https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=144665518

Monday, October 25, 2021

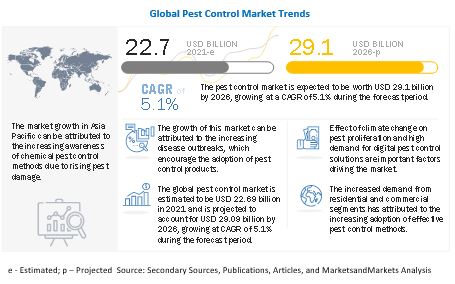

Pest Control Market Growth Opportunities by 2026

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=144665518

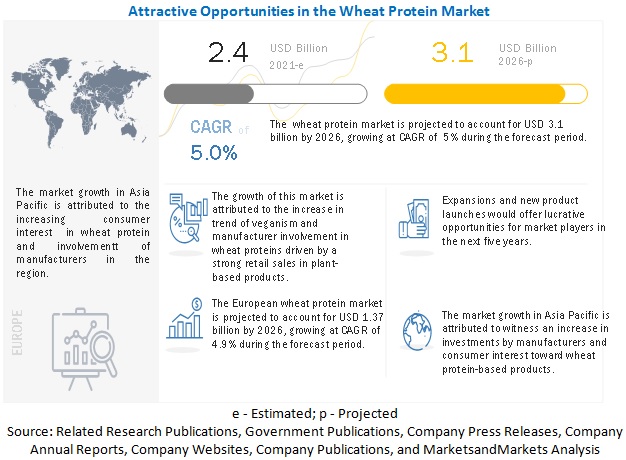

Sustainable Growth Opportunities in the Wheat Protein Market

Friday, October 22, 2021

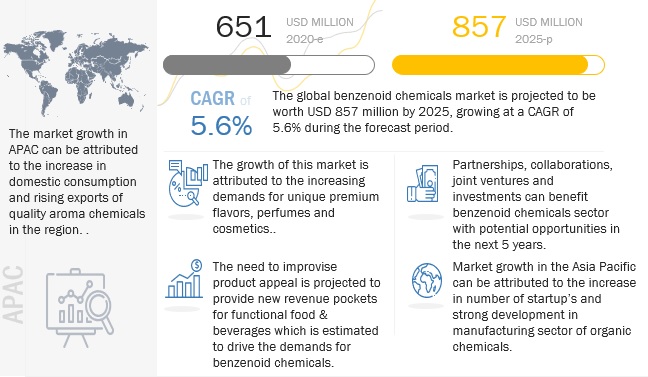

Benzenoid Market to See Major Growth by 2025

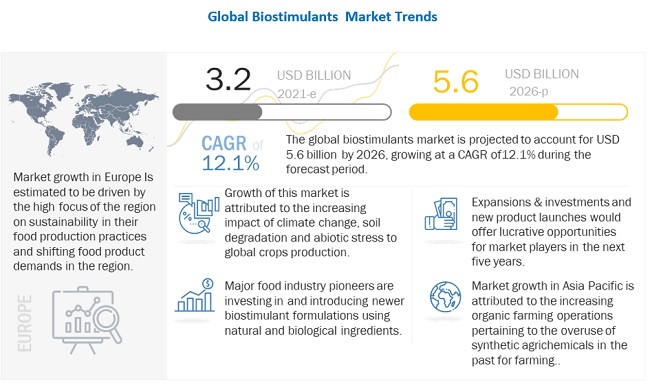

Biostimulants Market Growth by Emerging Trends, Analysis, & Forecast to 2026

Thursday, October 21, 2021

Flavor Systems Market: Growth Opportunities and Recent Developments

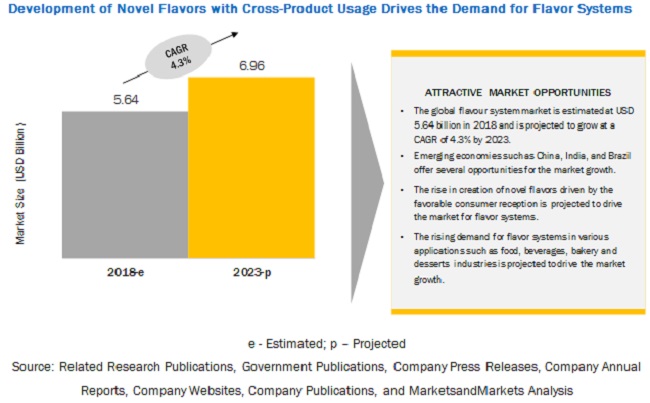

The report "Flavor Systems Market by Type (Brown, Dairy, Herbs & Botanicals, Fruits & Vegetables), Application (Beverages, Savories & Snacks, Bakery & Confectionery Products, Dairy & Frozen Desserts), Source, Form, and Region - Global Forecast to 2023", is estimated to be valued at USD 5.64 billion in 2018 and is projected to reach a value of USD 6.96 billion by 2023, growing at a CAGR of 4.3% during the forecast period. Factors such as the Creation of novel flavors driven by favorable consumer reception and cross product usage of flavors are driving the growth of this market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=237716072

The brown segment by type, is

estimated to account for a larger market share, in 2018

The brown segment dominated the

market for flavor systems. This is attributed to the fact that brown flavors

are the most commonly used flavor variant and used across a number of

applications. There has been an increase in the number of areas such as

beverages, and dairy, in which brown finds applications. Due to these factors,

the market is projected to witness significant growth.

The nature-identical segment by

source is estimated to be the fastest growing segment in the flavor systems

market, during the forecast period

They are chemically identical to

substances that are naturally present in materials of plant and animal origins.

Although nature-identical substances are formulated in a laboratory, the human

body cannot distinguish between natural and nature-identical substances.

Therefore, nature-identical flavoring substances, having molecular structures

that mimic the chemical structures of natural ingredients, enjoy a higher

preference among consumers, especially because these substances have no

artificial flavoring. Thus, this segment is projected to witness fastest growth

in coming years.

The beverages segment, by

application, is estimated to account for the largest market share, by value, in

2018

The market for beverages held the

largest share in 2017 in the flavor systems market and is also projected to be

the fastest-growing segment during the forecast period. The use of various

