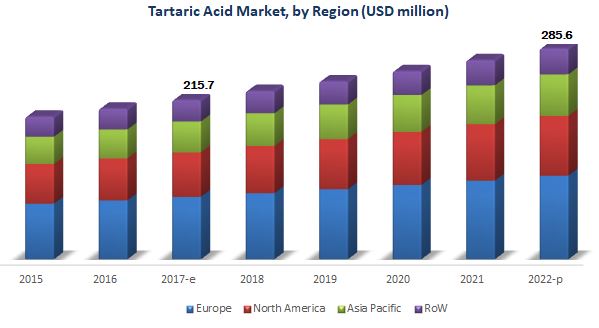

The report "Tartaric Acid Market by Source (Grapes & Sun-dried Raisins, Maleic Anhydride), Type (Natural, Synthetic), Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care Products), and Region - Global Forecast to 2022", The tartaric acid market is estimated to be valued at USD 215.7 Million in 2017 and is projected to reach USD 285.6 Million by 2022, at a CAGR of 5.77%. The market is driven by multiple functionalities across different industries, R&D and technological innovations, and growth in the wine industry.

Download PDF Brochure:https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=59894738

Food & beverages segment is estimated to be the largest in 2016

The tartaric acid market, by application, was dominated by the food & beverages segment. It is also projected to grow at the highest CAGR during the forecast period, followed by the pharmaceuticals segment. Consumption of tartaric acid in food & beverages is expected to grow, along with the increasing demand for processed food and ready-to-drink beverages, and improvements in living standards in developing markets, including countries in the Asia Pacific region. Tartaric acid has a larger role to play in winemaking and the finished product of wine, where acids are an important component. Tartaric acid is present in both wine and grapes, which have direct influences on the color, balance, and taste of the wine.

Natural segment is projected to be the fastest-growing during the forecast period

The natural tartaric acid segment is projected to be the fastest-growing during the forecast period, due to its high usage in applications such food & beverages, especially in the wine industry, resulting in an exponential increase in the consumption and production. Tartaric acid is mostly used in the wine industry due to the major role it plays in maintaining the chemical stability of the wine, controlling the acidity of wine and its color, and finally in influencing the taste of the finished wine.

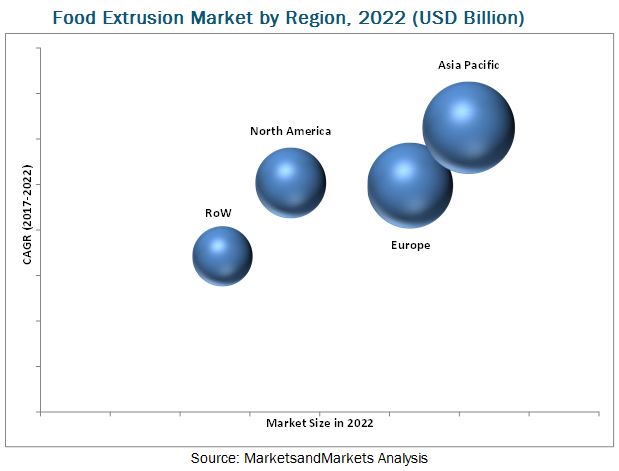

Asia Pacific is projected to be the fastest-growing market during the forecast period

The market in the Asia Pacific region is driven by China and Japan, the two economic giants. The relatively low operational costs in this region enable manufacturers to have competitive pricing on a global platform. In this region, less stringent regulations are in place regarding the trade and domestic marketing of tartaric acid. The rising disposable incomes and the growing demand for processed and packaged food have impacted the overall food & beverages industry in the Asia Pacific region. Tartaric acid is used as an acidulant and preservative in food products; hence, the growth of the food & beverage industry has a direct impact on the demand for tartaric acid.

Request for Customization:

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading service companies such as Caviro Group (Italy), ATP Group (US), Merck (Germany), Omkar Specialty Chemicals (India), Changmao Biochemical Engineering (China), Tarac Technologies (Australia), PAHI (Spain), Distillerie Mazzari (Italy), Distillerie Bonollo (Italy), Derivados Vinicos (Argentina), Industrias Vinicas (US), and Tártaros Gonzalo Castelló (Spain).

Targeted Audience:

- Food & beverage regulatory organizations

- Tartaric acid manufacturers, suppliers, distributors, and retailers

- Food & beverage product manufacturers, suppliers, distributors, and retailers