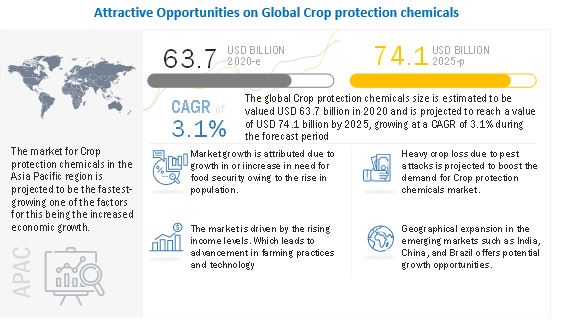

The report "Crop

Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides

& Bactericides), Origin (Synthetic, Biopesticides), Form (Liquid, Solid),

Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and

Region - Global Forecast to 2025" The global Crop protection chemicals

size is estimated to be valued USD 63.7 billion in 2020 and is projected to

reach a value of USD 74.1 billion by 2025, growing at a CAGR of 3.1% during the

forecast period. The growth of this market is attributed to an increasing need

for food security of the growing population.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

Herbicides, by type, are estimated to hold the largest market share

during the forecast period.

The market for crop protection

chemicals, by type, has been segmented into feed grade and nutrition grade. Herbicides are widely used in

weed control, which helps in enhancing crop productivity and quality of output.

Herbicides help in reducing soil erosion and increase soil fertility and crop

yield. They are used to control or kill unwanted plants and are often known as

weed killers.

The liquid segment, by form, is estimated to hold the largest share in

the Crop protection chemicals during the forecast period

Liquid forms of crop protection

chemical products are preferred more by suppliers as well as end-users. Liquid

forms offer a longer shelf-life with easy handling, transportation, and

application. Also, they are cost-effective, eco-friendly, and sustainable.

Companies are investing in the technological development of crop protection

chemicals in liquid forms. The liquid forms of crop protection chemicals can

either be water-based, oil-based, polymer-based, or their combinations. Typical

liquid formulating lines consist of storage tanks or containers to hold active

ingredients, inert materials, and a mixing tank for formulating the crop

protection chemical products. Water-based formulations require inert

ingredients such as stabilizers, stickers, surfactants, coloring agents,

anti-freeze compounds, and additional nutrients. Examples of liquid forms are

suspension concentrate, suspo-emulsions, and capsule suspension.

Synthetic, by source, is estimated to account for the largest market

share during the forecast period

Synthetic crop protection

chemicals are manufactured in laboratories and are mixtures of chemicals that

intend to avert, kill, repel, or destroy any pests. Synthetic crop protection

chemicals are perceived to be toxic and dangerous if proper chemicals are not

used. However, since the past 60 years, various innovative synthetic crop

protection chemicals have been developed which are less toxic and more

effective on crops. Due to innovative product development by the leading crop

protection chemical manufacturing companies such as BASF SE (Germany), various

new and more pest-specific synthetic crop protection chemicals are being

developed, which cause less damage to the environment.

Foliar spray, by mode of application, is estimated to account for the

largest market share during the forecast period

The foliar spray mode of

application is the most widely used for crop protection chemicals. It can be

used for herbicides, insecticides, as well as fungicides. However, it is

majorly used for spraying herbicides and insecticides due to labor shortage for

removing unwanted weeds manually and also for destroying insect attacks on

crops.

Foliar spray or foliar feeding is

a technique of feeding plants by applying liquid crop protection chemicals

directly to their leaves. Foliar spray is suitable for destroying large number

of unwanted grasses, herbs, and shrubs.

Cereals & grains, by crop type, is estimated to account for the

largest market share during the forecast period

The cereals & oilseeds

segment accounted for the largest market share in terms of value; this is

projected to grow at the highest CAGR during the forecast period. The demand

for cereals & oilseeds is increasing significantly across the globe owing

to the increasing demand for food.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=380

South America is estimated to hold the largest market share during the

forecast period

South America is an emerging

agricultural powerhouse, growing at a rapid pace above the global growth

average. Growth in this region is significantly contributed by the growth in

Brazil and Argentina, which are the world’s most potent agricultural producers

and are expected to grow well above the regional average. The economic growth

in South America has been stimulated by democratization, economic reforms, and

the foundation of the two trading blocs namely, Mercosur and the Andean Pact.

Regulatory framework in South

America is quite weak as compared to North America and Europe. The South

American Pesticide Action Network controls the regulatory issues in the region.

The international trade system from the WTO for regional and bilateral trade

deals also undermines national pesticide laws and threatens the ability of

South American nations to prohibit dangerous chemicals from being used. This is

especially observed in the case of WTOs demand for establishing certain common

minimum standards for pesticides among countries. For instance, if a country

wants to implement a stricter standard on pesticides as compared to the WTO, it

could be recognized as a technical barrier to trade.

This report includes a study on

the marketing and development strategies, along with a study on the product

portfolios of the leading companies operating in the Crop protection chemicals.

It consists of the profiles of leading companies such BASF SE (Germany), The

Dow Chemicals Company (US), Dupont (US), Sumitomo Chemical Co., Ltd (Japan),

Syngenta AG (Switzerland), Bayer Cropscience AG (Germany), FMC Coropration

(US), NufarmLimited (Australia), Adama Agricultural Solutions (Israel),

Verdesian LIfescineces (US), Bioworks Inc. (US), Valent US (US), Arysta

Lifescince Corporation (US), American Vanguard Corporation (US), Chr. Hansen

(Denmark), Corteva Agrisciences (US), UPL Limited (India), Jiangsu Yangnong

Chemical Group Co Ltd (China), Agrolac (Spain), Lianyungang Liben Crop Science

Co. Ltd. (HongKong), Nanjing red sun co. ltd (China), Kumiai Chemicals (Japan),

Wynca Chemicals (China), Lier Chemicals (China), Simpcam Oxon (Italy).