types of flavors in this application is largely attributed to the introduction

and combination of different flavors to create an elegant and aromatic taste.

The liquid segment, by form, is

estimated to account for the largest market share, in 2018 and is projected to

be the fastest growing segment during the forecast period

Liquid form of flavoring systems is

made available in oil as well as water-based textures. A common form of using

liquid flavor systems is via flavor microemulsions. Flavor microemulsions which

find its usage in clear beverages and other consumer products, are defined as a

clear, thermodynamically stable dispersion of two immiscible

liquids—oil-in-water or water-in-oil. Flavor enhancers can easily be mixed in

various application and therefor has higher demand.

Mass customization of flavor systems

has created opportunities for manufacturers

Mass customization majorly refers to

the entire process of providing a wide variety of goods or services that are

then modified and customized to suit major consumer group requirements. Mass

customization is mostly used as a marketing and manufacturing technique wherein

the products offered ensure a certain level of flexibility and personalization.

This technique also ensures manufacturers with low unit costs, thereby

improving operational efficiencies. The technique of mass customization has

gained a high degree of traction in recent times due to consumers being

increasingly inclined toward highly customized options. While consumers earlier

focused on efficient and reasonable products, they are willing a slightly

premium price for customized or quality products today. Owing to such factors,

opportunities pertaining to customized solutions have started to gain pace and

significance in the market.

Request for

Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=237716072

Europe is projected to grow at the

highest CAGR of 5.0% during the forecast period

In Europe, growing consumption of

bakery & confectionery products and savories & snack products, and the

demand for their product variety has resulted in intensifying demand for flavor

systems in these food products. Moreover, several innovations in food &

beverages industry happening in this region that also accommodate flavor

systems have been driving the growth of flavor systems market in this region.

This report includes a study on the

marketing and development strategies, along with a study on the product

portfolios of the leading companies operating in the flavor systems market.

Givaudan (Switzerland), International Flavors & Fragrances (IFF) (US),

Firmenich (Switzerland), Symrise (Germany), and Mane SA (France) are the

leading players in the flavor systems market. Some of the other players in the

flavor systems market include Frutarom (Israel), Sensient (US), Takasago

(Japan), Robertet (France), Tate & Lyle (France), T. Hasegawa (Japan),

Kerry Group (Ireland).

