According to

MarketsandMarkets "Animal Disinfectants

Market by Application (Dairy Cleaning, Swine, Poultry, Equine,

Dairy & Ruminants, and Aquaculture), Form (Liquid and Powder), Type

(Iodine, Lactic Acid, Hydrogen Peroxide), and Region - Global Forecast to

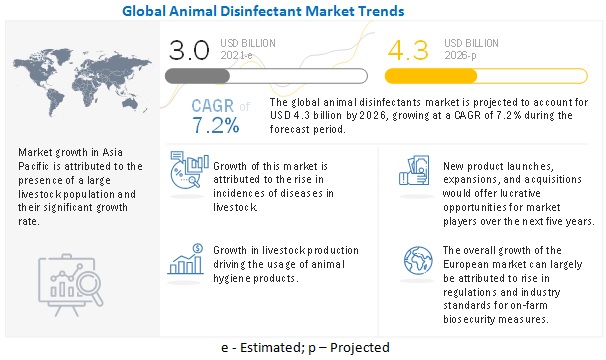

2026", The global animal disinfectants market size is

estimated to be valued at USD 3.0 billion in 2021. It is projected to reach USD

4.3 billion by 2026, recording a CAGR of 7.2% during the forecast period. The

market has a promising growth potential due to several factors, including the

rising awareness regarding hygiene and sanitation amidst this COVID-19 pandemic

and increasing demand for meat and other animal products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38718363

COVID-19 Impact on the Animal

Disinfectant Market

The impact of COVID-19 lockdown was

tremendous in scale across the globe and profound especially in the key

consumption markets for animal disinfectants. The demand for disinfectant

products channelized for the livestock sector has remained high, with manufacturing

plants for both disinfectants and water treatment being utilized at almost full

capacity for companies such as Lanxess. However, the supply-chain disruptions

in the key emerging markets, especially Mexico and Central America, negatively

impacted the sales, albeit for a temporary period. The last mile connectivity

to small and medium-scale livestock farms suffered a setback due to weakness in

the distribution channels. Prominent players in the market such as Neogen

expect a surge in demand with markets opening up gradually, and thus,

capacity-building remains among the major focus areas. Key giants have also

embarked on inorganic growth strategies by acquiring regionally-prominent

disinfectant manufacturers and thereby strengthening their geographical

outreach. Livestock disinfectant companies are also intensifying their efforts

to develop a plethora of anti-bacterial, anti-fungal, and anti-viral solutions

in the wake of growing concerns for zoonotic diseases.

Restraint: High entry

barriers for players

The high costs associated with the development and

registration of animal disinfectant products can result in small to

medium-scale companies losing out to larger players. Another barrier for

smaller players entering the market is the dynamic nature of the market itself,

which has recently witnessed prominent players intensively seeking to

consolidate their position through inorganic growth attempts such as acquiring

smaller market players. New companies showing disruptive potential become the

key targets for acquisitions by larger players such as Neogen Corp. and CID

Lines.

Prominent players in the market are intensively seeking to

increase their market share with the combination of inorganic and organic

growth trajectories with former holding precedence in the form of growing

number of acquisitions witnessed in recent years. The regulatory framework in

the developed markets of North America and Western Europe is very stringent,

with growing focus on good hygiene practices (GHP) which are cost-intensive thereby

hindering the entry of small to medium-scale enterprises.

On the basis of

application, dairy cleaning segment is expected to retain its dominance in the

foreseeable period

Dairy cleaning is a terminal biosecurity measure, which is

carried out at regular intervals. Due to the cost factor for larger cattle

herds, the use of dairy cleaning has a greater significance in the developed

markets. Countries in regions such as Europe and North America maintain

large-scale farms and dairy farms required to maintain proper dairy cleaning

measures to ensure the efficacy of the livestock and the equipment.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=38718363

Asia Pacific is projected

to be the fastest-growing region in the animal disinfectant market.

The animal disinfectant market in Asia Pacific is driven

by growing inclination towards animal-based food products that have prompted

stakeholders in supply-chain to ramp up their production and intensify rearing

leading to greater demand for cleaning and hygiene products, including

disinfectants. The region has also witnessed growing regulatory focus on the

Good Hygiene Practices (GHP) that are embedded as part of various mandatory

regulations to be followed at dairy, poultry, swine, equine and aquaculture

sectors. Markets in South East Asia such as Singapore and Malaysia are

providing vital cues to improve hygiene infrastructure in animal husbandry and

this trend is largely adopted by other countries in the region such as

Thailand, Vietnam, Indonesia where there is a strong need to implement robust

disinfection protocols.

Key Market Players

Key global market players offer wide range of animal disinfectant products to improve animal health and performance. Prominent livestock disinfectant manufacturers have strong presence in the European and North America countries. The key companies in the animal disinfectant market are Neogen Corporation (US), GEA (Germany), Lanxess AG (Germany), Zoetis (US), Kersia Group (France), and CID Lines (Belgium). Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the animal disinfectant market.