- To define, segment, and estimate the size of the essential oil market with respect to its type, application, method of extraction, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, joint ventures, in the essential oils market

Tuesday, April 13, 2021

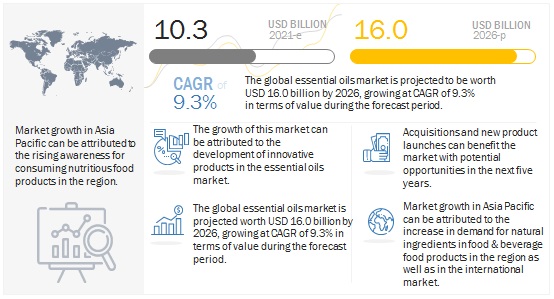

Essential Oils Market: Growth Opportunities and Recent Developments

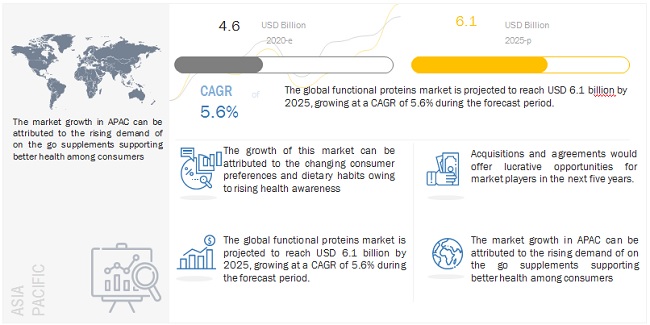

Functional Proteins Market to Witness Unprecedented Growth in Coming Years

- Determining and projecting the size of the functional proteins market, with respect to type, application, form, source, and regional markets, over a five-year period, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the region

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the functional proteins market

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

- December 2020, Cargill expanded its European ingredient portfolio with the addition of pea protein. This product launch enabled Cargill to get access to the pea protein market.

- November 2020, Ingredion acquired Verdient Foods (Vanscoy, SK) with 100% ownership. The acquisition enabled net sales growth and expanded the manufacturing capability of Ingredion, with the addition of two manufacturing facilities in Canada.

- September 2020, ADM expanded their protein portfolio with textured wheat and pea proteins. These high-functionality proteins improve the meat-like texture of alternative meats. This new launch ensured ADM’s leadership in the plant protein market.

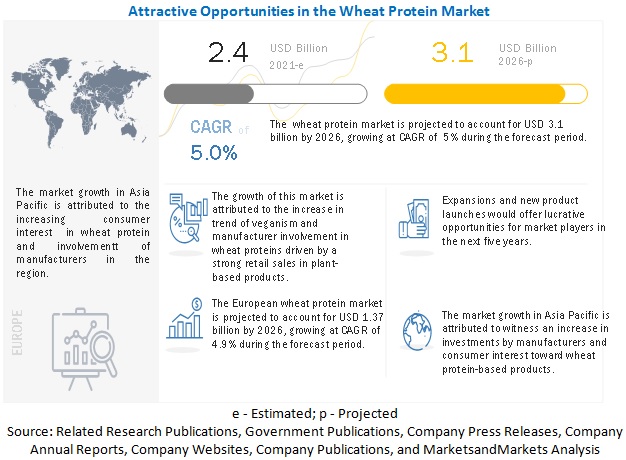

Wheat Protein Market to Record Steady Growth by 2026

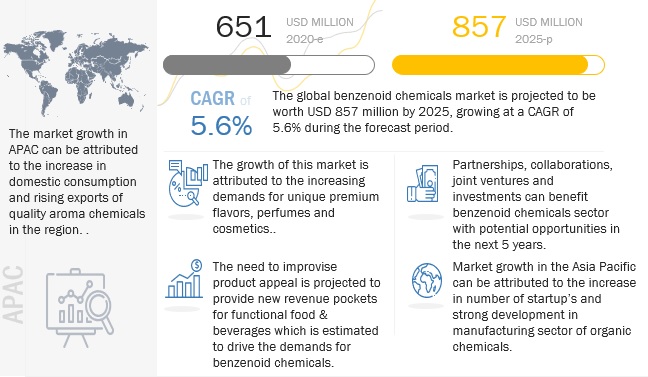

Benzenoid Market Projected to Garner Significant Revenues by 2025

- To describe and forecast the benzenoid chemicals market, in terms of type, application, and region

