Tuesday, September 28, 2021

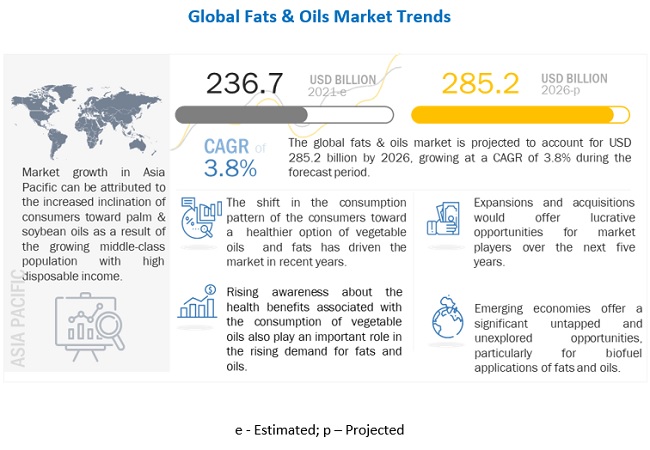

Fats & Oils Market Growth by Emerging Trends, Analysis, & Forecast to 2026

Monday, September 27, 2021

Brewing Ingredients Market Projected to Garner Significant Revenues by 2026

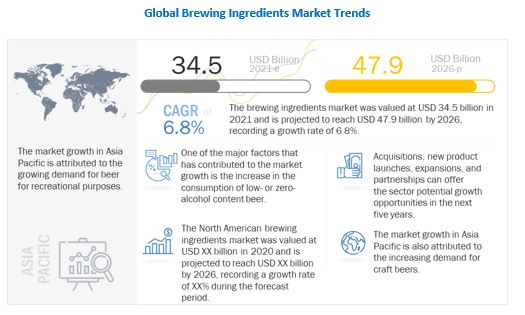

The report "Brewing Ingredients Market by Source (Malt

Extract, Adjuncts/Grains, Hops, Beer Yeast, and Beer Additives), Brewery Size

(Macro Brewery and Craft Brewery), Form (Dry and Liquid), and Region - Global

Forecast to 2026" The brewing ingredients market was

valued at USD 34.5 billion in 2021 and is projected to grow at a CAGR of 6.8%,

to reach USD 47.9 billion by 2026. The rise in global population and increasing

disposable income in developing economies are creating new avenues for

alcoholic beverages.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

The brewing ingredients market includes five major

sources: malt extract, adjuncts/grains, hops, beer yeast, and beer additives.

Malt extract is further bifurcated into standard malt and specialty malt.

Specialty malt is sub-segmented into crystal, roasted, dark, and others.

Different types of beers are obtained by using different sources of brewing

ingredients. For instance, roasted malt is used for producing the porter type

of beer. The malt extract segment dominated the global market for brewing

ingredients and accounted for a larger share in 2020. Beer additives accounted

for the second-largest market share in terms of revenue in 2020.

By source, the malt extract is expected to hold the largest

share in the market, during the forecast period

Types of malt extracts differ depending on the grains that

are used when making them. The production of malt extracts begins by grinding

malt, followed by mashing under controlled conditions to produce various

degrees of starch breakdown and resultant fermentability. This involves

carefully controlling the pH and using multiple temperature steps during mashing.

In the next step, the wort is separated from the spent grains in lauter tuns or

mash filters. Both these methods produce high-quality worts and can be set up

for high throughput, with as many as 10–14 brews per day. The further steps

include boiling, trub removal, vacuum evaporation, and spray drying.

The macro brewery as a brewery size is expected to hold one of

the largest shares in the brewing ingredients market, in terms of value, in

2021

On the basis of brewery size, the market is classified

into macro brewery and craft brewery. Macro or large breweries are defined as

breweries with annual beer production of ≥ 6 million barrels. The most popular

macro breweries include Anheuser-Busch InBev (Belgium), Heineken N.V.

(Netherlands), China Resources Snow Breweries Limited (China), and Carlsberg

Group (Denmark). These breweries generally operate on a global scale, shipping

their products to customers across the world. Anheuser-Busch owns the biggest

brewery in the world. Large breweries usually have a large staff as well. These

breweries employ staff to handle the brewing process, administrative staff,

logistics of distribution, teams for marketing and finance, and every role

imaginable required for a business to operate. Craft beers are perceived as

healthier beers as they may offer help in lowering the rate of cardiovascular

disease, improved bone density due to the presence of bone-developing elements

such as silicon, lower the risk of joint issues such as arthritis, and

increased high-density lipoprotein (HDL) levels which help lower cholesterol,

and lower the instances of diabetes.

