The report “Starter Feed Market by Type (Medicated and Non-medicated), Ingredient (Wheat, Corn, Soybean, Oats, and Barley), Livestock (Ruminants, Swine, Poultry, Aquatic, and Equine), Form (Pellets and Crumbles), and Region – Global Forecast Up to 2022″, The global market for starter feed was valued at USD 21.45 Billion in 2015; this is projected to grow at a CAGR of 4.57% from 2016, to reach USD 29.15 Billion by 2022. The market is driven by factors such as the need to increase livestock production to cater to the growing demand for animal sourced products, and adoption of precision nutrition techniques.

Wednesday, April 14, 2021

Sustainable Growth Opportunities in the Starter Feed Market

Upcoming Growth Trends in the Food grade Alcohol Market

The report "Food-grade Alcohol Market by Type (Ethanol, Polyols), Application (Food, Beverages, Healthcare & Pharmaceuticals), Source (Sugarcane & Molasses, Grains, Fruits), Functionality, and Region - Global Forecast to 2022", The food-grade alcohol market is projected to reach USD 12.86 Billion by 2022, at a CAGR of 3.9% from 2017 to 2022. The market is driven increasing global beer production and popularity of craft beer. Also, the increasing consumption of alcoholic beverages in the developing regions supported with the expansion of potential export markets due to demographic and economic reasons, have developed a growing platform for increased alcohol trade which is in turn driving the food-grade alcohol market.

Tuesday, April 13, 2021

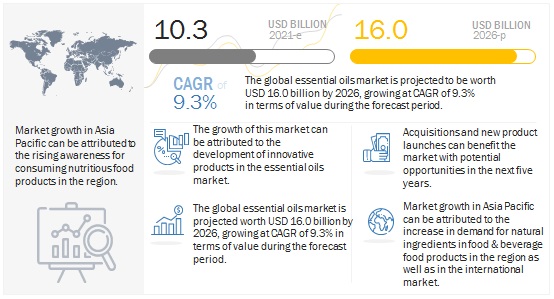

Essential Oils Market: Growth Opportunities and Recent Developments

- To define, segment, and estimate the size of the essential oil market with respect to its type, application, method of extraction, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, joint ventures, in the essential oils market

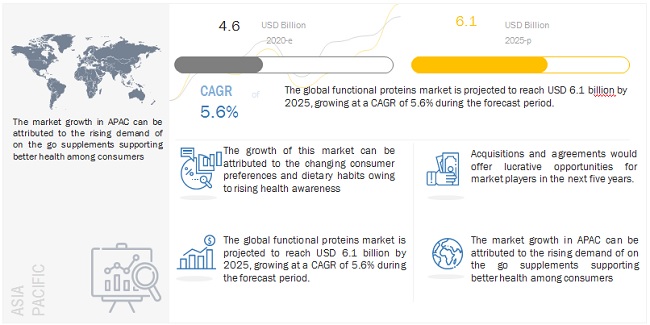

Functional Proteins Market to Witness Unprecedented Growth in Coming Years

- Determining and projecting the size of the functional proteins market, with respect to type, application, form, source, and regional markets, over a five-year period, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the region

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the functional proteins market

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

- December 2020, Cargill expanded its European ingredient portfolio with the addition of pea protein. This product launch enabled Cargill to get access to the pea protein market.

- November 2020, Ingredion acquired Verdient Foods (Vanscoy, SK) with 100% ownership. The acquisition enabled net sales growth and expanded the manufacturing capability of Ingredion, with the addition of two manufacturing facilities in Canada.

- September 2020, ADM expanded their protein portfolio with textured wheat and pea proteins. These high-functionality proteins improve the meat-like texture of alternative meats. This new launch ensured ADM’s leadership in the plant protein market.

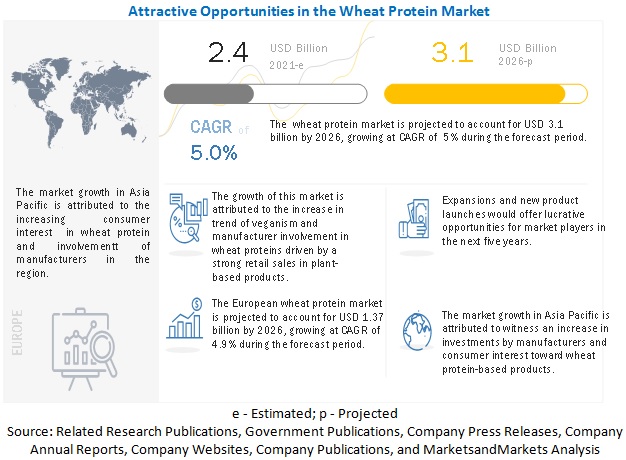

Wheat Protein Market to Record Steady Growth by 2026

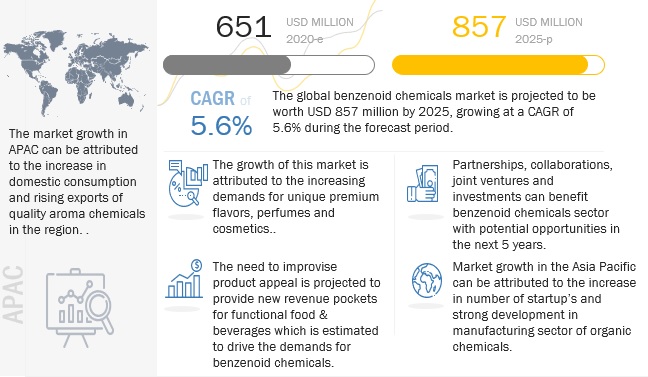

Benzenoid Market Projected to Garner Significant Revenues by 2025

- To describe and forecast the benzenoid chemicals market, in terms of type, application, and region

- To describe and forecast the benzenoid chemicals market, in terms of value and volume, by region-Asia Pacific, Europe, North America, South America and Middle East & Africa-along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of benzenoid chemicals market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the benzenoid chemicals market

Monday, April 12, 2021

Food Encapsulation Market to Record Steady Growth by 2025

The global food encapsulation market is estimated to account for USD 9.9 billion in 2020 and is projected to reach USD 14.1 billion by 2025, recording a CAGR of 7.5% during the forecast period. The market is primarily driven by the increasing use of encapsulated flavors in the food and beverage industry and the rising adoption of microencapsulation for functional ingredients.

- In July 2019, DSM (Netherlands) entered into a joint venture with Evonik (Germany) to produce encapsulated omega-3 fatty acids, reducing the pressure on fish stocks, and supporting the aquaculture industry.

- In May 2017, Lycored (Israel) entered into a joint venture with a biotechnology company, Algatechnologies (Israel), to distribute Algatech's AstaPure in the form of beadlets, which will help in increasing the brand's commercial reach for this product range in the North American market.

- In January 2017, DSM (Netherlands) launched a new product, MEG-3, with new encapsulation technology.