https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

Thursday, March 31, 2022

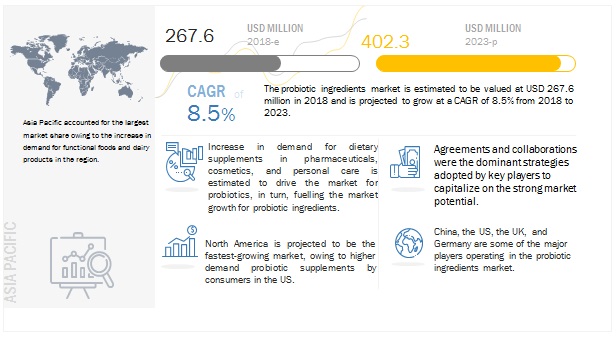

Sustainable Growth Opportunities in the Probiotic Ingredients Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238635114

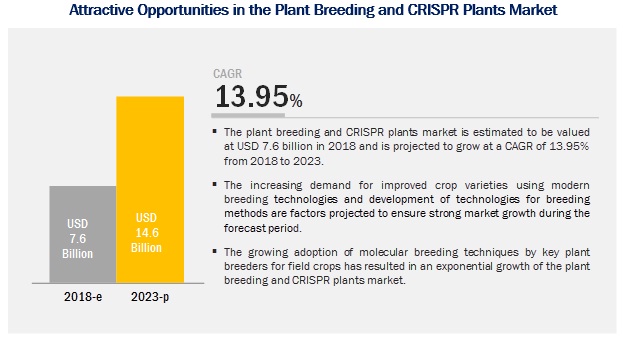

Sustainable Growth Opportunities in the Plant Breeding and CRISPR Plants Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=256910775

Wednesday, March 30, 2022

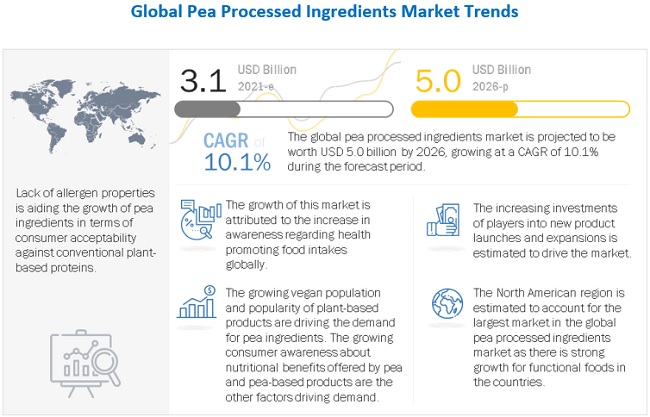

Upcoming Growth Trends in the Pea Processed Ingredients Market

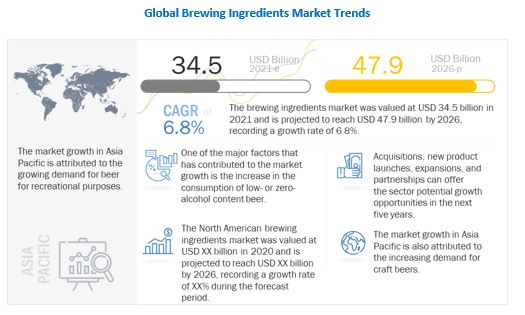

Sustainable Growth Opportunities in the Brewing Ingredients Market

Tuesday, March 29, 2022

Rodenticides Market: Growth Opportunities and Recent Developments

The report "Rodenticides Market by Type (Non-anticoagulants, Anticoagulants (FGAR, SGAR)), End use (Agricultural fields, Warehouses, Residential, Commercial), Mode of application (Pellet, Spray, and Powder), Rodent type, and Region - Global Forecast to 2026", The global rodenticides market size is estimated to be valued at USD 4.9 billion in 2020 and is expected to reach a value of USD 6.6 billion by 2026, growing at a CAGR of 5.0% during the forecast period. Factors such as the displacement of rodents due to urbanization and increase in rodent population due to climatic change such as global warming drive the growth of the market.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=189089498

The rodenticides market includes major product manufacturers and service providers like Syngenta AG, Bayer AG, BASF SE, UPL Ltd, Rentokil Initial plc, Ecolab Inc and Rollins Inc. These companies have their manufacturing and service facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses up to some extent. Though this pandemic situation has impacted their businesses, there is no significant impact on the global operations and supply chain of rodenticides. Multiple manufacturing facilities of players are still in operation. The service providers are providing rodent control services by following safety and sanitation measures.