By form, the dry form will drive the demand for brewing

ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and

liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the

same way as liquid malt extract, except it goes through an additional

dehydration step, which reduces the water content down to about 2%. Because of

the lower water content, DME tends to have a better shelf life without the

darkening issues of light malt extract. It offers more fermentable extract by

weight. Thus, less of it is required to achieve the target gravity. Moreover,

as a powder, DME is easier to measure in precise increments. With a digital

scale, it can be measured out in fractions of an ounce. This makes DME a great

choice for priming, supplementing beer recipes, and for making gravity

adjustments.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share,

in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented

into North America, Europe, Asia Pacific, South America, and Rest of World

(RoW). Due to the increase in population and rise in disposable income, Asia

Pacific is projected to account for the largest share during the review period.

The drinking preferences of the population in this region are gradually

shifting toward alcoholic culture. The large, increasing population and the

growing market mean that the demand for brewing ingredients is still promising.

Another factor is the densely populated areas that are not completely tapped by

beer manufacturing and brewing ingredient companies. Rapid industrialization

and urbanization, increase in environmental concerns, rise in disposable income

of growing middle class, and rising demand for craft beers are factors

consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.

Growth Strategies Adopted by Major Players in Biofertilizers Market

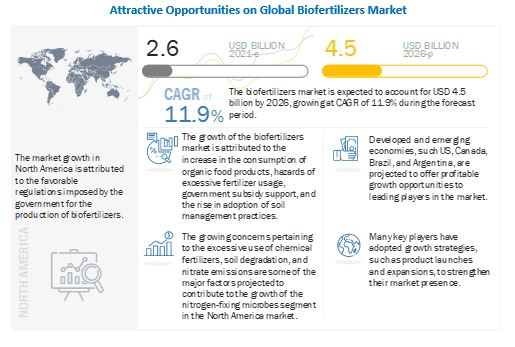

The report "Biofertilizers Market by Form (Liquid,

Carrier-Based), Mode of Application (Soil Treatment, Seed Treatment), Type

(Nitrogen-fixing, Phosphate solubilizing & Mobilizing, Potash Solubilizing

& Mobilizing), Crop Type, and Region - Global Forecast to 2026"

The global biofertilizers market size is estimated to be valued at USD 2.6

billion in 2021 and is expected to reach a value of USD 4.5 billion by 2026,

growing at a CAGR of 11.9% in terms of value during the forecast period.

Factors such as growth in consumer preference for organic food products,

adoption of soil fertility management practices, serious concerns regarding the

control of nitrate emissions and eutrophication in the aquatic environment, and

government promotions for the use of organic fertilizers are some of the factors

driving the growth of the biofertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=856

Liquid, by form, is estimated to hold the largest market share

during the forecast period

The market for biofertilizers, by form, has been segmented

into liquid biofertilizers and carrier-based biofertilizers. Liquid

biofertilizers account for the largest market during the forecast period owing

to the large pool of products available in the market. Liquid biofertilizer

technology is considered an alternative solution to the conventional form of

carrier-based biofertilizers. Liquid biofertilizers are specially formulated

and contain not only the desired microorganisms and their nutrients, but also

substances that can support the stability of the storage conditions of resting

spores and cysts for longer shelf-life. Liquid fertilizers have better

tolerance limits for adverse conditions. The quality control protocols for

liquid biofertilizers are easy and expeditious compared to carrier-based

biofertilizers.

Pulses & oilseeds, by crop type, is projected to grow at the

second-highest CAGR in the biofertilizers market during the forecast period

The pulses & oilseeds segment is projected to grow at

the second-fastest rate during the forecast period. Oilseeds such as soybean

are also used as animal feed in the form of cakes as well as in the production

of biodiesel and other renewable chemicals. Inoculation with Rhizobium is often

recommended to augment nitrogen supply from the soil, particularly where the

crop has been introduced recently or has not been grown for several years, or

where the native Rhizobium population is inadequate and/or ineffective. Pigeon

pea is another important perennial legume crop, which often requires a

significant amount of soil nutrients for proper growth. These requirements are

easily fulfilled with the assistance of biofertilizers at an affordable price,

thus increasing the demand for biofertilizers.

