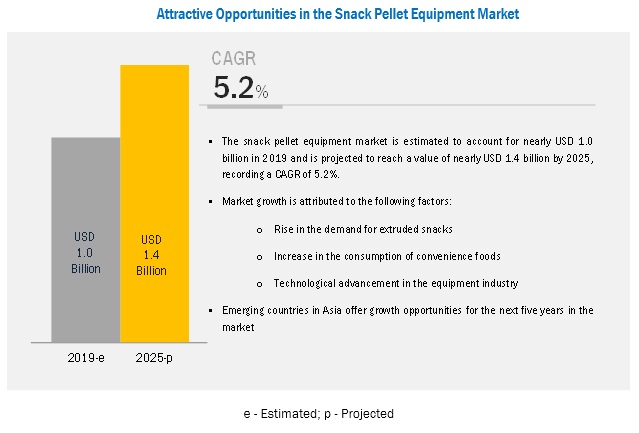

The snack pellet equipment market is estimated to account for nearly USD 1.0 billion in 2019 and is projected to reach a value of nearly USD 1.4 billion by 2025, recording a CAGR of 5.2%. The snack pellet segment is driven by the increasing need for convenience foods due to the busy lifestyles of consumers. Thus, the increasing consumer preference for processed foods contributes to the growing demand for snack pellets as they require less time and efforts to prepare. This, in turn, has contributed to the growth of the snack pellet equipment market. Easy availability is also one such factor, which significantly impacts the consumption and demand for snack pellets.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136666490

By product type, the potato-based segment is estimated to account for the largest share in the snack pellet equipment market in 2019.

On the basis of product type, the potato-based segment is estimated to dominate the snack pellet equipment market in 2019. This is due to the increasing consumer preference for convenience foods, which indirectly drives the increasing demand for snack pellets products, as they require less time and efforts. Currently, snack pellet manufacturers are focusing on adopting advanced technologies and offering GM potatoes to drive the demand for potato pellets. GM potatoes are protein-packed potatoes with approximately 35%–60% protein content, which makes it more preferable. This, in turn, is projected to drive the growth of the snack pellet equipment market.

The snack pellet equipment market is projected to witness strong growth due to the increasing advancements in equipment and technologies.

Earlier, snack pellet manufacturers used different extruders for making pellets based on various raw materials that have different characteristics and cooking time. However, with the upgradation and automation, snack pellet manufacturers are adopting extrusion systems that produce three-dimensional pellets, thus providing better end products to its customers. Moreover, advanced manufacturing processes enhanced the bulk production capacity and shelf life of pellets, prior to frying or puffing. In addition, these improvements in the manufacturing process offer advantages such as innovative designs and capital cost reduction, which is projected to contribute to the market growth.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=136666490

North America is estimated to dominate the snack pellet equipment market in 2019.

North America is estimated to account for the largest market share in the snack pellet equipment market in 2019. The North American region witnesses the presence of various established snack pellet manufacturing companies that are increasing their production capacity due to the rising demand for ready-to-eat snacks. This is projected to create an opportunity for manufacturers in the snack pellet equipment market to expand in North America. Busy lifestyles of consumers reduce the time available for homemade snacks; this increases the demand for convenience foods. In addition, increasing health consciousness and concerns for food safety have encouraged the production of light and convenient snack foods such as snack pellets. These factors are projected to drive the snack pellet equipment market during the forecast period.

This report includes a study of marketing and development strategies along with the product portfolios of the leading companies in the snack pellet equipment market. It also includes the profiles of leading companies such as Clextral (France), GEA Group (Germany), Buhler AG (Switzerland), N.P. & Company, Inc. (Japan), Kiremko B.V. (Netherlands), JAS Enterprises (India), Grace Food Processing & Packaging Machinery (India), Tsung Hsing Food Machinery Co., Ltd. (Taiwan), AC Horn Manufacturing (US), Jinan Dayi Extrusion Machinery Co., Ltd (China), Mutchall Engineering Pvt. Ltd (India), and Radhe Equipments India (India).