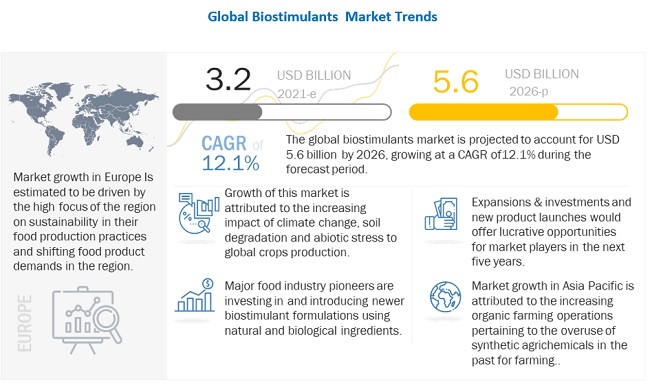

The biostimulants market is estimated at USD 3.2 billion in 2021; it is projected to grow at a CAGR of 12.1% to reach USD 5.6 billion by 2026. The market for biostimulants is projected to grow in the coming years due to the increasing consumer awareness about the sustainable agricultural practices, and demand for residue free food. With the advancement in technologies, the increasing need for sustainable agriculture, and intense research on this market, formulations for blending multiple active ingredients have been developed by major players.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1081

The biostimulants market consists of a few globally established players such as BASF SE (Germany), UPL (India), Adama (Israel), and Bayer AG (Germany). These players have adopted growth strategies such as collaborations and acquisitions to increase their presence in the global market.

BASF SE is one of the leaders operating in the chemical industry with various business segments such as chemicals, performance products, functional materials and solutions, agricultural solutions, and others. Under these broad categories, it offers products such as intermediate chemical products, monomers, petrochemicals, dispersions & pigments, care chemicals, nutrition & health, paper chemicals, performance chemicals, catalysts, construction chemicals, coatings, performance materials, and crop protection. It provides biostimulant products through its agricultural solutions unit. From 1st January 2019, the company has revised its business segments as chemicals, materials, industrial solutions, surface technologies, nutrition and care, and agricultural solutions. The company has renamed its crops protection segment as agricultural solutions after acquiring some of the significant businesses from Bayer in August 2018. BASF SE has a strong global presence with its operations through subsidiaries and joint ventures in more than 90 countries through the functioning of six integrated production sites and 355 other production sites in Europe, Asia, Australia, the Americas, and Africa.

UPL is one of the leading companies that offer total crop solutions in order to secure the food supply. Its business segments are divided into various segments such as seeds, crop protection, bio-solutions, post-harvest, aquatics, farmer engagement, and other businesses. The company has its presence in over 130 countries with 48 manufacturing plants. Acquisition is one of the major strategies of the company to achieve a market position. In February 2019, UPL announced the complete acquisition of Arysta Lifesciences that was proposed in the year 2018 to Platform Specialty Products under which Arysta was operating as a subsidiary. This acquisition helps UPL to widen its biostimulants portfolio. Arysta LifeScience Corporation is a global specialty chemicals company, primarily engaged in offering a broad spectrum of products such as insecticide, herbicide, fungicide, biostimulants, and other value-added nutrients. Arysta LifeScience deals with the development, sales, and distribution of chemical solutions for agriscience and life science markets.

Syngenta Group acquired Valagro, through its business unit Syngenta Crop Protection in October 2020. However, it is decided so that Valagro will continue to operate as an independent brand in the market within the Syngenta Crop Protection business. Valagro S.p.A is one of the leading companies in the production and marketing of biostimulants and fertilizers. The company operates with its 12 subsidiaries across the globe. Apart from its production site in Italy, it also owns two active production facilities in Norway, two in India, and one in Brazil. Valagro S.p.A offers farm products such as plant biostimulants, water-soluble nutrition, and micronutrients. The company follows the growth strategy of introducing new products and entering into agreements for enhanced R&D. The company’s strength has been to develop diverse product formulations based on different and innovative components. The product portfolio of Valagro S.p.A covers almost all the crops as well as has target-specific functions. The company operates under two business segments—farm for agriculture and industrials for the local and international industry.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=1081

The European biostimulants market is driven by the growing importance of a sustainable agriculture approach and increasing development of new innovative products that target specific agronomic needs. Spain, Italy, and France are the major drivers for higher consumption of biostimulants in the region. These countries are also the major exporters of biostimulants to global markets. Further the underdeveloped regulatory framework for this sector in the region has led to the development of numerous startups for biostimulants.