Nitrogen-fixing microbes, by type, is estimated to account for

the largest market share during the forecast period

Nitrogen-fixing microbes account for the largest market size

during the forecast period. Biological nitrogen fixation provides sustainable

and environment-friendly agricultural production. The value of nitrogen-fixing

biofertilizers in improving and enabling a higher yield of legumes and other

crops can be realized through the application of biofertilizers. They are

mainly used in legumes, pulses, black grams, groundnuts, and soybeans. Among

all the microorganisms, rhizobium is majorly used due to its efficiency in

nitrogen fixation as well as popularity. Rhizobium is a symbiotic,

nitrogen-fixing bacterium, which integrates atmospheric nitrogen and fixes it

in the root nodules of crops.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=856

North America is estimated to hold the largest market share

during the forecast period

The imposition of bans on the usage of harmful chemicals

and fertilizers in the agricultural industry by governments in North American

countries has created a high growth potential for biofertilizers. In addition,

the increasing acceptance of organic foods among consumers is projected to

widen the scope of growth for leading players. The US dominated the

biofertilizers market in North America in 2020. The FDA introduced stringent

regulations pertaining to the quality standards of agricultural products, which

is projected to encourage the use of biofertilizers in the US.

This report includes a study on the marketing strategies and the product

portfolios of the major companies that operate in the biofertilizers market.

The report has leading company profiles such as Novozymes A/S (Denmark), Vegalab

SA (Switzerland), UPL Limited (India), Chr. Hansen Holding A/S (Denmark), Kiwa

Bio-Tech (China), Lallemand Inc. (US), Rizobacter Argentina S.A. (Argentina),

T. Stanes & Company Limited (India), IPL Biologicals Limited (India),

Nutramax Laboratories Inc. (US), Symborg (Spain), Kan Biosys (India), Mapleton

Agri Biotech Pty Ltd (Australia), Seipasa (Spain), AgriLife (India), Manidharma

Biotech Pvt Ltd (India), Biomax Naturals (India), Jaipur Bio Fertilizers

(India), Valent BioSciences (US), Aumgene Biosciences (India), Agrinos (US),

Criyagen (India), LKB BioFertilizer (Malaysia), Varsha Bioscience and

Technology India Pvt Ltd. (India), and Valagro (Italy).

Friday, September 24, 2021

Probiotic Ingredients Market Projected to Garner Significant Revenues by 2023

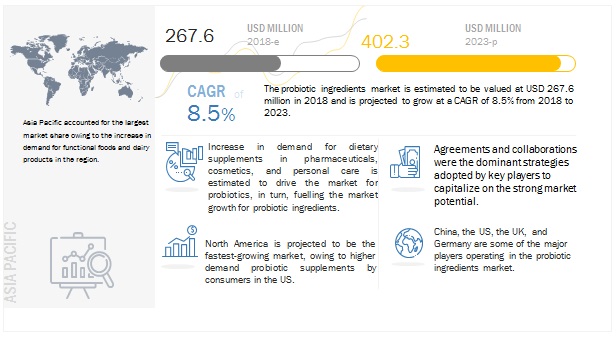

The

report "Probiotic Ingredients Market by

Application (Functional Foods & Beverages, Pharmaceuticals, and Animal

Nutrition), Source (Bacteria and Yeast), Form (Dry and Liquid), End User (Human

and Animal), and Region - Global Forecast to 2023", is estimated at USD 268 million in 2018 and is

projected to reach USD 402 million by 2023, growing at a CAGR of 8.5% during

the forecast period. The market is driven by factors such as increasing

popularity of probiotic dietary supplements and participation of government

bodies in the R&D of probiotics.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

By application, the market has

been segmented into functional food & beverages, pharmaceuticals, animal

nutrition, and others which include cosmetics & personal care products. The

pharmaceuticals segment is growing at the highest rate owing to a spike in the

number of diseases such as antibiotic-associated diarrhea, inflammatory bowel

disease, lactose intolerance, irritable bowel syndrome, vaginal infections,

rheumatoid arthritis, liver cirrhosis, and immune enhancement. The intake of

dietary supplements for overall improvement in health among consumers would

drive the growth of the segment during the forecast period.

By form, the market has been segmented into dry and liquid.

The dry form is projected to dominate the market during the forecast period

owing to lower costs in transportation when compared with liquid form. The dry

form of probiotic ingredients has a higher shelf-life, due to which it is

preferred by manufacturers and suppliers.

