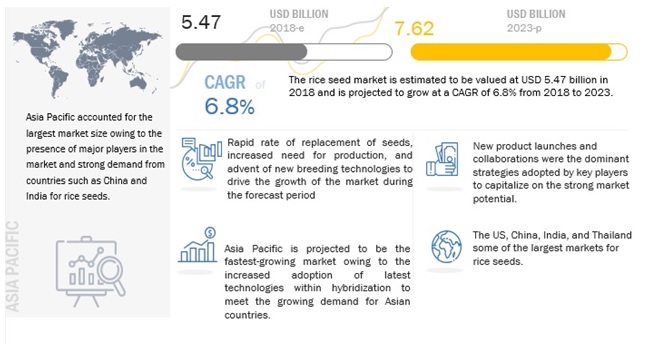

The report "Rice Seeds Market by Type (Hybrid and Open-Pollinated Varieties), Grain Size (Long, Medium, and Short), Hybridization Technique (Two-Line and Three-Line), Treatment (Treated and Untreated Seeds), and Region - Global Forecast to 2023", The rice seeds market is projected to reach USD 7.62 billion by 2023, from USD 5.47 billion in 2018, at a CAGR of 6.85% during the forecast period. The market is driven by factors such as the increasing technological advances in rice breeding, declining prices of hybrid rice seeds, growing adoption of hybrid rice seeds in the developed and developing countries, and rising seed replacement rate for paddy across Asian countries.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=129962473

According to the International Seed Federation (ISF), rice accounted for nearly 5% of the global commercial seeds market in 2014. The major seed manufacturing companies have been expanding their product portfolio in Asian countries. Strong support from the government in terms of subsidies for hybrid seeds has encouraged farmers to adopt this technology in developing countries as well. The decline in prices of hybrid seeds, to bridge the difference between hybrids and OPV seeds, has also encouraged key players to invest in the market.

Open-pollinated varieties were estimated to dominate the rice seeds market in 2018. Increasing adoption of hybrid seeds and increasing seed replacement rate across the countries of Asia Pacific, particularly in India, Thailand, China, and Vietnam is projected to impact the market growth; however, due to the high prices of hybrid seeds, its adoption has been limited to these developing countries. According to industry experts, even though the consumption of hybrid seeds has been exponentially increasing, particularly in China and India, and hybrid seeds have been increasingly preferred by farmers, the market is dominated by open-pollinated varieties owing to the high price of the hybrids.

The advent of genetically modified rice seeds was projected to boost the rice seed market, after the success of Bt cotton. Most of the key players have also invested in the development and support of GM rice projects. The Golden Rice Project supported by Syngenta and the development of GM rice seeds by Mahyco was scheduled to be commercialized in the past few years. However, the stringent regulations against GM technology for edible crops have hindered the commercialization of this technology, and multiple projects got shelved due to the regulatory policies.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=129962473

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=129962473

Asia Pacific accounted for the largest share in the rice seeds market in 2017, followed by North America due to the high adoption of commercial open-pollinated varieties and hybrid rice seeds over farm-saved seeds to increase rice yield in countries such as China, India, Thailand, and the US. Development of improved hybrid seeds and the subsidy benefits provided by the government to encourage the adoption of hybrid seeds over farm-saved or OPV seeds have contributed to the growth of this market. The major factors restraining the adoption of hybrid seeds are their high cost as compared to OPV seeds and the lack of awareness about the advantages of hybrids on crop yield and profit margins. Also, the lack of skilled professionals and infrastructural facilities in the developing countries for hybridization techniques is projected to hinder the growth potential of this market.

The global market for rice seeds is dominated by key players such as Bayer (Germany), DowDuPont (US), Syngenta (Switzerland), Advanta Seeds (UPL) (India), and Nuziveedu Seeds (India). Some of the emerging players in the rice seed market include Mahyco (India), BASF (Germany), Kaveri Seeds (India), SL Agritech (Philippines), Rasi seeds (India), Rallis (India), JK Seeds (India), Hefei Fengle (China), LongPing (China), Guard Agri (Pakistan), and National Seeds Corporation (India).