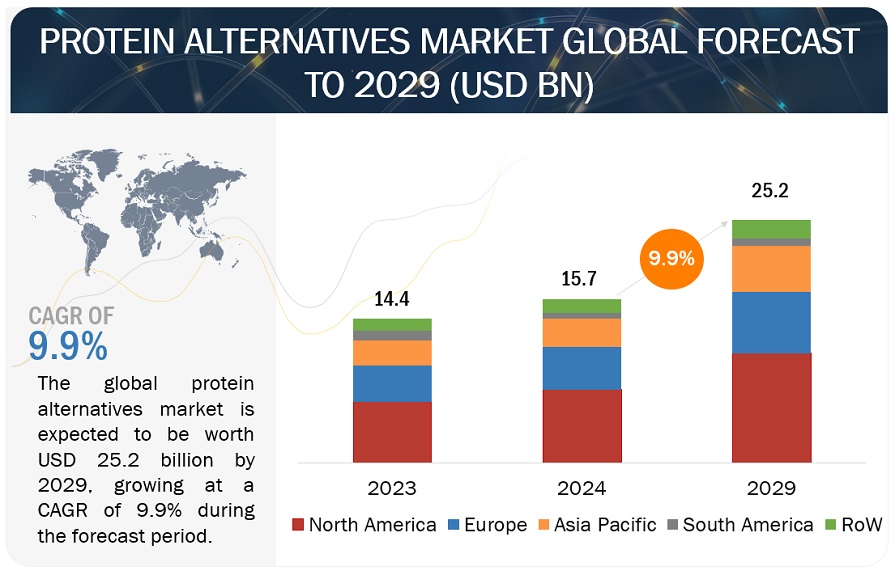

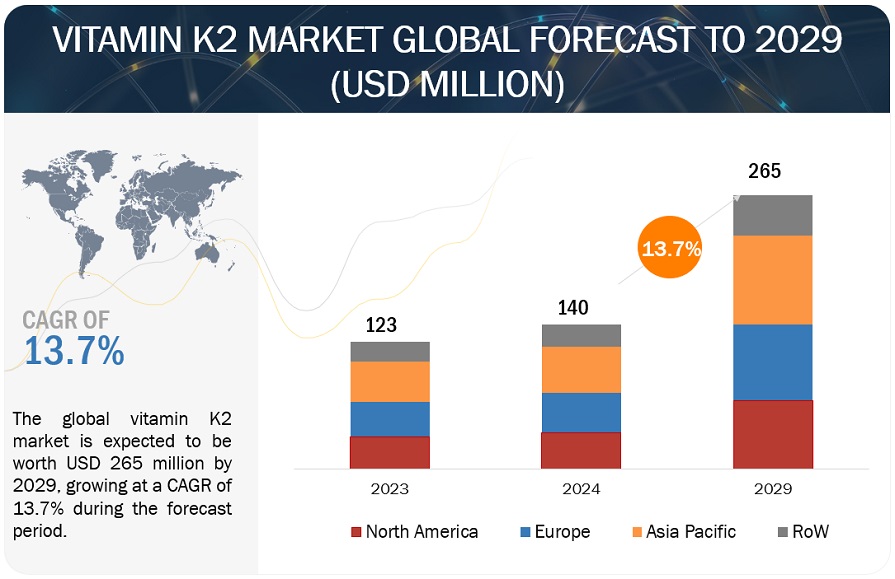

The global vitamin K2 market is on a trajectory of significant expansion, with an estimated value projected to reach USD 265 million by 2029 from the 2024 valuation of USD 140 million, displaying a promising Compound Annual Growth Rate (CAGR) of 13.7%. As scientific research continues to highlight the benefits of Vitamin K2, particularly in calcium metabolism and the prevention of arterial calcification, more individuals are incorporating this nutrient into their diets. This heightened awareness is especially prevalent among aging populations, who are at greater risk for osteoporosis and cardiovascular diseases, thereby fueling demand for Vitamin K2 supplements.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=80962397

