Tuesday, April 26, 2022

Feed Antioxidants Market to Witness Unprecedented Growth in Coming Years

Friday, April 22, 2022

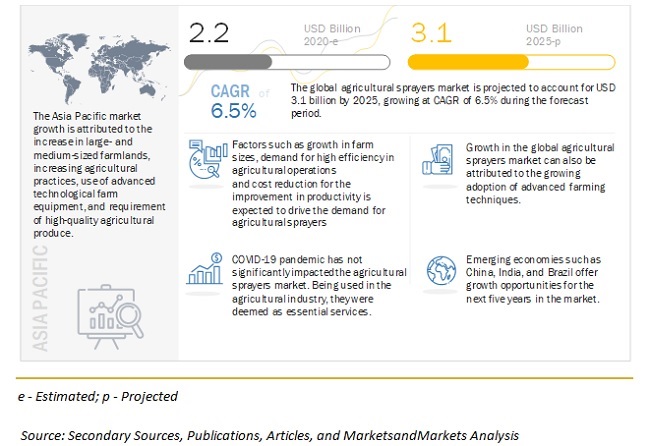

Agricultural Sprayers Market to Record Steady Growth by 2025

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

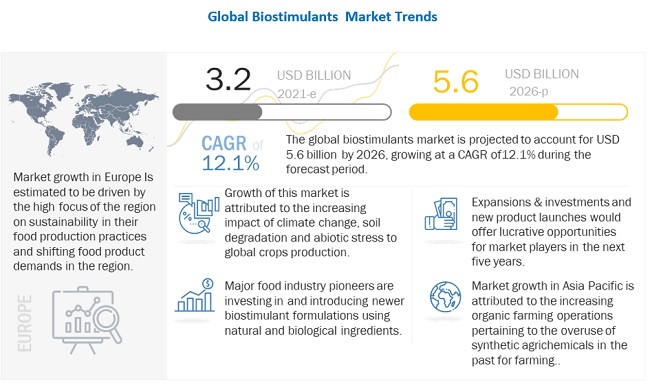

Biostimulants Market: Growth Opportunities and Recent Developments

Thursday, April 21, 2022

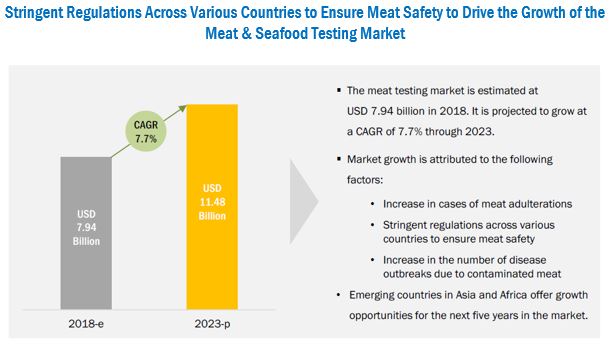

Meat Testing Market Projected to Garner Significant Revenues by 2023

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=60189057

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=60189057

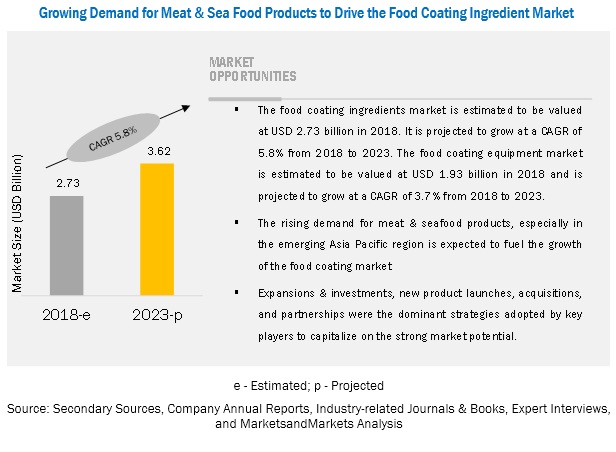

Food Coating Market Growth by Emerging Trends, Analysis, & Forecast

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=168532529

Wednesday, April 20, 2022

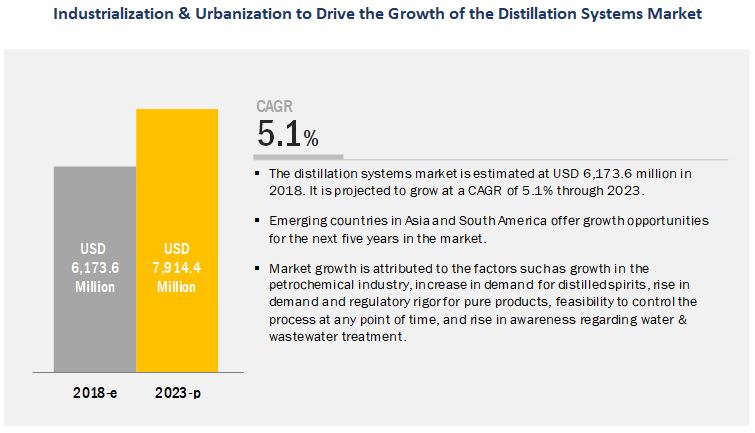

Growth Opportunities in the Distillation Systems Market

The distillation systems market was valued at USD 5.94 billion in 2017; it is projected to grow at a CAGR of 5.1%, to reach USD 7.91 billion by 2023. The basic objective of the report is to define, segment, and project the global market size for distillation systems on the basis of components, techniques, type, industry, operation, process, and region. Other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of the market trends, analyzing the macro and microeconomic indicators of this market to provide factor analysis and projecting the growth rate of the market. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=3730016