- To describe and forecast the benzenoid chemicals market, in terms of value and volume, by region-Asia Pacific, Europe, North America, South America and Middle East & Africa-along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of benzenoid chemicals market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the benzenoid chemicals market

Monday, April 12, 2021

Food Encapsulation Market to Record Steady Growth by 2025

The global food encapsulation market is estimated to account for USD 9.9 billion in 2020 and is projected to reach USD 14.1 billion by 2025, recording a CAGR of 7.5% during the forecast period. The market is primarily driven by the increasing use of encapsulated flavors in the food and beverage industry and the rising adoption of microencapsulation for functional ingredients.

- In July 2019, DSM (Netherlands) entered into a joint venture with Evonik (Germany) to produce encapsulated omega-3 fatty acids, reducing the pressure on fish stocks, and supporting the aquaculture industry.

- In May 2017, Lycored (Israel) entered into a joint venture with a biotechnology company, Algatechnologies (Israel), to distribute Algatech's AstaPure in the form of beadlets, which will help in increasing the brand's commercial reach for this product range in the North American market.

- In January 2017, DSM (Netherlands) launched a new product, MEG-3, with new encapsulation technology.

Upcoming Growth Trends in the Food & Beverage Metal Cans Market

The report "Food & Beverage Metal Cans Market by Material (Aluminum and Steel), Type (2-Piece and 3-Piece), Degree of Internal Pressure (Pressurized Cans and Vacuum Cans), Application (Food and Beverages), and Region - Global Forecast to 2025", According to MarketsandMarkets, the food & beverage metal cans market is estimated to be valued at USD 27.6 billion in 2020 and is projected to reach USD 37.0 billion by 2025, recording a CAGR of 6.1%. The rapid growth in awareness toward environmental sustainability and recyclable properties of metal cans are the driving factors for the food & beverage metal cans market.

By material, the aluminum segment is projected to account for the larger share in the food & beverage metal cans market

The aluminum segment is projected to dominate the market, on the basis of material, during the forecast period. This is attributed to the cost-effectiveness and recycling rates of aluminum. Increasing the use of metal packaging for food & beverages packaging provides a sustainable and environment-friendly solution for packaging in multiple applications. Aluminum cans are convenient to keep in refrigerators and ovens. Changes in consumer preferences are observed for food & beverage packaging. According to the Environmental Protection Agency of the United States (EPA), 1.9 million tons of aluminum packaging was generated for beers and soft drink cans, and 49.2% of aluminum beverage cans were recycled. The metal packaging for the food industry is considered to be safe, which is one of the major factors to support its growth in the market.

By application, the beverages segment accounted for the larger size in the food & beverage metal cans market during the forecast period

Based on the application, the food & beverage metal cans market is segmented into food and beverages. The beverage cans are estimated to account for the larger share, because of the high consumption of carbonated, non-carbonated, and sports & energy drinks. The rise in the consumption of alcoholic beverages leads to the growth of beverage cans market. Moreover, changes in consumer trends toward healthy drinks are driving the market for metal cans during the forecast period.

The Asia Pacific region is projected to witness the fastest growth during the forecast period

The Asia Pacific food & beverage metal cans market is projected to have higher growth potential in the coming years. A large consumer market and increasing disposable income in India and China are driving the growth of the demand for high-quality metal packaging. Also, China is the hub for the manufacture of metal cans and has sufficient manufacturing plants to meet the demand for food & beverage metal packaging. Moreover, rapid urbanization in countries such as India and China are expected to result in high growth of the food & beverage metal cans market in Southeast Asia during the forecast period.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=251

This report includes a study on the marketing and development strategies, along with the product portfolios of the leading companies. It consists of the profiles of leading companies such as Crown Holdings, Inc (US), Ball Corporation (US), Silgan Holdings Inc. (US), Ardagh Group (Luxembourg), CAN-PACK S.A. (Poland), Kian Joo Group (Malaysia), CPMC Holdings Limited (China), Huber Packaging Group GmbH (Germany), CCL Industries (US), Toyo Seikan Group Holdings Ltd (Japan), Universal Can Corporation (Japan), Independent Can Company (US), Mauser Packaging Solution LLC (Germany), Visy (Australia), Lageen Food Packaging (Israel), Massilly Holding S.A.S (France), P. Wilkinson Containers Ltd. (UK), Unimpack (Netherlands), Müller und Bauer GmbH (Germany), and Allied Cans (Canada).

