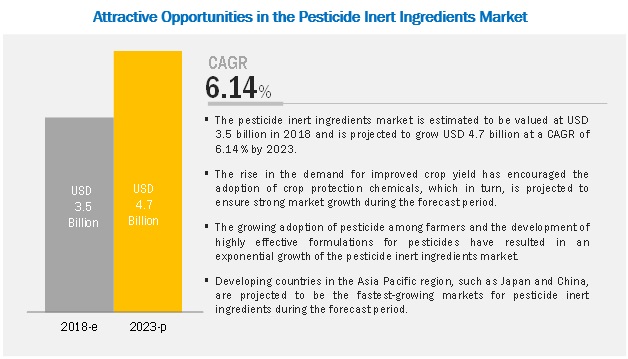

The report "Pesticide Inert Ingredients Market by Type (Emulsifiers, Solvents, and Carriers), Source (Synthetic and Bio-based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides, and Rodenticides), and Region - Global Forecast to 2023", The pesticide inert ingredients market is projected to reach USD 4.7 billion by 2023, from USD 3.5 billion in 2018, at a CAGR of 6.14% during the forecast period. The market is driven by factors such as the increasing demand for specific inert ingredients in pesticide formulation and capability of inert ingredients to improve the efficacy of pesticide application.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176580687

Pesticide inert ingredients for the herbicide segment is estimated to have the highest share during the forecast period.

Pesticide inert ingredients are used in herbicide spray solutions to accentuate the emulsifying or other surface modifying properties of liquids. Inert ingredients are mostly present in herbicide treatment solutions with the aim to improve the penetration of active ingredients into plant foliage or to reduce foaming activity of the spray solution. Also, with reference to the herbicides available in the market, the amount of inert ingredients used in herbicide solutions are higher compared to insecticides and fungicides.

High adoption of inert ingredients in the North American region also drives the overall pesticide inert ingredients market. The major use of the formulation of herbicides is in the form of emulsifiers and solvents.

The dry segment in terms of forms of pesticide inert ingredients is projected to witness the fastest growth during the forecast period.

Dry inert ingredients are available in various forms such as wettable powders, dust, granules, and talc. The dry form of inert ingredients is majorly used in the formulation of herbicides and rodenticides. Dry forms of pesticides help in attracting rodents in the fields and thus are preferred in agricultural fields for repelling and skilling rodents. The high share of herbicides in the pesticide industry also drives the market for dry inert ingredients.

Asia Pacific is projected to witness the highest growth in the pesticide inert ingredients market during the forecast period.

The Asia Pacific region is one of the leading consumers of pesticides across regions, even though the region mainly depends on imports for pesticide supply. Inert ingredients are increasingly consumed by pesticide manufacturers at the production facility during the formulation stage, and countries such as India, Thailand, and Vietnam depend on imports for pesticides. Hence, the market for pesticide inert ingredients remains smaller when compared to the Americas and Europe. However, the pesticide inert ingredients market is well-established in developed countries with the increasing establishment of production plants in Asian countries. Due to these factors, the use of inert ingredients along with pesticide application is projected to increase in the future.

Key Market Players:

Major market players in the pesticide inert ingredients market are BASF (Germany), Clariant (Switzerland), DowDuPont (US), Stepan Company (US), and Croda International (UK). BASF SE (Germany), one of the world’s largest chemical companies, operates through seven major segments. With a broad product range, diverse customer base, and operations in more than 80 countries through its joint ventures and subsidiaries, the company has marked its presence on the growth trajectory. DowDuPont is another leading player wherein, Dow Crop Defense focuses on providing inert and additive ingredients, which enhances the effectiveness of pesticides and adjuvant formulations. This, in turn, helps farmers to produce and offer healthier crops. There are some other players in the industry, which are focusing on serving the market with various inert ingredient products and capturing a larger market share such as Eastman Chemicals (US), Solvay (Belgium), Evonik (Germany), Huntsman Corporation (US), Akzonobel (The Netherlands), Royal Dutch Shell (The Netherlands), and LyondellBasell Industries (Netherlands).

Key questions addressed by the report:

- Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

- Which region will have the highest share in the pesticide inert ingredients market?

- Which type of pesticide inert ingredients witnesses high demand in each key country market?

- What are the trends and factors responsible for influencing the adoption rate of bio-based inert ingredients in key emerging countries?

- Which are the key players in the market and how intense is the competition?