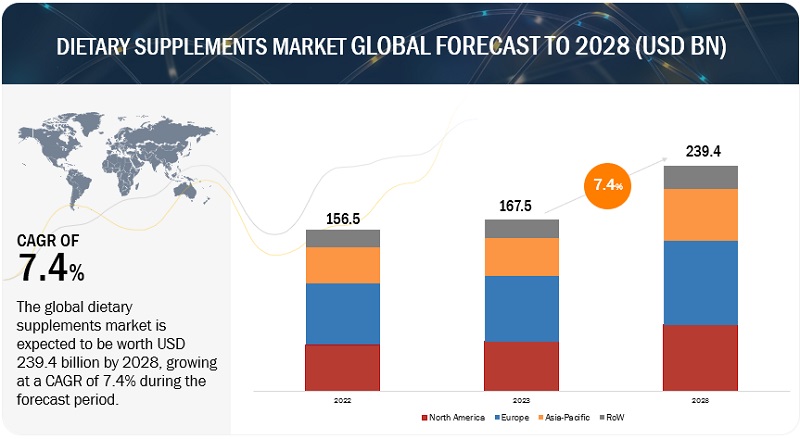

Another significant contributor to market expansion is the rise of the health and wellness trend. Consumers worldwide are becoming more proactive about their health, seeking preventive measures to avoid chronic diseases. This shift is evident in the growing popularity of dietary supplements and functional foods fortified with essential nutrients like Vitamin K2. Moreover, advancements in the production and formulation of Vitamin K2 supplements are also playing a crucial role in the market’s upward trajectory. Innovations such as microencapsulation and improved delivery systems have enhanced the bioavailability and efficacy of Vitamin K2, making supplements more effective and appealing to consumers. These advancements not only improve the absorption of Vitamin K2 in the body but also extend the shelf life of products, ensuring that consumers receive the maximum benefits from their supplements.

Drivers: Growth in health consciousness among consumers and increasing health expenditure

The Vitamin K2 market is experiencing robust growth, primarily driven by the increasing health consciousness among consumers and the rise in health expenditure globally. As more individuals become aware of the importance of preventive healthcare, they are seeking out dietary supplements that can support their long-term well-being. This trend is evident across various demographics, from young adults focused on maintaining their health to older populations looking to manage age-related health issues. The growing emphasis on holistic health and wellness is leading consumers to invest in products that offer specific health benefits, such as improved bone density and cardiovascular health, which are directly linked to Vitamin K2. Additionally, higher disposable incomes and greater health expenditure are enabling consumers to spend more on premium health products, further boosting the demand for Vitamin K2 supplements.

Restraints: Inconsistency in regulatory norms governing vitamin K2

Despite the promising growth prospects, the Vitamin K2 market faces significant challenges due to the inconsistency in regulatory norms across different regions. These regulatory disparities can create barriers for manufacturers and marketers, complicating the process of bringing new Vitamin K2 products to market. Different countries have varying guidelines and standards for the production, labeling, and marketing of dietary supplements, including Vitamin K2. This lack of uniformity can lead to increased costs for compliance and potential delays in product launches. Moreover, stringent regulations in certain regions can limit market entry for new players, hindering the overall growth of the Vitamin K2 market. Navigating these regulatory complexities requires substantial investment in legal and regulatory expertise, which can be a restraint for smaller companies.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=80962397

Mk-7 Product Type is Witnessing Higher Growth During the Forecast Period.

Menaquinone-7 or MK-7 is the most studied menaquinone due to its high bioavailability, longer half-life, and more than three decades of clinical research. Furthermore, Vitamin K2 MK-7, specifically MenaQ7 and vitaMK7, represents a pivotal advancement in nutritional science, renowned for its dual benefits in bone and cardiovascular health. Distinct from its K1 counterpart, K2 MK-7's superior bioavailability and extended half-life in the body make it optimal for promoting calcium utilization towards bone strength while preventing arterial calcification.

As consumer awareness grows and dietary deficiencies persist, the market potential for K2 MK-7 continues to expand, driven by increasing demand for scientifically validated supplements that address fundamental health challenges across diverse demographic segments.

Asia Pacific is the Fastest-Growing Market for Vitamin K2 Among the Regions.

The Asia Pacific region is emerging as the fastest-growing market for Vitamin K2, driven by a combination of demographic, economic, and lifestyle factors. One of the primary drivers of this growth is the region’s rapidly aging population. Countries such as Japan, China, and South Korea are experiencing significant increases in their elderly populations, who are more prone to bone-related ailments like osteoporosis and cardiovascular issues. This demographic shift is creating a substantial demand for nutritional supplements that support bone health and prevent arterial calcification, making Vitamin K2 a sought-after nutrient.

Request Sample Pages : https://www.marketsandmarkets.com/requestsampleNew.asp?id=80962397

The key players in this market include Gnosis by Lesaffre (NattoPharma) (France), Kappa Bioscience AS (Balchem Corp.) (US), J-OIL MILLS INC. (Japan), Novozymes A/S (Denmark), BASF SE (Germany), Sungen Bioscience Co.,Ltd. (China), Vesta Nutra (US), Richen Nutritional Technology Co., Ltd. (China), Menadiona (Spain), and GENOFOCUS (Korea).