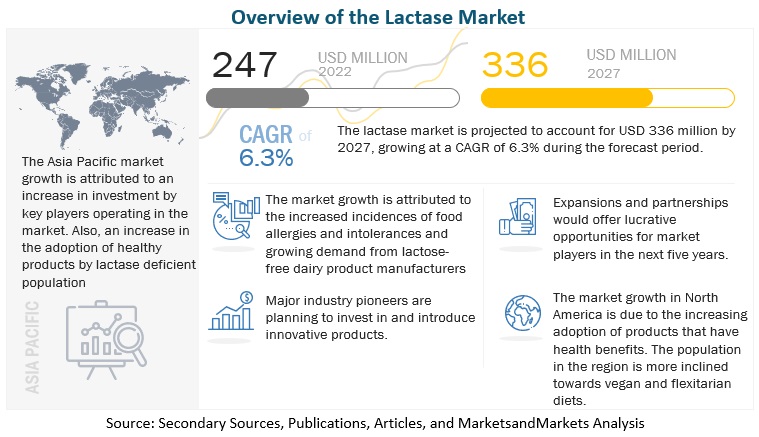

Lactase Market Growth by Emerging Trends, Analysis, & Forecast

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125332780