Anticoagulant, by type, is estimated to grow at the highest rate during the forecast period

Anticoagulant rodenticides are widely used for controlling commensal rodents, which are primarily Norway rats, ship rats, and house mice. Despite the consistent decrease in ecological risk assessments, the anticoagulant segment is projected to dominate the rodenticides market due to the high demand for effective rodent-control alternatives and the lack of safe alternatives.

Pellet, by mode of application, is estimated to hold the largest share in the rodenticides market, in terms of value, in 2020

Pellets offer effective control against commensal rodents and are resistant to various environmental conditions, which makes them suitable for outdoor use. With the increase in urbanization and displacement of rats in city areas, the pellets mode of application is widely used in residential buildings, as they can easily be used with baits.

Commercial, by end-use sector, estimated to account for the largest market share, by value, in 2020

A majority of the commercial places across the European and North American countries have a mandate annual rodent control service program. Hence, the market is estimated to be dominated by the commercial segment in 2020.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=189089498

Asia Pacific is projected to grow at the highest CAGR during the forecast period

The market for rodenticides is projected to grow at the highest CAGR in the Asia Pacific region owing to the increase in awareness of the effectivity of chemical rodenticides. As the world’s largest and most populous region, Asia Pacific is one of the key markets for rodenticides. Rodents are common pests present in agricultural fields. Annually, extensive volumes of agricultural produce are destroyed and contaminated by rodents. To meet the increase in demand for food products and to reduce the crop damages caused by rodents, the use of rodenticides has increased significantly in the region. Food retail, food manufacturing, pharmaceutical, hospitality, and residential sectors are projected to be major growth verticals in this market.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the rodenticides market. It consists of the profiles of leading companies such as Bayer AG (Germany), Syngenta AG (Switzerland), BASF SE (Germany), Rentokil Initial Plc (UK), Ecolab Inc (US), Rollins Inc (US), UPL Limited (India), Anticimex (Sweden), The Terminix International Company (US), Liphatech Inc (US), Neogen Corporation (US), PelGar International (UK), Bell Laboratories Inc (US), JT Eaton (US), Truly Nolen (US), Abell Pest Control (Canada), Futura Germany (Germany), SenesTech Inc (US), Bioguard Pest Solutions (US) and Impex Europa S.L (Spain).

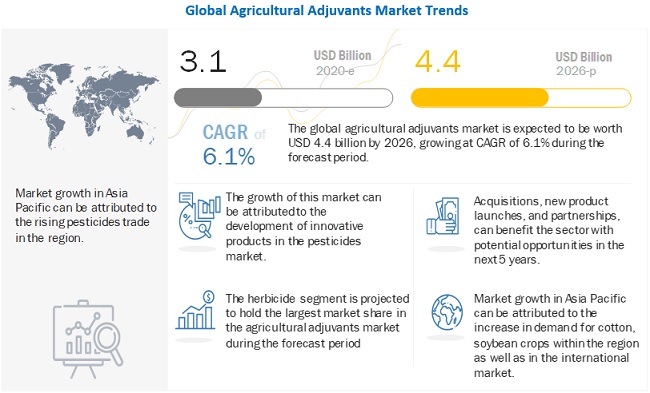

Agricultural Adjuvants Market to Record Steady Growth by 2026

Monday, March 28, 2022

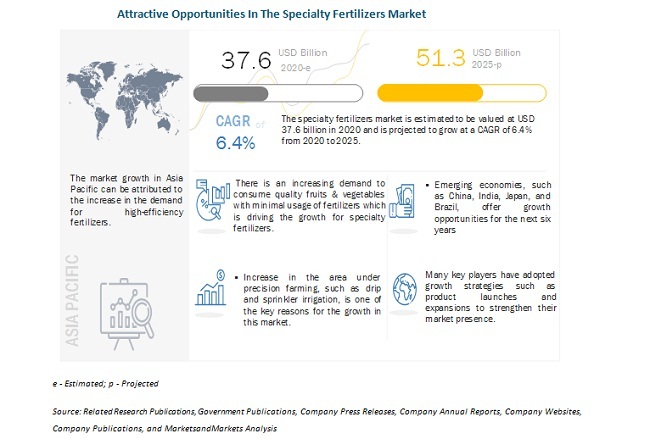

Sustainable Growth Opportunities in the Specialty Fertilizers Market

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=57479139