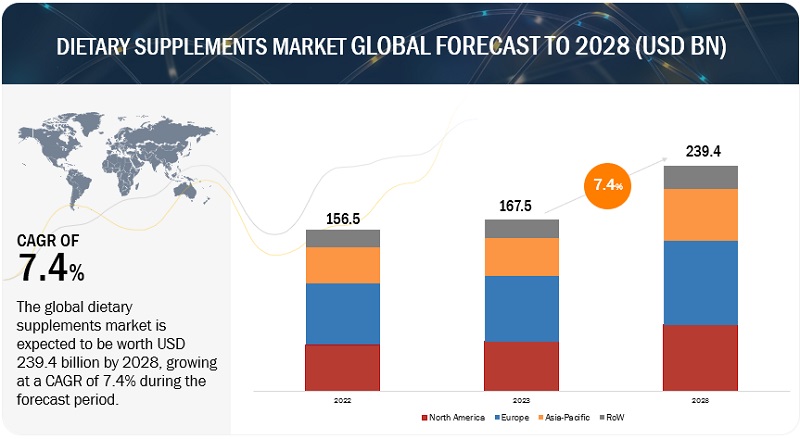

The dietary supplements market size is expected to grow at a compound annual rate of 7.4%, reaching $167.5 billion in 2023 and $239.4 billion by 2028. This growth is driven by several factors, including an aging population, a shift from pharmaceuticals to nutraceuticals, and an increasing focus on preventive healthcare, which boosts the demand for amino acids and protein supplements. The trend toward personalized nutrition is also propelling the industry forward, as consumers prioritize self-directed care and focus on personal health, weight management, and overall well-being.

In recent years, the personal care market has evolved significantly. Consumers are increasingly adopting weight management and protein supplements to address lifestyle-related disorders. Many regions report inadequate protein intake among populations, leading to a higher demand for amino acids and protein supplements. Additionally, poor eating habits and unhealthy lifestyles have prompted a large number of consumers to turn to weight management supplements to combat obesity and overweight issues.

Dietary Supplements Market Drivers: Shift in Consumer Preferences Due to Increasing Health and Prevention Focus

A recent survey by the Council for Responsible Nutrition (CRN) revealed that 73% of Americans will use dietary supplements in 2020. The primary motivation for this growing trend is the perceived "overall health and wellbeing benefits" of these products. Rising health awareness has spurred consumers to seek out customized dietary supplements tailored to their biological needs. As health consciousness grows, there has been a significant increase in the demand for products like protein supplements, vitamins, and mineral supplements. Moreover, consumers are increasingly incorporating herbal (botanical) supplements into their daily diets to address health issues and support lifestyle changes.

The sports nutrition function segment is expected to experience the fastest growth during the forecast period.

Many sports nutrition supplements today contain a variety of ingredients such as multivitamins, branched-chain amino acids (like leucine), omega-3 fatty acids, glucosamine, glutamine, beta-alanine, beetroot, and green tea extract. Each of these components offers distinct performance benefits. While everyone needs sufficient macro and micronutrients, athletes, due to their intense physical exertion, must carefully monitor their dietary intake. Sports nutrition supplements help meet these nutritional needs, contributing to the rapid growth of this category within the dietary supplements market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=973

The elderly age group is expected to hold a significant share of the dietary supplements market by target consumer during the forecast period.

Due to the increasing aging population and their specific nutritional needs. As individuals age, they may require additional support to address nutritional deficiencies and age-related health concerns. Dietary supplements provide a convenient and targeted solution to fulfill these needs, offering vitamins, minerals, and other essential nutrients. The elderly segment seeks supplements to support joint health, cognitive function, cardiovascular health, bone strength, and immune system function. Manufacturers are developing specialized formulations to cater to the unique requirements of older adults. With the growing elderly population, the dietary supplements market is expected to experience significant growth in this segment.

North America holds the highest market share during the forecast period.

The North American market dominates in the field of nutrition and supplements and is projected to see further growth. This is fueled by a growing awareness among North Americans about the importance of dietary supplements in maintaining overall health and managing weight. Lifestyle-related ailments such as diabetes, obesity, and hypertension are prevalent in this region due to poor dietary habits, including the consumption of nutritionally deficient junk and processed foods. There's also a rising preference for vegan and minimally processed foods, which is contributing to an increased demand for dietary supplements to address nutritional gaps. Meanwhile, South Africa is emerging as a promising market for both the production and consumption of dietary supplements, driven by widespread malnutrition and other nutritional deficiencies within the population. Collectively, these factors are propelling the global dietary supplements market forward.

Top Dietary Supplements Companies

Key players in this market include Nestle (Switzerland), Abbott (US), Amway Corp (US), Pfizer Inc. (US), ADM (US), International Flavors & Fragrance (US), Otsuka Holdings Co., Ltd (Japan), Glanbia PLC (Ireland), GSK PLC. (UK), Bayer AG (Germany), Herbalife International of America, Inc. (US), Nature's Sunshine Products, Inc (US), Bionova (Canada), ArkoPharma (France), American Health (US), Pure Encapsulation (US), H&H Group (Hong Kong), Nu Skin (US), Power Gummies (India), Biomedical Research Laboratories (US), HealthKart (India), NutriScience Corporation (US), Nature's Essentials (US), and Life Extension (US).