This report includes estimations of the distillation systems market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets. The key players in the market have been identified through secondary research (from sources such as press releases and paid databases, which include Factiva and Bloomberg), annual reports, and financial journals; their market shares in respective regions have also been determined through primary and secondary research. All percentage shares splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

The market, based on technique, is segmented into fractional, steam, vacuum, multiple-effect (MED), and others. The vacuum segment is projected to grow at the highest CAGR among all distillation techniques from 2018 to 2023. The technique is widely used for the separation of components, where chances of decomposition are high due to changes in temperature and pressure. Vacuum distillation is commonly used for the separation of heavy hydrocarbon residues that are left during the atmospheric distillation of crude oil.

Based on application, the market is segmented into petroleum & biorefineries, water treatment, food, beverages, pharmaceuticals, cosmetics, and chemicals. Of the various applications, the beverages segment is projected to witness the fastest growth due to the high growth of the alcoholic beverage market. Distillation is an important process used in the manufacturing of alcoholic beverages, such as wine, beer, brandy, gin, rum, whiskey, and vodka. Although the continuous distillation process used in the manufacturing of alcoholic beverages dominates the market segment, the batch distillation process is also used significantly to manufacture alcoholic beverages with various flavors and different percentage levels of alcohol.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=3730016

The Asia Pacific market has witnessed robust growth in the distillation systems market. The Asian subcontinent is an emerging market, which is growing at a rapid pace. Desalination requirements, high consumption of alcoholic beverages, and the rising potential for industrial growth highlight the positive growth prospects in the region. Countries such as China, India, South Korea, Australia, and Japan are among the key manufacturing hubs in the region. Distillation system manufacturers are mainly focusing on expanding their presence in the Asia Pacific market through new product launches and expansions to strengthen their position. The growing R&D activities by governments as well as private organizations in the region is projected to drive the market growth. Technological advancements in Asia Pacific countries due to the development of infrastructure provides a potential scope for innovation in the production of distillation systems, thereby improving their cost-effectiveness and output.

The key players that are profiled in the report include GEA (Germany), Alfa Laval (Sweden), SPX FLOW (US), Sulzer (Switzerland), Core Laboratories (Netherlands), PILODIST (Germany), Anton Paar (Austria), Praj Industries (India), L&T Hydrocarbon Engineering (India), EPIC Modular Process Systems (US), BÜFA Composite System (Germany), and Bosch Packaging Technology (Germany).

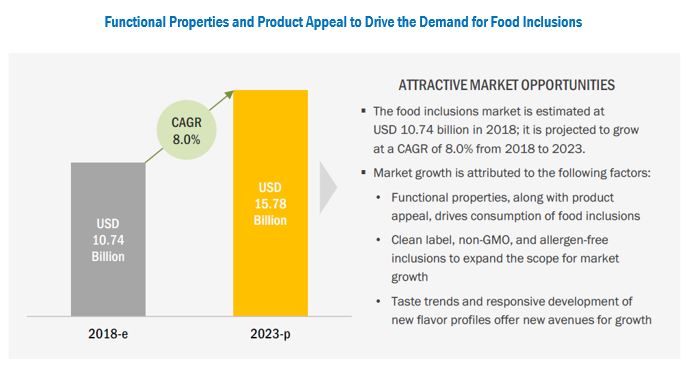

Food Inclusions Market Growth Opportunities by 2023

The food inclusions market is estimated at USD 10.74 billion in 2018. It is projected to reach USD 15.78 billion by 2023, at a CAGR of 8.0%. The growth in the market is attributed to functional properties of food inclusions along with enhanced product appeal; clean label, non-GMO, and allergen-free inclusions; and taste trends and responsive development of new flavor profiles offering new avenues for growth. The chocolate segment is projected to dominate the global market through the forecast period. The market for chocolate inclusions is largely driven by its flavor popularity and consumer inclination toward chocolate components in food products such as confectionery, ice cream, bakery, dairy, beverages, frozen desserts, and cereal products.

- R&D institutes and centers

- Raw materials suppliers to food inclusion manufacturers

- Food inclusion manufacturers

- Food inclusion distributors and traders

- Food & beverage manufacturers

- Regulatory bodies