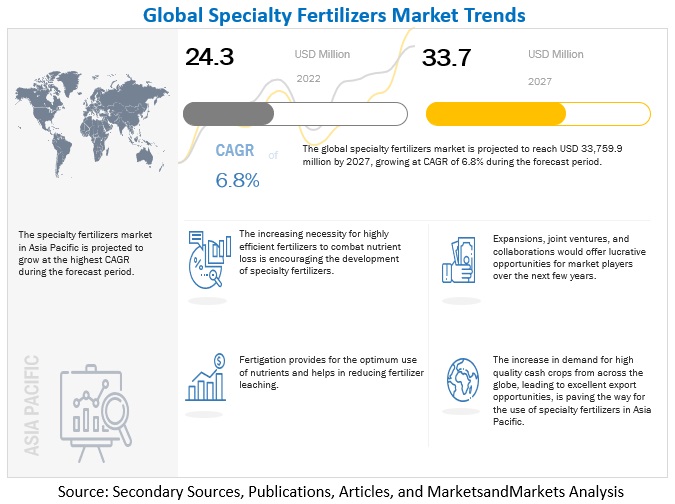

According to a research report "Specialty Fertilizers Market by Technology (Controlled-release Fertilizers, Micronutrients, Water Soluble Fertilizers, and Liquid Fertilizers), Form (Dry and Liquid), Application Method, Type, Crop Type and Region - Global Forecast to 2027" published by MarketsandMarkets, the global specialty fertilizers market size is estimated to be valued at USD 24.3 billion in 2022 and is projected to reach USD 33.7 billion by 2027, recording a CAGR of 6.8% in terms of value.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=57479139

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=57479139

Usage of foliar mode of application to avoid deficiencies and reduce stress drives demand

Foliar fertilizer technology is a one-of-a-kind, dynamic, and efficient crop nutrition method. Foliar feeding is an excellent solution when the plant root system is not functioning properly or when nutrition from the soil is failing. When root uptake is hampered by factors such as cold or warm soils, high soil pH, high weed competition, or nematode infestation, this type of feeding is ideal. Foliar fertilizers are also ideal for preventive measures to avoid deficiencies and reduce stress.

Water-soluble fertilizers have been introduced exclusively for foliar feeding and fertilization. This application technique helps increase nutrient supply during the early growth stages when the roots are not well-developed. This method of applying liquid specialty fertilizers on crops, such as corn and soybean, has helped overcome possible limitations in crop nutrient uptake and increase the yield and efficiency of the nutrients used. The foliar mode of application is widely used to apply micronutrients, particularly iron and manganese. It is mostly used for many fruits, vegetables, and flower crops. Micronutrients can be foliar applied as liquid or suspensions to crops. Soluble inorganic salts of micronutrients are effective in foliar spray and lower in cost than synthetic chelates. For many horticultural crops, foliar application is preferred for correcting iron chlorosis. Foliar nutrient application can also correct occasional nutrient deficiencies or ensure that the plant’s nutrient needs are ‘topped up’ during critical stages of growth when soil nutrient supply is insufficient or during stressful periods such as heat or drought.

The ease of application of liquid specialty fertilizers is driving the market during the forecasted period

Liquid specialty fertilizers include micronutrient, slow-release, water-soluble, and other liquid fertilizers. These are simple to handle and apply. Pumps are used for movement, and they usually require less labor to handle. Liquid fertilizers contain one or more plant nutrients that are readily available. They have better tolerance limits for adverse conditions. To keep fertilizer particles from settling, suspension agents such as colloidal clay material are typically used. Suspension fertilizers are not meant to be stored for an extended period. True solution fertilizers can be stored if the temperature stays above freezing but salting out may be an issue in cold weather.

Liquid fertilizers can be applied either on the ground or on the leaves. They can also be broadcast and applied as a band at planting. When applied foliar, plant nutrients are absorbed through the leaves and are more readily available for plant use than when applied ground. However, the availability of foliar-applied nutrients is transient and does not last throughout the growing season. Foliar applications can help to correct mid-season deficiencies or supplement nutrients applied to the soil. According to Michigan State University, liquid fertilizer use in Michigan has steadily increased over the last 50 years. They accounted for roughly half of the market in 2018 because of their ease of handling and application. A custom blend and greater uniformity in application rate can be achieved with liquids.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=57479139

The growth of the specialty fertilizers market in Europe is driven by well-established distribution networks of Key players

Agriculture in Europe is driven by the adoption of advanced technologies for farming and the introduction of regulations for innovative agricultural products. Most of the arable farmland in Europe is used for cereal production. There has been a significant utilization of controlled-release and water-soluble fertilizers for fruit and vegetable crops in this region for their effectiveness in reducing the application of nitrogen-based fertilizers.

Recently, Europe launched the new European Fertilizer Products Regulation EU 2019/1009 on July 16, 2022. The regulation aims to standardize quality, safety, and labeling requirements for all fertilizing products, support the Farm2Fork strategy, and replace its predecessor EU 2003/2003, which regulated mineral fertilizers. To reduce environmental degradation and align with the EU’s Green Deal, key companies such as ICL have launched a new control release technology in urea administration in Europe in 2022. The technology, “ego.x’’ claims to leverage biodegradable release technology to enhance nutrient use efficiency by 80% and reduce nutrient losses to the environment by 50%. It is further claimed to help provide higher or similar yields with reduced frequency and fertilizer usage. The development is expected to help the European farmers who faced an average production decline of 10-20%. The European strategy, launched in mid-2020, aims at minimizing the environmental footprint of the agriculture industry by reducing fertilizer losses by at least 50% and reducing overall fertilizer use by at least 20% by 2030.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as C Nutrien Ltd. (Canada), Yara (Norway), ICL (Israel), The Mosaic Company (US), CF Industries and Holdings, Inc. (US), Nufarm (Australia), SQM SA (Chile), OCP Group (Morocco), Kingenta (China), K+S Aktiengesellschaft (Germany), OCI Nitrogen (Netherlands), EuroChem (Switzerland), Coromandel International Limited (India), Zuari Agro Chemicals Ltd. (India), and Deepak Fertilizers and Petrochemicals Corporation Limited (India).