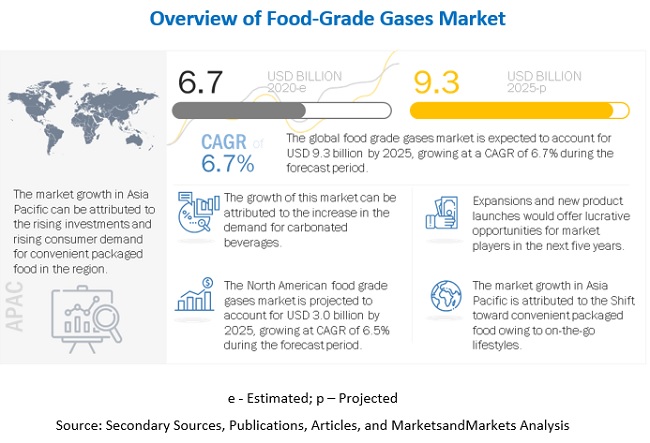

The global food-grade gases market is estimated to be valued at USD 6.7 billion in 2020 and is projected to reach USD 9.3 billion by 2025, at a CAGR of 6.7% from 2020 to 2025. Changing consumer preferences toward convenient packaging and the growing number of microbreweries across all regions are some of the factors that are driving the market.

The key players profiled in the food-grade gases market include The Linde Group& Praxair, Inc. (Germany), Air Products & Chemicals, Inc (US), Air Liquide (France), The Messer Group GmbH (Germany), Taiyo Nippon Sanso (Japan), Wesfarmers Ltd. (Australia), SOL Group (Italy), Gulf Cryo (Kuwait), Air Water, Inc. (Japan), Massy Group (Caribbean), PT Aneka Industri (Indonesia), National Gases Limited (Pakistan), SIAD (Italy), Cryogenic Gases (US), Les Gaz Industriels Ltd. (East Africa), Aditya Air Products (India), Sidewinder Dry Ice & Gas (South Africa), Axcel Gases (India), Chengdu Taiyu Industrial Gases Co., Ltd (China), Yingde Gas Group Ltd (China), Siddhi Vinayak Industrial Gases Pvt Ltd (India), American Welding & Gas (US), Ijsbariek Strombeek N.V (Belgium), Air Source Industries (US), and Purity Cylinder Gases Inc. (US).

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

The key market players adopted various growth strategies such as new product launches, expansions, acquisitions, partnerships, collaborations, joint ventures, agreements, and mergers to cater to the increasing demand for food-grade gases. The companies have been expanding their operations in various regions across the globe to establish themselves as the leading players in the food-grade gases market.

The Linde Group (Germany) is the largest player in the food-grade gases market. It is an engineering and gases company that is based in Germany. It operates through two key business segments, namely, engineering division and gases division. It has become the largest player in the industrial gases segment, globally, after the merger of Linde AG (Germany) and Praxair, Inc. (US) in 2018 to form Linde plc. Through its gases division, the company offers a variety of compressed and liquified gases as well as other chemicals. It has a vast clientele from the industrial sectors, such as aquaculture, chemicals, construction & infrastructure, food & beverages, electronics, and medical. Further, Linde has segmented its gases division, based on product area, into on-site, healthcare, cylinder gases, and liquified gases. The food & beverage industry generally uses the cylinder gases or liquified gases based on the production capacities and requirements. The Linde Group has a presence across 100 countries in 6 continents and has an extensive network of distributors and suppliers. The company primarily operates in Europe; it has gained a strong presence in the Americas after merging with Praxair, Inc. It operates through its subsidiaries—BOC (UK); Linde Consulting Group L.L.C. (US); the Linde Group (US); and the Linde Group, Incorporated (Mexico).

Air Liquide (France) is one of the largest players in industrial gases in the world. The company is engaged in producing and supplying gases, technologies, and services for health and other industries. It produces air gases—oxygen, nitrogen, argon, and rare gases—and other gases for aeronautic, beverage, chemical, construction, food, pharma, and metal industries. The company classifies its business activities across 3 segments, namely, gas & services, engineering & construction, and global markets & technologies. Its gas business is operated undr the gas & services business unit, which is further classified into different end-user industries, such as industrial merchants (suppliers of a wide range of different gases and application equipment to industries), large industries (steel, chemical, and refining industry), healthcare, and electronics.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=9473111

The microbrewery culture is also on the rise in the North American market. There are multiple microbreweries present in the region. These microbreweries require carbon dioxide for beer dispensing. Also, the North American soft drinks market is one of the largest, with the presence of all the big brands such as Coca-Cola and PepsiCo. The soft drinks industry is one of the largest users of food-grade carbon dioxide for the carbonation of beverages.

The large beverage industry and rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American market holds the largest market share in the food-grade gases market.