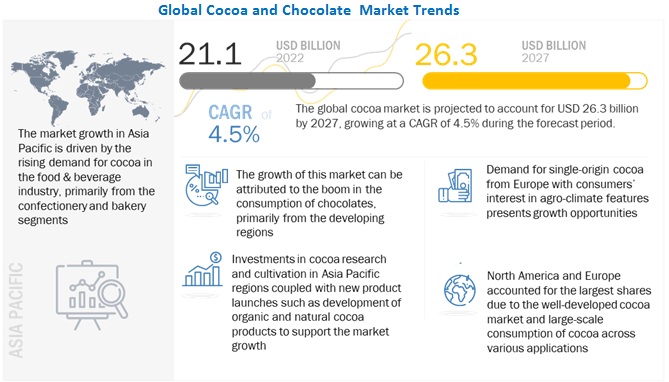

According to a research report "Cocoa and Chocolate Market by Type (Dark Chocolate, Milk Chocolate, Filled Chocolate, White Chocolate), Application (Food & Beverage, Cosmetics, Pharmaceuticals), Nature (Conventional, Organic), Distribution and Region - Global Forecast to 2027" published by MarketsandMarkets, the global cocoa market is projected to reach USD 26.3 billion by 2027, growing at a CAGR of 4.5% from 2022 to 2027. The global chocolate market is projected to reach USD 160.9 billion by 2027, growing at a CAGR of 4.7% from 2022 to 2027.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=226179290

With the growing awareness about health, an increasing number of consumers are prioritizing their health and following specific diets with specific needs. This propels the demand for dark chocolate with high cocoa and less sugar. Cocoa is the major raw material required to manufacture chocolate. The slightest turbulence in the cocoa market would lead to price fluctuations. According to the International Cocoa Organization, the world’s largest supplier of cocoa is Africa, which accounts for 72% of the global production of cocoa. Ivory Coast and Ghana are the major countries producing cocoa, but these countries are also facing certain issues such as fair trade discrepancies, environmental issues, spells of government unrest, and reducing labor force as more population is leaving farming as an occupation and opting other professions Therefore, measures such as implementation of National Cocoa Development Plan (NCDP) in the member countries of ICCO are being undertaken to improve the production of cocoa. Initiatives like these gives a promising outlook towards fulfilling the rising demand for cocoa globally. The cocoa & chocolate market players are showing trends of pursuing both organic as well as inorganic strategies for their expansion, consolidation, and sustainability in the market. Developments and new product launches in chocolate and rise in the use of cocoa for cosmetics and pharmaceuticals are driving the market and is leading to an increased demand for cocoa.

Milk Chocolate segment is the fastest growing among the various types of chocolate during the forecast period

The market for chocolate, based on type, is segmented as dark chocolate, milk chocolate, filled chocolate, and white chocolate. The milk chocolate segment is estimated to dominate the chocolate market in 2022 and is anticipated to witness similar trends throughout the forecast period. Milk chocolate has low level of cocoa solids and is lighter and sweeter than dark chocolate. Dark chocolate segment has witnessed an upwards trend over the years owing to various health benefits associated with it due to the presence of high fiber, high iron, magnesium, potassium, and phosphorous content.

In the cocoa and chocolate market, organic nature segment is registering the highest growth during the forecast period

The cocoa market, based on the nature, is segmented into conventional and organic. In 2022, the conventional cocoa market segment is expected to dominate the market. The conventional cocoa products are easily available at low cost and is widely preferred. Due to the need for organic farming, high labour expenses, maintenance requirements, and other organic cocoa-related operating expenditures, organic cocoa ingredients and products are quite expensive. The organic cocoa segment, however, is estimated to witness a higher growth rate during the forecast period owing to its various health benefits and environment friendliness.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=226179290

Asia Pacific region is witnessing the highest growth rate in chocolate market

The Asia Pacific region is witnessing the fastest growth rate of 5.72% during the forecast period. The Chinese cocoa market, in terms of volume, is estimated to grow at a CAGR of 6.39%. This is attributed to the strong demand for chocolate in the country. Across Europe, Germany consumed the highest quantity of chocolate in 2021 followed by UK, and Belgium. United States accounted for the largest market share primarily driven by the large consumption of confectionary and bakery items. According to the Observatory of Economic Complexity (OEC), the US was the seventh largest exporter of chocolate in 2020, with key export destinations being Canada, Mexico, South Korea, Australia, and the UK. Growth in this region is attributed to the growing population, rise in per capita income, growing urbanization, and therefore, an increase in demand for chocolate-based products. Additionally, the nutritional benefits of chocolate are promoting the growth of chocolate in the region.

The key players in cocoa and chocolate market include Mars, Inc.(US), Mondelez International (US), Nestle S.A. (Switzerland), Meiji Holding Co. Ltd.(Japan), Ferrero International(Italy), Olam Group (Singapore), Barry Callebaut(Switzerland), Cargill Incorporated (US), Cocoa Processing Company (GHANA), Archer Daniel Midland (ADM) Company (U.S.), Chocoladefabriken Lindt & Sprüngli AG (Switzerland) and Pladis Global(UK) among others.