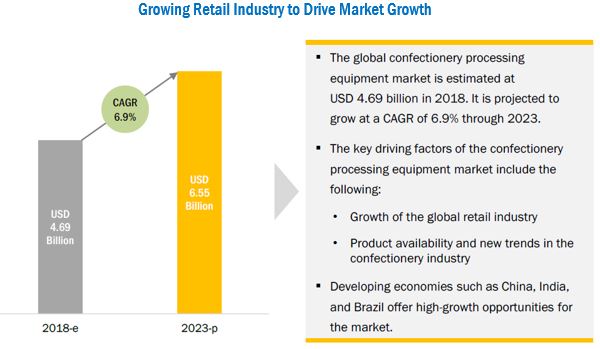

The report "Confectionery Processing Equipment Market by Type (Thermal, Mixers, Blenders, Cutters, Extrusion, Cooling, Coating), Product (Hard Candies, Chewing Gums, Gummies & Jellies, Soft Confectionery), Mode of Operation, and Region - Global Forecast to 2023", The confectionery processing equipment market is estimated to be valued at USD 4.69 Billion in 2018 and is projected to reach USD 6.55 Billion by 2023, at a CAGR of 6.90% from 2018. Factors such as growth of the retail industry and increase in demand for confectionery items such as candies, toffees, chocolates, chewing gums, and jellies have driven the growth of the confectionery processing equipment market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=26974693

By product, soft confectionery segment to lead the confectionery

processing equipment market from 2018 to 2023

The soft confectionery segment dominated the market based on product. It is one of the most consumed confectionery products by almost all age groups in all regions and is a key ingredient in many food products such as candy bars, milkshakes, cookies, and other food products. Increase in awareness regarding the health benefits of chocolate and inclination of consumers toward functional dark and sugar-free chocolates are the major factors for the growth of this market.

Extrusion segment projected to grow at the highest CAGR, by food

product, from 2018 to 2023

Extrusion is becoming an important process during confectionery processing as it has many advantages over conventional food processing; it has flexible equipment which can be used to manufacture different types of products with different physical properties and texture.

Automatic segment projected to grow at a higher CAGR, by mode of

operation, from 2018 to 2023

The implementation of automation and robotics in confectionary processing has offered quality assurance and increased productivity so far, which acts as a key driver for the growth of the automatic confectionery equipment market. With the incorporation of automatic machinery, confectionery processing can be carried out for a large number of products, and comparatively lesser employees are required to attend to the machines; as these equipment function automatically, constant monitoring of processes is eliminated.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=26974693

Asia Pacific is projected to be the fastest-growing region during the

forecast period

Rise in the middle-class population in the region and the increase in disposable incomes drive the demand for nutritious chocolate bars & candies with new & enhanced flavors, which increases the need for confectionery processing equipment. This provides an opportunity for the major players in the field of confectionery processing to expand their geographical reach in the region.

This report includes a study of business strategies, along with the product portfolios of leading companies. More than nine developments were tracked for the 13 companies in the confectionery processing equipment market. It includes the profiles of leading companies such as Robert Bosch GmbH (Germany), Bühler AG (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), John Bean Technologies Corporation (JBT) (US), Aasted ApS (Denmark), BCH Ltd (England), Tanis Confectionery (Netherlands), Baker Perkins Limited (UK), Sollich KG (Germany), Heat and Control, Inc. (US), and Rieckermann GmbH (Germany).