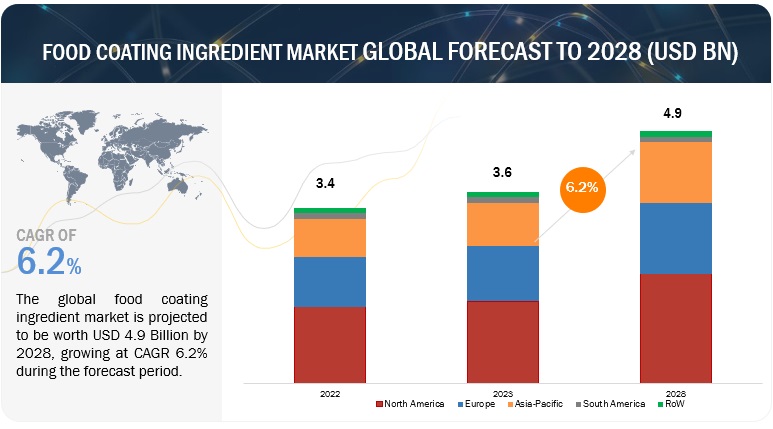

The food coating ingredients market is estimated at USD 3.6 billion in 2023 and is projected to reach USD 4.9 billion by 2028, at a CAGR of 6.2% from 2023 to 2028. The food coating equipment market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 7.7 billion by 2028, at a CAGR of 6.3% from 2023 to 2028. Food coating refers to the process of adding a layer of coating or breading to food products, which can provide improved texture, taste, appearance, and preservation. The market for food coating is driven by several factors, including the growing demand for convenience and processed food products, increasing consumer preferences for crispy and crunchy food textures, and the need for extended shelf life of packaged food. The demand for convenience food products, such as frozen and ready-to-eat meals, has been on the rise. Food coatings are used to enhance the taste and texture of these products, thereby driving the market growth. The food coating equipment market is steadily increasing in North America and Europe and growing consistently due to established equipment manufacturers and the organized food industry.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

Based on Application, the meat & seafood products sub segment of the food coating ingredient market is anticipated to dominate the market.

Commonly used ingredient for the coating of meat & seafood products is flour, which helps to provide appealing colors and flavors. Different coatings are applied to the surface of meat loaves, sausages, and other meat food products. Both fresh and frozen types of meat, when subjected to extended storage, lose substantial water due to evaporation. It is desirable to have the meatloaves coated as the coating lends protection to the product and gives it more appealing organoleptic characteristics.

Based on application, the confectionery products is projected to witness the highest CAGR in food coating equipment market during the forecast period.

There has been a rising demand for confectionery products in the European region, which presents a mature market for the confectionery industry. Hence, this region is expected to show slow growth as compared to other regions. Confectionery is generally high in calories and carbohydrates but poor in micronutrients. Industry statistics show that, in terms of sales generated, the Western European region dominated the worldwide confectionery sector. Better-for-you products have become more popular as a response to health issues. The clean label movement has impacted the confectionery market because of the demand for colors that are derived naturally. Many food firms announced plans to reformulate their products to swap out artificial additives and streamline ingredient lists to meet this growing demand. Few companies have made acquisitions, with companies having a strong bakery processing equipment portfolio to enhance their product as well. Gea Group (Germany) has firmly moved into the bakery sector with the acquisition of Comas and Imaforni, the leading suppliers of demanding industrial processing equipment and solutions for the cakes, pies, cookies and biscuits, crackers, and snacks industry.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=168532529

The Asia Pacific market is projected to dominate the food coating equipment market.

The region’s growing demand for processed food, improved manufacturing industry growth over the past decade, and advancements in the food industry have provided new opportunities for the food coating ingredients market. An increase in processed and convenience food production and innovations in segments such as meat, snacks, and bakery & confectionery products drive the demand for coating ingredients in the Asia Pacific region. China and India are set to experience continual demand during the forecast period. Many global companies are focusing on these emerging markets and are increasing their footprint by setting up manufacturing facilities, distribution centers, and R&D centers. India is projected to be the fastest-growing market in the region as there are many investments being made by several multinational corporations due to favorable support of the government and low labor cost. The Asia Pacific food & beverage industry is greatly influenced by rising consumer preference for conscious food habits, the growing trend toward natural & organic foods, and the increasing demand for convenience food products. With emerging economies, growing industrialization, increasing demand for processed foods, and consumer preference for quality products, ingredient suppliers are optimistic about the growth of the food & beverage industry. These trends and preferences have associated with the increasing consumption of coated food products.

Archer Daniels Midland (US),Kerry Group (Ireland), Cargill (US), Ingredion Incorporated (US), and DSM (The Netherland) are among the key players in the global food coating market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the food coating market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.