By end use, the probiotic ingredients market has been segmented into animal and human use. While human use accounts for a larger market share during the forecast period, the usage of probiotic strains in the animal nutrition industry is growing. Probiotic strains are used in feed to enhance the effectiveness of nutrients and show their effects on the gut by aiding in better digestion and reducing the impact of pathogenic bacteria, which causes various diseases in animals. The animals can grow better as the feed is altered in terms of quality and palatability due to its added probiotic content. The aim of probiotic strains is to take care of deficiencies of the natural microflora and provide animals with better resistance against diseases.

Speak to Analyst: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

By region, the Asia Pacific

market accounted for the largest share of the probiotic ingredients market in

2017, followed by Europe. Some factors that influence these market shares

include the high demand for functional foods and dairy products, the presence

of major players in these regions, and awareness about the benefits of using

probiotics. Top probiotic manufacturers, such as DowDuPont (US), Kerry

(Republic of Ireland), Lallemand (US), and Chr. Hansen (Denmark) together

account for more than one-third of the total market share. These companies have

a strong presence in Europe and the Asia Pacific and have manufacturing facilities

across these regions along with strong distribution networks.

The competitive landscape for the probiotic ingredients is fragmented, with many big and small players concentrated in the European market. The focus is on the human use products due to which the competition is higher to provide for the functional food and pharmaceutical industries where the demand is high. Significant growth is being witnessed in new players trying to penetrate the probiotic ingredients market to cater to the animal feed industry.

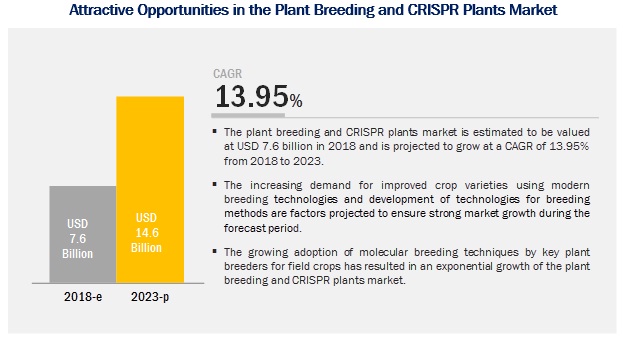

Upcoming Growth Trends in the Plant Breeding and CRISPR Plants Market

Thursday, September 23, 2021

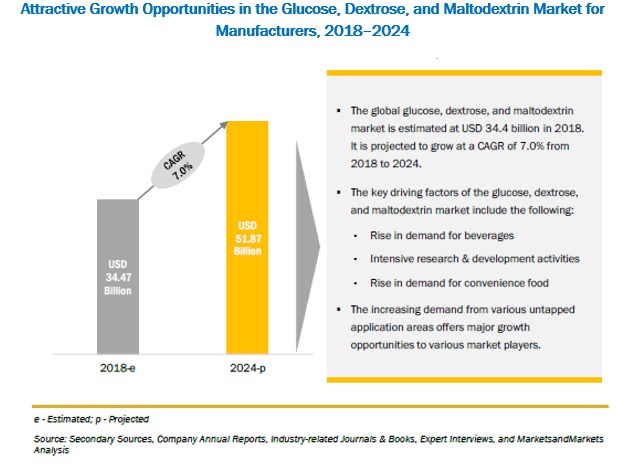

Glucose, Dextrose, and Maltodextrin Market Will Hit Big Revenues In Future

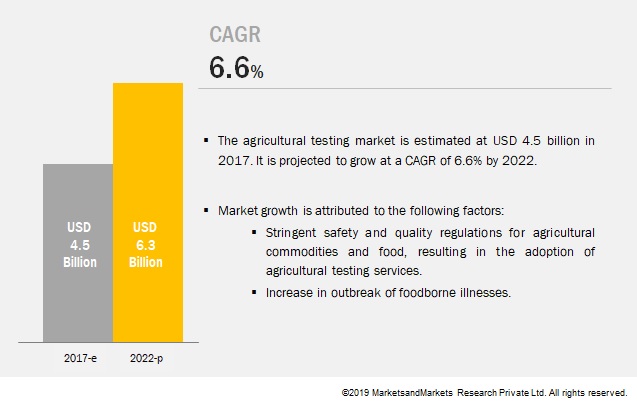

Latest Regulatory Trends Impacting the Agricultural Testing Market

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=203945812