Sustainable Growth Opportunities in the Rice Seeds Market

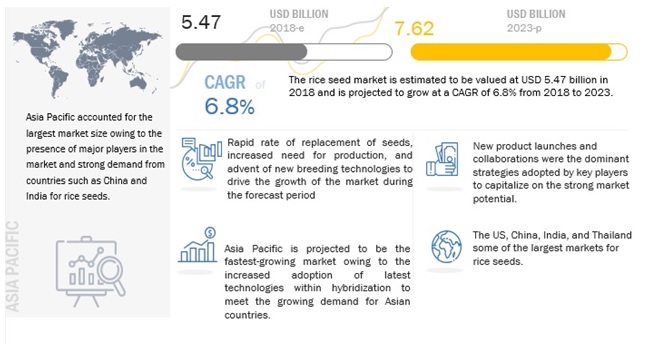

The report "Rice Seeds Market by Type (Hybrid and

Open-Pollinated Varieties), Grain Size (Long, Medium, and Short), Hybridization

Technique (Two-Line and Three-Line), Treatment (Treated and Untreated Seeds),

and Region - Global Forecast to 2023", The rice seeds

market is projected to reach USD 7.62 billion by 2023, from USD 5.47 billion in

2018, at a CAGR of 6.85% during the forecast period. The market is driven by

factors such as the increasing technological advances in rice breeding,

declining prices of hybrid rice seeds, growing adoption of hybrid rice seeds in

the developed and developing countries, and rising seed replacement rate for

paddy across Asian countries.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=129962473

Long-grain rice seeds are

estimated to be the most widely used variety of rice seeds in 2018.

Long grain rice is cultivated at a high rate across

different countries due to the changing consumer demand and limited application

of short grain rice in the food industry. The production of long rice has been

growing across the globe, particularly in the US and Asian countries. Basmati and

jasmine are some of the long grain rice varieties that are exported from Asia

in large quantities and have industrial importance from the perspective of rice

millers in terms of price value. In addition, hybrids and OPV seeds offered by

key players such as Bayer and DowDuPont are mainly for long rice grains,

followed by medium-sized rice and short rice.

The treated segment is projected to witness the fastest growth

during the forecast period.

Seed treatment has been gaining importance for field

crops, such as corn, wheat, and soybean, to reduce crop loss from early pest

attacks. However, the adoption of this technology for rice is still gradual

across countries. Rice is mainly cultivated in the Asian countries. However,

farmers are reluctant toward investing capital on crop inputs and prefer

adopting the traditional techniques of crop protection. Due to the rising need

for sustainable agriculture and integrated pest management guidelines laid by

governments in the Asian countries has encouraged farmers to adopt seed coating

technologies. On the account of these factors, this segment is projected to

grow at the highest rate during the forecast period.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=129962473

Asia Pacific is estimated

to dominate the market in 2018 and is projected to be the fastest-growing

market for rice seeds through 2023.

Asia Pacific is a major consumer and producer of rice

across the globe, and inadequate arable land in this region has encouraged

farmers for better yield from their cultivation. Adoption of advanced

technologies such as hybrid and certified seeds is also increasing in this

region. According to the recent data of USDA published in 2016, India and China

are the two major producers and consumers of rice, not only in the Asia Pacific

region but across the globe. The Asia Pacific market for rice seeds is

consolidated with two players occupying the largest share, followed by other

players. Since rice cultivation in other regions of the world is comparatively

low, the growth of the Asia Pacific market is projected to remain steady during

the forecast period.

This report includes a study of the development strategies, along with the product portfolios of leading companies. It also includes the profiles of leading companies such as Bayer (Germany), DowDuPont (US), Syngenta (Switzerland), Advanta Seeds (UPL) (India), and Nuziveedu Seeds (India), Mahyco (India), BASF (Germany), Kaveri Seeds (India), SL Agritech (Philippines), Rasi seeds (India), Rallis (India), JK Seeds (India), Hefei Fengle (China), LongPing (China), Guard Agri (Pakistan), and National Seeds Corporation (India).