Recent Developments:

- In April 2019, Crown Holdings, Inc. announced the launch of round and square shorter cans in the luxury packaging market. This will help the company to broaden its product portfolio.

- In August 2019, Ball Corporation signed an agreement to sell its tinplate steel aerosol packaging facilities to Envases del Plata (Argentina), an Argentinian metal packaging company. This agreement will help the company to expand its reach in the South American region.

- In October 2019, Ball Corporation announced the construction of its new aluminum cups manufacturing plant in Rome, Georgia to cater to the growing demand for beverage packaging in the US. This new plant will help the company expand its presence in the US region.

- In July 2019, Ardagh Group launched a slimline 187 ml can particularly designed for protecting wine and wine-based drinks. This launch would help the company to expand its product portfolio.

Key Trends Shaping the Technical Enzymes Market

The global technical enzymes market size is projected to grow from USD 1.1 billion in 2019 to USD 1.5 billion by 2026, recording a compound annual growth rate (CAGR) of 4.0% during the forecast period. The increasing trend of environmental concerns in developing countries and advancements of R&D activities for technical enzymes are the major factors that are projected to drive the growth of this market during the forecast period.

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=72989187

The microorganism source is projected to account for the largest share in the technical enzymes market during the forecast period.

Microorganisms are the primary source of technical enzymes, as they are cultured in large quantities in a short period, and genetic manipulations can be done on bacterial cells to enhance the enzyme production for usage in various industries such as biofuel, pulp & paper, textile & leather, and starch processing. Additionally, the microbial enzymes are preferred by the manufacturers due to their active and stable nature as compared to enzymes from plants and animals.

The liquid form is projected to account for a larger share in the technical enzymes market during the forecast period.

The liquid form of enzymes is widely used in the biofuel and textile & leather industries, due to better blending properties with the resources used for the production of biofuels. In biofuel, the liquid enzymes augment the supply of liquid fuel; whereas, in textiles, it offers the potential to completely replace the use of other chemicals in textile preparation processes. The enzymatic degreasing process replaces the solvent-based process followed by the leather manufacturers. Since the liquid enzymes interfere less with the skin structure, the enzymatic process also results in a product with improved quality. Due to these factors, the liquid form is projected to dominate the market during the forecast period.

North America is projected to account for the largest share in the technical enzymes market during the forecast period.

The North American market is projected to account for the largest share by 2025, due to various benefits of technical enzymes, as they are an environment-friendly and cost-effective alternative to replace the conventional alkaline or conventional acidic catalysts. Technological advancements have made technical enzymes available for a wide range of applications in biofuel, paper & pulp, textile & leather, starch processing, and other industries, which is estimated to drive the growth in the region. The North American region is estimated to be the largest market for technical enzymes, globally, owing to the development of novel and superior performing products, developed technologies, and global industrialization.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=72989187

Key vendors in the global technical enzymes market include BASF (Germany), DuPont (US), Associated British Foods (UK), Novozymes (Denmark), DSM (Netherlands), Dyadic International (US), Advanced Enzymes Technologies (India), Maps Enzymes (India), Epygen Labs (India), Megazyme (Ireland), Aumgene Biosciences (India), Enzymatic Deinking Technologies (US), Tex Biosciences (India), Denykem (UK), MetGen (Finland), and Creative Enzymes (US). These players have a broad industry coverage and high operational and financial strength.

Key questions addressed by the report:

- Who are the major market players in the technical enzymes market?

- What are the regional growth trends and the largest revenue-generating regions for the technical enzymes market?

- What are the key regions and industries that are projected to witness significant growth in the technical enzymes market?

- What are the major industries of technical enzymes that are projected to account for a major revenue share during the forecast period?

- In which major forms are technical enzymes majorly used, and which form is projected to dominate during the forecast period?

- What are the major sources of technical enzymes that are projected to account for a major revenue share during the forecast period?