The report "Agricultural Testing Market by Sample (Soil, Water, Seed, Compost, Manure, Biosolids, Plant Tissue), Application (Safety Testing (Toxins, Pathogens, Heavy Metals), Quality Assurance), Technology (Conventional, Rapid), and Region - Global Forecast to 2022",agricultural testing market is estimated to be valued at USD 4.56 Billion in 2017, and is projected to reach USD 6.29 Billion by 2022, at a CAGR of 6.64%. The market is driven by stringent safety and quality regulations for agricultural commodities increase in outbreaks of foodborne illnesses, and rapid industrialization leading to the disposal of untreated industrial waste into the environment.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203945812

Driver: Stringent safety and quality regulations for agricultural commodities

Growing complexities in the supply chain, lack of adoption of good agricultural practices (GAP), and absence of proper hygiene & sanitation practices have resulted in increasing instances of contamination of food, feed, and agricultural products at the beginning of the supply chain, which are responsible for large-scale outbreaks of illnesses and poisoning in both humans and livestock. This has caused severe concerns among farmers, livestock producers, end consumers, regulatory authorities, and other industry stakeholders.

Furthermore, in countries such as the US, Canada, Australia, and countries in the European Union, various mechanisms have been formed, and there is a strong emphasis in the framework regarding monitoring policies and their strict enforcement to attain higher transparency in the supply chain and ensure traceability. Such moves have ensured that contaminated food, feed, and agricultural products face border rejections and are quarantined. Moreover, violators are penalized with heavy fines and have their licenses revoked. Therefore, in order to comply with the safety and quality parameters set by various regulatory authorities, agricultural testing is increasingly being adopted as an essential pre-emptive measure.

Water and soil are the fast growing segments in agricultural testing during the forecast period

The global market, based on sample, has been segmented into soil, water, seed, compost, manure, biosolids, and plant tissue. The market for testing for soil is estimated to dominate in 2017, and is also projected to be the second fastest-growing segment during the forecast period. The growing contamination of soil, caused by wastewater and industrial effluents, has been propelling the importance of soil testing; this, in turn, is driving the market for agricultural testing.

Spectrometry & chromatographic technologies contributed to the fastest growing rapid technology market in agriculture testing

The agricultural testing services market, by technology, has been segmented into conventional and rapid. The rapid technology segment is estimated to dominate the market in 2017, and is projected to grow at a higher CAGR by 2022. This can be attributed to low turnaround time, higher accuracy, sensitivity, and ability to test a wide range of bacteria in comparison to conventional technological methods.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=203945812

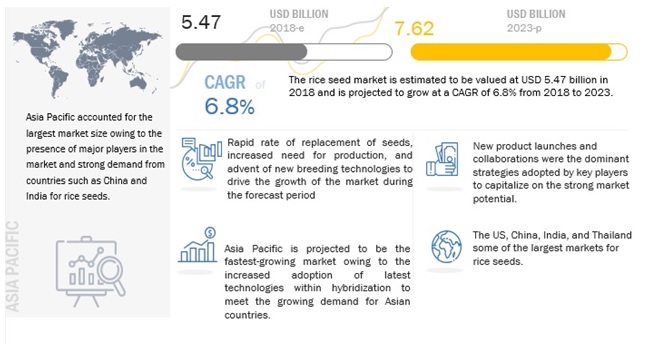

Asia Pacific is projected to be the fastest-growing market during the forecast period

The Asia Pacific market is projected to grow at the highest CAGR from 2017 to 2022. Major growth drivers of the region include increased adoption of advanced biotechnological methods and organic farming resulting in the need for agricultural testing, and an increase in the number of exports from the region, necessitating agricultural testing for the produce.

This report includes a study of marketing and development strategies, along with the services & product portfolios of leading companies. It includes the profiles of leading service companies such as SGS (Switzerland), Intertek (UK), Eurofins (Luxembourg), Bureau Veritas (France), ALS Limited (Australia), and TÜV NORD GROUP (Germany). It also includes profiles other players that also have significant share in this market such as Mérieux (US), AsureQuality (New Zealand), RJ Hill Laboratories (New Zealand), SCS Global (US), Agrifood Technology (Australia), and Apal Agricultural Laboratory (Australia).